Valiant Organics Part 3.

Navigating the Specialty Chemicals Industry Amidst Global Challenges

Why part 3 ?

I have written Part 1 and Part 2 long ago in 2017, If you are interested do go through the blog posts link below-

Although a lot has changed since then.

Tracking Valiant Organics Ltd since its IPO in 2016 has been a learning experience, both as an investor and an observer of market dynamics. Initially a single-product company focused solely on Chlorophenols, Valiant Organics has since expanded into multiple chemicals, including Para Amino Phenol (PAP) and Ortho Amino Phenol (OAP). Despite a promising growth trajectory, the company now faces significant headwinds from external competition and cyclicality in the chemicals market.

This blog post will take you through Valiant Organics’ growth story, its product portfolio, the cyclical nature of the PAP market, and the broader dynamics affecting the specialty chemicals sector. In doing so, we aim to provide a detailed, numbers-driven analysis of how Valiant has navigated these challenges and what lies ahead for the company.

Valiant Organics: From Chlorophenols to a Diversified Portfolio

Chlorophenols were the cornerstone of Valiant Organics’ early success. Used in agrochemicals, dyes, and pharmaceuticals, Chlorophenols are essential for various industries. Between FY2012 and FY2017, Valiant’s capacity utilization reached 100%, setting the stage for the company’s IPO in 2016 on the SME platform. The IPO raised capital for capacity expansion, increasing production fivefold. At that time, the stock traded at a Price-to-Earnings (PE) ratio of 10-15, which tested my patience as an early investor.

The turning point came when they got the environmental clearance in 2018 and when Valiant Organics began to diversify its portfolio, moving beyond Chlorophenols into other chemical products. Notable acquisitions, including Abhilasha Tex Chem Ltd (in FY2018) and Amarjyot Chemicals Ltd (in FY2020), expanded Valiant’s product offerings. These moves allowed the company to enter new markets, increasing both revenue streams and geographic reach.

However, even with these expansions, Valiant Organics faced new challenges as the market dynamics shifted—most notably in the PAP segment.

The PAP Story: A High-Growth, High-Risk Segment

Para Amino Phenol (PAP) is a critical intermediate used primarily in the production of paracetamol. Paracetamol, an over-the-counter medication, saw unprecedented demand during the COVID-19 pandemic, causing a massive spike in PAP prices.

The PAP Market Dynamics

Pre-COVID Pricing: In 2018, PAP was priced around ₹400 per kg.

COVID-19 Spike: By 2020, supply chain disruptions caused by the pandemic and the global surge in paracetamol production pushed PAP prices to ₹1,000 per kg.

Post-Pandemic Correction: As of late 2023, PAP prices have normalized to between ₹360 and ₹550 per kg, depending on quality and supplier.

The global demand for PAP remains robust, with the CAGR for the PAP market expected to be 3.2% from 2021 to 2026, driven by pharmaceuticals and dye industries. However, the oversupply of PAP by Chinese manufacturers, who scaled up production during the pandemic, has led to severe pricing pressures and dumping in international markets, impacting Indian manufacturers like Valiant Organics.

China’s Dominance in PAP

China is the world’s largest producer of PAP, with a manufacturing capacity of 1.1 lakh tonnes per annum (TPA). Major Chinese players include:

Taixing Yangzi: 35,000 TPA

Liaoning Shixing: 40,000 TPA

Anhui Bayi Chemical: 60,000 TPA

India, on the other hand, has a domestic demand for PAP of approximately 40,000 TPA, of which nearly 28,000 to 30,000 TPA is met through imports from China. Valiant Organics is one of the few Indian companies involved in PAP production, with plans to scale up its PAP capacity to 1,000 tonnes per month (12,000 TPA).

The Price War: Impact of Chinese Competition on Margins

The rapid expansion of Chinese PAP producers, fueled by the pandemic-induced demand surge, has created an oversupply in the market. With COVID-related demand stabilizing, Chinese companies have been dumping excess PAP at lower prices, creating margin pressure for Indian manufacturers like Valiant Organics.

