Personally, I found it very hard to write a blog on this company as there is a plethora of information, It’s very rare to see companies being very transparent so, I would encourage you to go through ppts, earning calls, and ARs as it was really fun going through all.

Whenever I try to analyze a startup-listed company, the first thing I try to figure out is the kind of people working there and do they have a product-market fit? because Starting up is tough and its a journey of iterations, facing new problems, failing then figuring out moving forward -

You can’t make an investment based on the current business model, current culture, and current finances as everything is evolving and after reading maybe 1000’s interviews of successful startups I found one common answer from almost all the successful Entrepreneur’s “your first few hires going to determine your success“

The very same reason why I invested in Apollo Finvest -

Shachindra Nath started this company, As we all know Religare wasn’t a successful organization, his success was more of climbing the corporate ladder rather than building the business & I have my personal biases against him but What really attracted me about this company is the “team” Shachindra Nath has been able to build.

I went across all the 400 employees of U-grow capital and I am impressed with the quality of people they have hired and the tech team they have built along with the financial services team.

I think no other NBFC of their size has built the team as Urgo has built.

Some of the links below -

https://www.linkedin.com/in/aghoshag/

https://www.linkedin.com/in/indrayan-ganguly-7b32b715/

https://www.linkedin.com/in/niravshahib/

https://www.linkedin.com/in/prasanna-madhyasta-a1b5b417/

https://www.linkedin.com/in/anuj-pandey-b046b55/

https://www.linkedin.com/in/gargrishabh/

https://www.linkedin.com/in/navneet-kaushal-7465953a/

https://www.linkedin.com/in/yash-yennam/

https://www.linkedin.com/in/sunil-lotke-7888b9a8/

https://www.linkedin.com/in/chaitanya-vadigi-374b5979/

https://www.linkedin.com/in/hitin-kumar-74a074117/

https://www.linkedin.com/in/sasank-amavarapu/

https://www.linkedin.com/in/dishant-dave/

https://www.linkedin.com/in/jayprakash-tiwari-b88b4b7/

https://www.linkedin.com/in/parthmistry21/

https://www.linkedin.com/in/shelly-arora/

https://www.linkedin.com/in/subrata-das-697735/

https://www.linkedin.com/in/vyshali-nanda-96b51365/

How is it all start?

(Source: https://www.entrepreneur.com/article/319470)

After spending more than two and half decades within the financial services sector and building various businesses under Religare’s portfolio, the very next step for Shachindra Nath was to start his own venture. The former Religare group CEO is started scouting for small yet clean-listed NBFCs. After screening records of around five such NBFCs, Nath acquired Chokhani Securities and rebranded it as Ugro Capital, wherein he bought INR 8500m (Rs 850 Cr) as capital (raised to QIPs, PEs, and HNI) and senior management on board.

He said - “The SME credit gap is real in India. The segment contributes roughly around 30 percent to the country’s GDP and yet, the capital gap within the sector is USD 650B”

Nath, who aspires to build an enterprise out of Ugro Capital to solve India’s credit-related need for SMEs, believes that the reason why there is a gap in the sector because the lending organization do not understand the underline borrower and their nature of operations very well.

“Historically, SMEs have been an unorganized sector. Banks traditionally lend against reported cash flow, balance sheet, etc. The unformatted organization structure is a challenge for a bank, an NBFC, and for us,” he says while adding that, “If you just look at reported numbers, you wouldn't be able to lend to these SMEs. However, if there is a way to assess the income, growth potential, nature, and behavior of the business. Then, we would be able to lend.”

In today’s age, where every third fintech company is keen to cater to the MSMEs, Nath is not interested in developing a dot-com company and selling it in a few years.

Sharing his vision for Ugro, he says, “We would be as technology-driven as any other fintech startup but we wanted to build a business for perpetuity that's why acquiring a listed company made a lot of sense.”

Additionally, technology can only solve the data-driven problems. The problem with SMEs is that there is hardly any organised data. However, with GST and other few other initiatives, this is bound to change. “So, just by using technology - you cannot build a scalable platform. You have to use a combination of technology and human judgement around it. This is even our approach,” he noted.

