Introduction

Virtuoso Optoelectronics Limited (VOEPL) is a burgeoning player in the electronic manufacturing and white goods sector, primarily known for its prowess in air conditioner (AC) manufacturing and other electronic products. Incorporated in 2015 and headquartered in Nashik, India, the company has swiftly expanded its footprint in the industry, showcasing remarkable growth and innovation. This blog post aims to provide a comprehensive understanding of VOEPL, covering its business model, financial performance, strategic initiatives, and future prospects.

Company Profile

Background and Evolution

VOEPL started its journey with electronic manufacturing and gradually expanded into the Original Equipment Manufacturer (OEM) and Original Design Manufacturer (ODM) spaces. Over the years, it has established itself as a key manufacturer in the air conditioning industry, catering to both domestic and international markets.

Manufacturing Facilities

VOEPL operates six manufacturing facilities around Nashik, Maharashtra, each dedicated to different aspects of production:

Unit 1: EMS and LED Lighting (48,000 sq.ft)

Unit 2: Indoor Unit (IDU) - AC Manufacturing (100,000 sq.ft)

Unit 3: Outdoor Unit (ODU) - AC Manufacturing (80,000 sq.ft)

Unit 4: Plastic Components and Cross Flow Fans (20,000 sq.ft)

Unit 5: Copper Tubing Section

Unit 6: Aluminium Pressure Die Casting and Brass Components (under commissioning)

Business Overview

Product Portfolio

VOEPL’s product portfolio is diverse, covering various segments within the electronics and white goods industry:

Air Conditioners (ACs): Both IDU and ODU units, benefiting from the Production Linked Incentive (PLI) scheme.

LED Products: LED downlights, panels, lamps, and street lights.

EMS Solutions: Electronic manufacturing services for a variety of applications.

New Ventures: Water dispensers and commercial refrigeration units, currently under development.

Backward Integration

VOEPL has heavily invested in backward integration to enhance value addition and reduce dependency on external suppliers. This includes in-house manufacturing of components like heat exchangers, plastic injection moldings, controller boards, and cross flow fans.

Financial Performance

Recent Financial Highlights (FY 2022-2023)

Net Revenue: INR 3,380.7 million, a significant 68.5% year-on-year growth.

EBITDA: INR 342.6 million, up 72.0% YoY.

EBITDA Margin: 10.1%, indicating efficient cost management despite aggressive capacity expansions.

Net Profit: INR 77.7 million, a substantial 97.1% YoY increase.

PAT Margin: 2.3%, showing improvement in profitability.

H1 FY 2023-2024 Performance

Net Sales: INR 2,384.4 million, a 111.9% increase YoY.

EBITDA: INR 238.4 million, up 42.1% compared to H2 FY23.

Profit Before Tax: INR 57.0 million, reflecting a 32.1% growth HoH.

The company’s financial growth is driven by increased production capacities, introduction of new product lines, and expansion into new markets.

Strategic Initiatives

Capacity Expansion

VOEPL has ambitious plans to expand its production capacities:

ODU: Increase from 250,000 to 400,000 units per annum.

IDU: Increase from 600,000 to 800,000 units per annum.

Cross Flow Fans: From 40,000 units to 80,000 units per month.

New Product Lines

The company is trialing new products like water dispensers and is developing commercial refrigeration units, expected to start commercial production in H1 FY25.

Market Expansion

VOEPL is exploring opportunities in Southeast Asia and Africa, aiming to establish a strong international presence.

Technological Advancements

The company is investing in newer technologies for cost reduction and efficiency improvements. This includes developing an in-house tool room and adding backward integration components like brass components and BLDC motors.

Industry Overview

Market Dynamics

Air Conditioners: The Indian AC market is growing rapidly, driven by rising disposable incomes and increasing urbanization. The organized sector dominates the industry, with significant growth potential in the residential segment.

LED Lighting: India is the second-largest LED market globally, boosted by government initiatives like the reduction in excise duty and the Smart City development model.

Commercial Refrigeration and Water Dispensers: These segments are poised for growth due to rising demand for frozen foods, dairy products, and clean drinking water solutions.