In 2020, the import price of PAP from China jumped to $7.5 per kg, compared to $3.5 per kg the previous year.

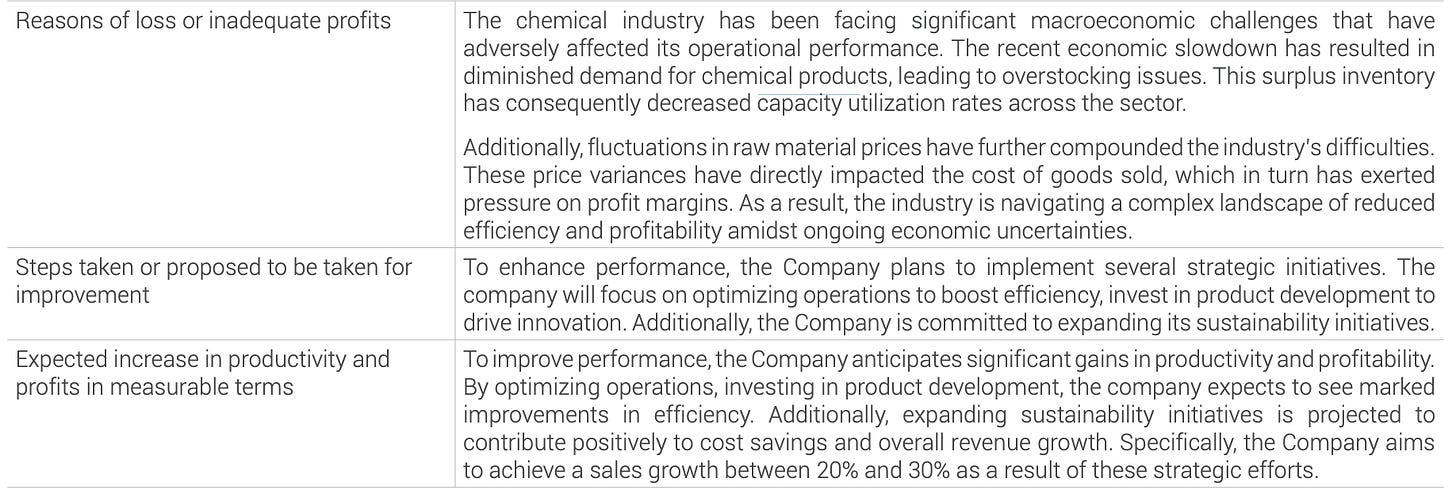

This has led to a significant decline in Valiant Organics’ margins, which once stood at over 25% EBITDA during the pandemic but have since dropped to 17-18% EBITDA due to pricing pressures.

The oversupply and reduced demand have hit Valiant Organics’ profitability hard. In FY2021, the company reported INR 574 crore in revenue with a PAT of INR 131 crore. However, by FY2024, despite a revenue increase to INR 723 crore, the company posted a net loss of INR 84 million.

Other Key Products in Valiant Organics’ Portfolio

Aside from PAP, Valiant Organics produces a range of specialty chemicals, each serving different end-use industries:

1. Chlorophenols

End-Use: Agrochemicals, pharmaceuticals, and dyes.

Revenue Contribution: Approximately 25-30% of the company's total revenue.

Market Dynamics: Chlorophenol production remains stable, but the company faces pricing pressure from Chinese competitors who are dumping cheaper Chlorophenol products in the market.

2. Hydrogenation Products

End-Use: Dyes, pigments, and pharmaceuticals.

Revenue Contribution: Around 20-25% of total revenue.

Market Trends: Hydrogenation products have faced lower demand, particularly in the dyes and pigments sector, which has contributed to margin compression.

3. Ammonolysis Products

End-Use: Agrochemicals and pharmaceuticals.

Revenue Contribution: 10-15% of total revenue.

Market Trends: These products continue to see stable demand, though the ongoing volatility in the agrochemical sector presents challenges.