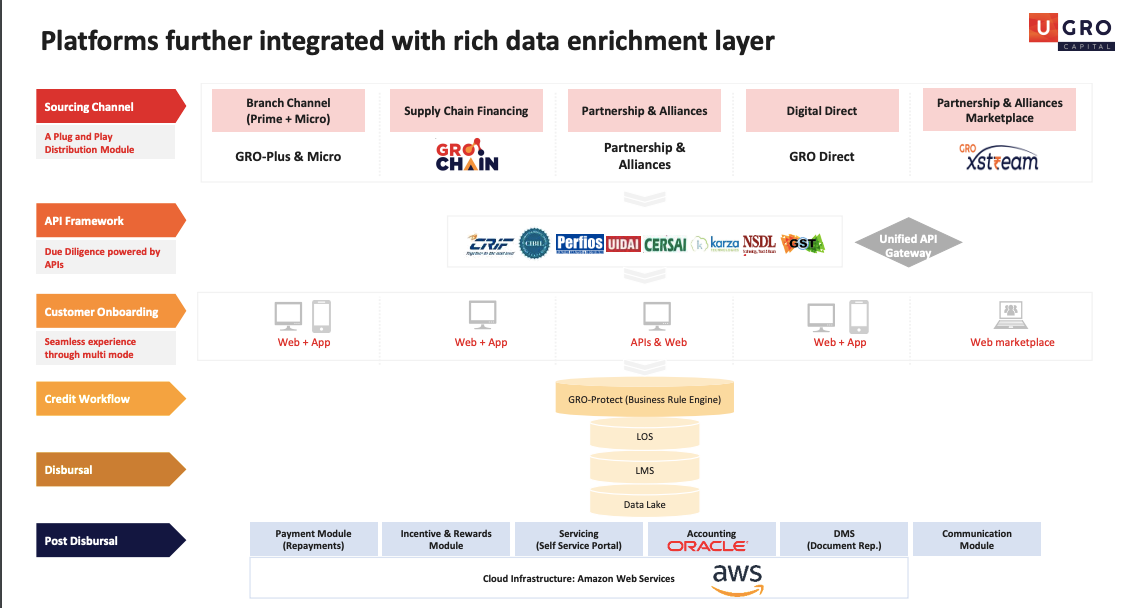

Ugro is now looking to build its very own technology platform, which can integrate with every fintech in the same space.

“One of the advantages we would have over others NBFCs is that we are starting now - in the same generation as fintech startups and hence, we would be able to integrate better with them. Considering we are a startup, we will be nimble enough to partner with them”

They have set a huge growth target for them -

U Grow Capital looking to acquire Rs.20,000 crore AUM by 2025, which is 10x of today’s AUM. (Which is like 9x of today’s AUM)

https://www.passionateinmarketing.com/u-grow-capital-looking-to-acquire-rs-20000-crore-aum-by-2025/

and many on social media calling it “next bajaj finance” already.

In the first-ever conference call that’s how he brief about the company -

Ugro Capital is a highly specialized technology-enabled small business lending platform focused on addressing the capital need of the SME segment. Our mission is, to solve the unsolved: the US $300 billion small business credit gap. We acquired control of Chokhani Securitiesfrom the erstwhile promoter in July 2018 and renamed the company to Ugro Capital. We have since then completely revamped the management team. As of today, our headcount stands at around 95 employees. Each of our senior management teams comes in within experience of 20 years plus in the industry. Post the change of control, the Board was also reconstituted, and a distinguished majority independent board was set up to supervise the business of the company. The company raised INR 953 crore of equity capital from multiple investors through two rounds of preferential allotments, qualified institutional placement and the demerger of the lending business of Asia Pragati Private Limited in to Ugro Capital. The net worth of the company stood at INR 637 crore, the demerger of Asia Pragati’s loan business is expected to be completed by end of Q1 FY20. The warrants are due to be compulsorily exercised by the end of December 2019. Post this, the net worth of the company would be INR 925 crore. Operationally we believe that the need of every SME is unique and therefore we adopted a highly sectoral approach to solve the problem of SME lending with a deep sector specialization to understand, reach and service the customer better. We have shortlisted 8 sectors and 38 sub-sectors through extensive study of macro and micro economic parameters, carried out in conjunction with the market experts like CRISIL and others. The 8 sectors shortlisted are healthcare, education, chemical, food processing, FMCG, hospitality, electrical equipment and components, auto components and light engineering. Our distribution, credit appraisal and products are aligned to these sectors. The company has put in place a new long-term strategic vision to build a technology-led small financing business using sectoral expertise and on the core pillar of knowledge plus technology. To this end the company has launched its new generation fully integrated technology platform to process both secured and unsecured loan within 60 minutes of login for in principal approval. To achieve this, we have established API integration with 20 plus data source. We’ve also created 8 sectoral statistical scorecards and 25 sub-sectoral expert scorecard - an industry first. We want to leverage the best practices of both the traditional NBFC world and the new digital lending firms; therefore the 60 minutes in principal approval will be followed up with the traditional checks and balances, personal discussion, site visits, etc. This, we believe, is the right strategy to win the Indian SME lending market. Lastly, we want to create a liability-centric organization by creating a granular, diversified, and largely secured high quality lending book. Being cognizant of the ALM mismatches and actively engaging with rating agencies, liability providers to create a diversified lending book. The company’s philosophy is also to adhere to the very highest level of corporate governance, so we have a very strong and experienced board of directors and we have inculcated the best practice into our articles of association of the company.