Conclusion

Virtuoso Optoelectronics Limited is well-positioned for sustained growth, backed by its robust manufacturing capabilities, strategic expansions, and strong market demand. The company’s focus on backward integration and new product development, coupled with favorable government policies, makes it an attractive investment opportunity. As an investor, keeping a close watch on VOEPL’s financial performance and strategic initiatives will provide valuable insights into its growth trajectory and potential returns.

My side notes from the conference calls -

The company is established in 2015 in 2015 they started with electronic components and sub-assemblies as the primary line from there we got the opportunity of manufacturing complete LED products then they got the opportunity of getting into manufacturing of indoor units for air conditioners and now they are manufacturing Complete air conditioners and they are fully backward integrated.

Virtuoso Optoelectronics Limited serves under both original equipment manufacturer ("OEM") and original design manufacturer ("ODM") business models.

Under the OEM model, the company manufactures and supplies products basis designs developed by its customers.

Under the ODM model, the company conceptualizes and designs the products.

The Air Conditioner Manufacturing (~80% revenue share) includes both Indoor Unit(IDU) and Outdoor Unit (ODU) while LED Lighting (~20% revenue share) comprises of LED Lamps, LED Street Lights and LED Down Lights and Panels

ODM - lighting

OEM - AC (Voltas)

Brief Profile of the Managing Director of the Company

Mr Sukrit Bharati: Chairman &Managing Director of the Company is having 13+ years of experience. He looks after the management and operations of the Company.

He is a qualified technocrat with education background of Masters in Science - Engineering Technology from BITS Pilani Diploma / Certification courses in Management subjects from Harvard Business School and NMIMS, Mumbai.

Further, he has completed a year long course under Stanford Seed Program, by Stanford University, USA. This program is about on-the-ground leadership for established founders and CEOs in emerging economies focused on growing their businesses and increasing the positive impact they have in their communities.

He is focused on ensuring sustainable growth of the company by improvement in customer satisfaction, addition of new customers and product verticals, employee training and growth. With the overall objective of strengthening the company, positive contribution to society and increasing shareholder value.

FY23 Conf Call Notes:

On this ODM LED lighting business -

90% of our lighting business this year came from Panasonic as a primary customer. The reason for that is Panasonic is a very structured customer; they have a set pattern and conduct business in a methodical manner. This shields us from direct market impacts, keeping us isolated from fluctuations. Of course, I think among the larger players, there has been a shuffle where Siska came in strong, but now Siska is struggling. However, I believe this will settle down.

As far as our business is concerned, we are very selective in terms of working with lighting customers because we understand this well. We learned this early on, from 2015 to 2018, dealing with smaller players in lighting. Relying heavily on tier 2 and tier 3 brands leads to higher fluctuations, reducing predictability and hindering our ability to establish a sustainable business model. Therefore, we started focusing on fewer, more consistent customers in terms of projections, volumes, and margins. We are not aiming for abnormal growth or decline in revenue or margins. With Panasonic as the anchor customer, we're considering leveraging exports using Panasonic as a brand. We're already exporting via Panasonic to Nepal and Sri Lanka, and we're also in talks with potential partners.

On Margins -

At the current rate of two to two and a half percent, yes, as I mentioned, we aim to maintain our competitiveness in the industry. Currently, our investment and turnover are relatively small, and to keep pace with competitors and explore various product segments, incremental investment is essential. Each investment will take one to two years to mature, putting pressure on our existing business. With a turnover of 750 crores, we anticipate a proportional growth in profitability, aiming for a two to two and a half percent net profit margin. However, considering our focus on growth and investments, this margin might fluctuate. While we strive to improve EBITDA margins, external factors like customer demands and raw material volatility may present challenges. Therefore, maintaining a guidance of nine to ten percent EBITDA margin seems reasonable, although we always aim to surpass it.

Regarding our superior margins despite lower scale, several factors contribute. Firstly, our overhead costs are significantly lower than those of our listed peers, which reflects positively on our EBITDA levels. Additionally, we've managed to keep our investment base relatively small. Furthermore, our equipment utilization is currently better than many of our competitors, providing us with an edge of about one or two percent.