Revenue Breakdown and Market Position (2024)

As of FY2024, Valiant Organics has a diversified revenue stream across its major chemical processes. The breakdown is as follows:

Chlorination: 24% of revenue

Hydrogenation: 41% of revenue

Ammonolysis: 28% of revenue

The company’s shift from agrochemicals to more diversified sectors like dyes and pigments has been evident in its revenue distribution:

Agrochemicals: 33% (down from 40% in FY2021)

Dyes & Pigments: 43% (up from 20%)

Pharmaceuticals: 19% (up from 10%)

Challenges and Market Outlook

Valiant Organics' challenges lie in managing external factors that have significantly impacted its profitability. The Chinese dumping of PAP and other chemicals, along with global supply chain issues, have created a perfect storm for the company. However, the cyclical nature of the specialty chemicals market suggests that the worst may be over, and margins could recover in the coming years.

Recovery Expectations for PAP Margins

The oversupply of PAP is expected to balance out as Chinese manufacturers scale back production, and global demand for paracetamol stabilizes. With the global market for PAP expected to grow at a CAGR of 3.2%, the cyclicality may play out favorably for Valiant Organics. The company is also investing in operational efficiency and process optimization, which should help it weather the storm.

Government Incentives: A Boon for Indian Manufacturers

In response to China’s dominance, the Indian government has introduced a Production Linked Incentive (PLI) scheme to reduce reliance on Chinese imports and boost local manufacturing of Key Starting Materials (KSMs) and Active Pharmaceutical Ingredients (APIs), including PAP. This initiative could benefit Valiant Organics by supporting domestic production and reducing import costs.

Conclusion: What Lies Ahead for Valiant Organics?

Valiant Organics' story is one of growth, diversification, and the challenges that come with navigating a highly competitive and cyclical market. While the company expanded its product offerings and increased capacity, external factors like Chinese competition and global price fluctuations have taken a toll on profitability.

However, the worst of the PAP cycle may be over, and with Indian government incentives, Valiant Organics is well-positioned to regain lost ground. The company's continued focus on optimizing operations, expanding into new product categories, and tapping into domestic demand could drive a recovery in the coming years.

For investors, Valiant Organics serves as a reminder of the importance of understanding market cycles, external competition, and the need for strategic diversification in an increasingly globalized world. While the road ahead is uncertain, the company's fundamentals remain strong, and with careful execution, Valiant Organics may yet emerge stronger from its current challenges.

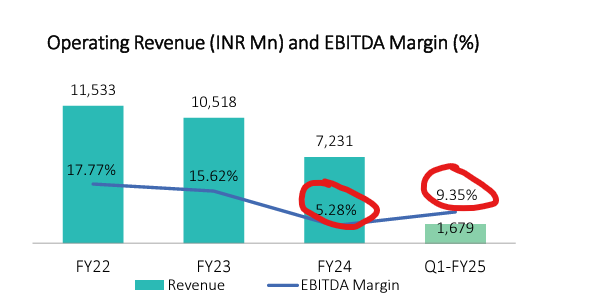

Based on general trends and operational updates from Valiant Organics, we know that:

In 2021, Valiant Organics' capacity utilization was close to 100% for key products such as Chlorophenols and Hydrogenation products, given the high demand driven by expansions and favorable market conditions.

By 2024, capacity utilization in certain segments, particularly Para Amino Phenol (PAP), had dropped significantly due to competition from Chinese manufacturers and oversupply issues. This led to underutilization of the PAP facility despite the company's efforts to expand production.

Company moreover got impacted due to geopolitical reasons - Raise in crude oil prices which primarily drove up their raw material prices. The oil prices seems to be cooling off as well but we never know.

Companies typically during bad times (down cycle) focus on improving the cost efficiency, backward integration etc that’s what Valiant organics has been doing since 2022. Which typically helps them in gaining marketshare in next up cycle.

I think we will see now profitability coming back as raw material cost pressure cools off and Chinese seems have run out of their excess inventory. As after a long time Valiant organics reported +ve EBITA growth which declined from 17.7% to 5% from 2022 to 2024 but increased to 9.3% in Q1 - FY25.