Regarding incentives, Maharashtra state offers subsidies for MSMEs setting up new plants. We've already received one sanction and anticipate more this year under the electronic policy of Maharashtra. Over the next three years, we expect subsidies totaling around 25 crores, with this year's figure estimated at 8 to 10 crores. These subsidies are against the GST paid to the state. However, it's likely that we'll need to share a portion of these subsidies with our workforce.

As for the question about PLI benefits and state government subsidies, none have been included in our current EBITDA margins and PAT. The PLI benefits are expected to start this year, while the state government subsidies will also contribute to our financials.

Why Voltas work with us?

Voltas's decision to work extensively with us stems from several factors. Firstly, our factory is dedicated to manufacturing for Voltas, providing them with greater autonomy and operational efficiency. Additionally, the complex nature of AC manufacturing, where tools are supplied by Voltas, makes it challenging to switch vendors quickly, ensuring a level of stability in our partnership.

Furthermore, our timely entry into the market during a period of import substitution allowed us to capitalize on opportunities and secure a favorable position. While facing competition from larger players, our early establishment and trustworthiness in handling tooling have provided us with an edge. Lastly, our competitive pricing ensures that we remain a viable option for Voltas. Overall, a combination of trust, timing, and competitiveness has contributed to our strong relationship with Voltas and protected us from potential competition.

Major component they import -

Currently, the main components we import are copper, aluminum, and motors. While there are efforts to set up facilities for copper and aluminum locally, none are operational yet. It's unlikely that we'll source copper and aluminum locally in the next one or two years. However, there are companies setting up motor production locally, resulting in a mix of local and imported motors.

Regarding our margins, they're superior compared to some listed peers despite lower skill levels. This can be attributed to our lower overhead costs and smaller investment base. Additionally, our capacity utilization is better than many competitors, providing us with a slight edge.

H1 FY24 Conf Call (notes)

We've started water dispenser manufacturing this month onwards, and we've received our first export order. Consequently, we will begin exporting water dispensers starting next month, which is also a positive development. The final update I have from my side is that we are getting into Commercial Refrigeration as a product category in the next financial year, investments have been initiated, and we aim to commission the planned facilities in the first half of F525. This summarizes the company's journey over the last six months. We've expanded our manufacturing capabilities, adding three primary units for IDU, ODU, and lighting, along with EMS. Additionally, three feeder units have been established for molding components, copper tubing, and brass components, along with aluminum pressure diagnostic. All these units are now operational, and we are on track to increase manufacturing capacity as planned. Furthermore, we are also on track to achieve our targeted top-line growth.

Water dispenser -

we are also that as a verticle is growing uh we've got into water dispensers so initially water dispensers we are setting up a capacity of 150,000 units and we can scale this up to almost 400 to 500,000 units over the next couple of years as far as the market Market size is concerned uh the Indian market for water dispensers anticipated to be about 10 to 15 lakh units there's no exact figure because there's a lot of combination of import and domestic manufacturing also India is exporting water dispensers so uh but the

On dependency on Votas-

The speaker begins by addressing the dependency of their revenue on Voltas, estimating it to be around 60-65%. They express interest in understanding if there have been any recent issues regarding quality or timely delivery raised by Voltas. They mention having a dedicated person at their factory to address routine issues and state that apart from the seasonal pressure to maximize capacity during peak demand, there have been no significant escalations.

Regarding the supply of air conditioners (ACs) to Voltas, they mention supplying more indoor units (IDUs) than outdoor units (ODUs) due to Voltas assembling or manufacturing more ODUs in their factory. They estimate supplying about 10 to 20 ACs out of every 100 sold by Voltas.

Regarding Voltas outsourcing contracts to them rather than building capacities in-house, the speaker believes it's not specific to Voltas but applies to large brands in general. They argue that it's not practical for large brands to have 100% in-house manufacturing or value addition. They suggest that typically only 30 to 50% of the total value addition happens in-house, while the remaining 50 to 70% is outsourced. Reasons cited include government regulations, capacity evaluation, specialization in manufacturing, and investment returns.

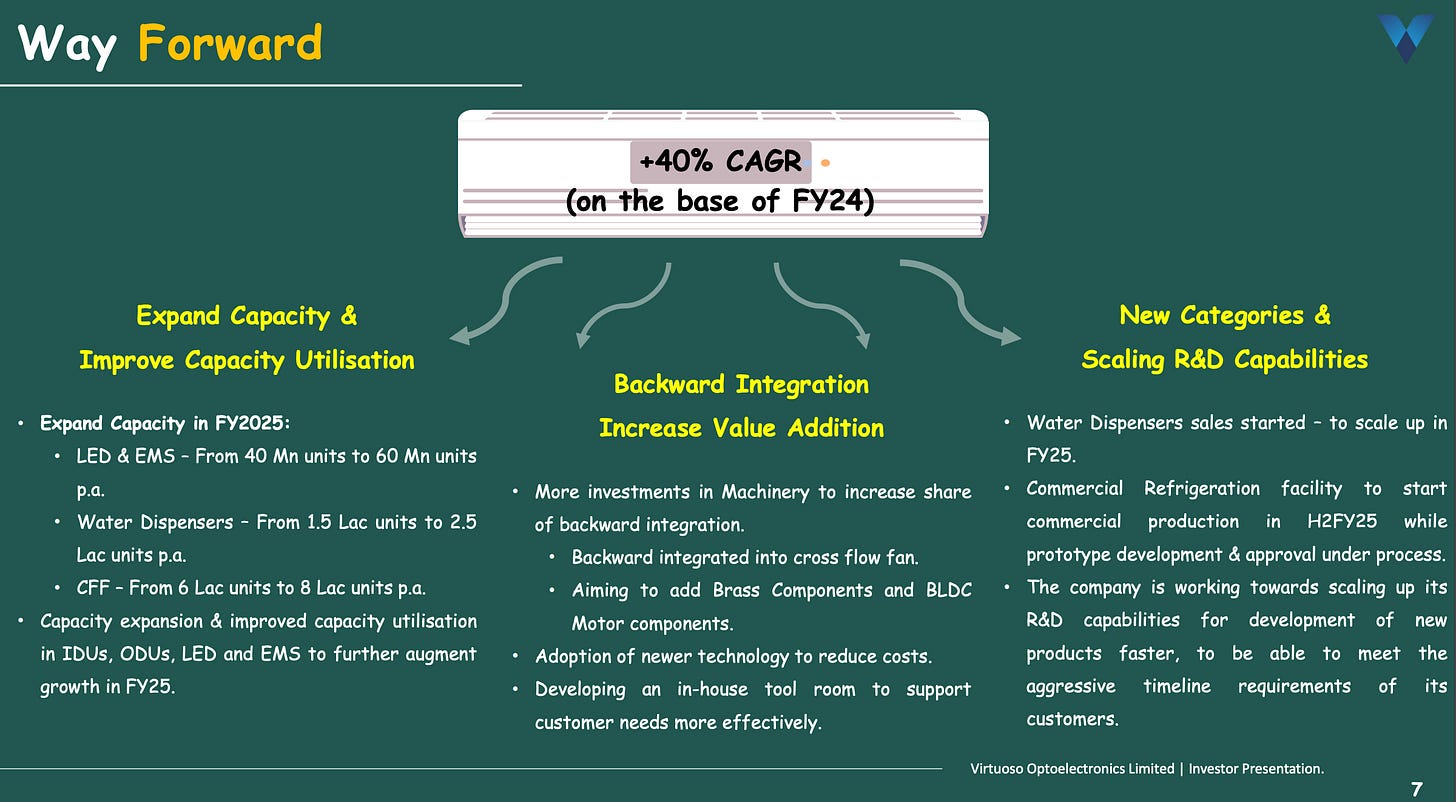

Way forward -

Interesting Management Interviews -

BLOGS ARE NOT A RECOMMENDATION SERVICE – These are my personal views about the Business Quality, Management Quality, Business Execution & Performance.

Voltas has outsourced ~10% of its ACs to Virtuoso. Do all the tier 1 brands opt for a higher number of EMS manufactures or do they concentrate to a few (less 3 for example)?

I am curious to know how the industry operates. On the one hand, a large number of manufacturers makes sense to avoid concentration but also raises issue of non-uniform quality for a single product line.