I’ll not be surprised if Valiant will be able to do Rs 100-120 Cr profits in two years from now what they used to do in 2019, which means its trading at 10-12x Fy 26 earnings.

I would ideally like to buy at PE 5x FY26 earnings but i believe that may not happen as prices have stabilised and weak hands must have already left but is it trading cheap today will really depend on what will be the growth rate for the company for next 10 years and how much of margins boost they will see given the work they have done in improving operating efficiency.

Its hard to guess but today i feel its neither trading very cheap or very expensive.

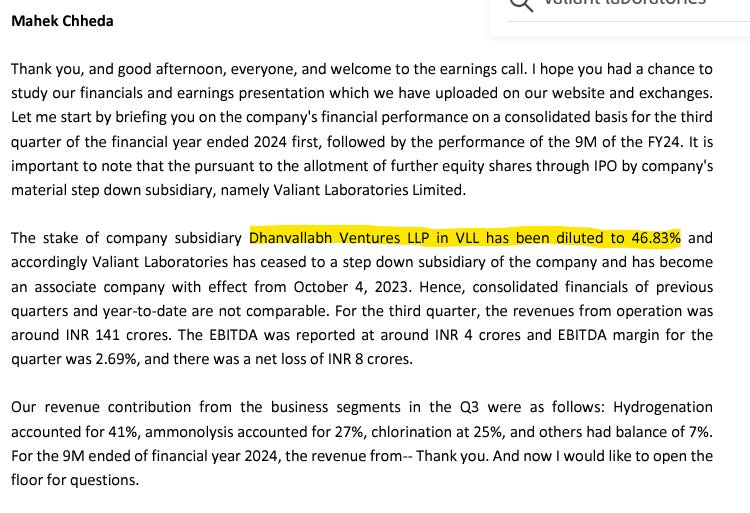

SUBSIDIARIES, ASSOCIATES AND JOINT VENTURE COMPANIES

The Company as on March 31, 2024 has 2 (two) subsidiaries namely, Valiant Speciality Chemical Limited, and Dhanvallabh Ventures LLP

Also company owns 46.83 % shares of listed company Valiant Labs Ltd. , Growth in valiant labs business will add to the valuation of Valiant organics ltd as well.

This is what management said about future outlook -

Mihir Shah

So next year, it is really difficult when we were sitting, at the same time last year we believed that things would turn around, but it actually hasn't. So, it's taking a lot longer and nobody really knows how quickly things will turn around. So, I have to say it with that caveat that if things go back or they start improving, then we will definitely have a better year because chlorophenols will pick up once the dyes and pigments market improve, our ammonolysis will also pick up. PAP is where the volume will increase eventually. OAP will be a newer addition to the product portfolio. So, all in all, we are expecting FY25 to be better, but it comes with that disclaimer that things should turn around the way we are expecting.

Please comment what are your views about the company.

Thank you.

BLOGS ARE NOT A RECOMMENDATION SERVICE – These are my personal views about the Business Quality, Management Quality, Business Execution & Performance.

Great write up! I have couple of questions-

1. Majority of the revenue is still coming from PAP which is more or less a commodity. What do you think would be the sustainable EBITDA margin for Valiant Organics?

2. Don't you think Valiant is a cyclical company and we should value it on Market Cap/ Sales?

Buy around P/S = 0.5-1 and sell it around P/S = 3-4

Hey, I have a relatively significant holding in this company and want to understand your expectations wrt the turnaround story. Have checked the PAP prices and they're down and expected to go down further yet. However, Q3 saw better performance and post March we have seen a rise of about Rs.100. P/S stands at about 1.4 on trailing basis and if the Q4 results are better we might see further upside. What are your view on this ?

Also if you can share on forward basis what multiple is it trading at currently? It would be really helpful.

Whichever businesses they are in, which one in your opinion, stands to be the key revenue driver going forward for a couple of years?