How digital they really are? or are they new-age lenders?

Q4Fy19 conf call -

This is interesting, but from where did he get this idea? Why wasn’t he doing this in Religare?

This Zomato thing sounds good but many times I wonder why banks won’t able to underwrite given that 80% of Zomato traffic comes from just the top 20% of restaurants that are well known that already have current / savings bank accounts in the established banks who are always able to underwrite at a rate lower than NBFC.

I am really curious to understand what kind of restaurant Ugro capital digital model is able to pick for them not already covered by banks may be due banks don’t have enough data about them. I also, feel in all this, Banks are also as involved as Zomato / Swiggy because they must have been depositing into the Current/ Savings accounts of the restaurant anyways so, a bank has the data always to underwrite any good restaurant having good cashflows.

Howsoever this is really interesting to know what these folks are doing, no other listed NBFC is doing this, and maybe banks are just sleeping over this data (Inflow from Zomato / Swiggy) they have and I am sure mostly PSU banks are which are huge in terms of market share are sleeping over it for sure.

Ugro in one of their presentation nicely categorized themselves - as “Specialized SME Lenders” below gives good insight on how they are differentiating themselves.

Mission & Approach:

They have set out on a mission for themselves to solve the (largely unsolved) problem of SME lending in India -

By using the approach mentioned below -

This all looks confusing to me - A) Either you should be doing it all digitally, if you have to do touch and feel then what’s the point of running an AI engine? The guy can open the Zomato app and check the ratings as well.

This is not scalable the traditional NBFCs are doing the same and these folks are doing the same with some analytics/statistics & that’s what management said when somebody asked what’s your Moat?

So, they will be able to underwrite better than the others let’s say using those scorecards but to solve the $400 B SME credit problem you have to build compete digital lending platform, where you have Zomato APIs, GST data, etc and restaurants can just avail credit from your app without any human being involved.

There are 42 million SMEs in India and having humans is a problem because a) you can’t hire enough humans to do it and b) many of them need small ticket-size loans, involving human beings to underwrite these loan increases the cost of lending which makes underwriting these small-ticket size loans unviable and this the core reason why SME credit problem exists, to begin with.

Anyways I would have loved it if they would have developed no human but a pure API-based / Digital lending platform, good thing is they are developing a “growth team” to solve this issue-

In the second half of Fy19, they really started their lending business and they have pivoted already a lot to today what they are doing which is expected from a startup.

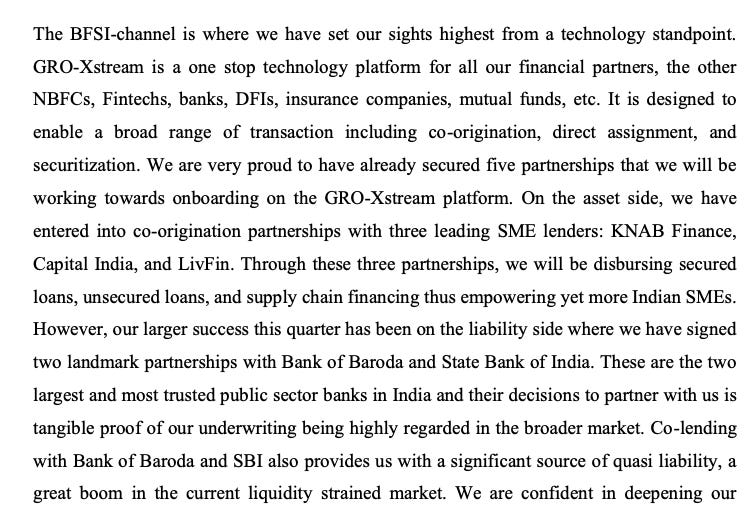

For the very first time in Q2 FY20, they talked about co-lending which is today their Core strategy to take the business forward -

This was an interesting quarter - because before this they have been talking about the co-lending business model but there was no clarity on what it would be? what It looks like is they aren’t interested in competing with banks or other NBFCs, instead they want to enable them with Data / Loan origination. What this means is they are developing a low risk & very scalable business model, I like this strategy as rather than going to a bank to raise capital than lending it to the market, it makes more sense to enable the bank to lend & you make ur little cut anyway, GRO-Xstream is the software layer they are building with the vision to enable any Bank, NBFC or DFI to lend through U Gro or any other SME focused NBFC.

strategic partnership with BOB and SBI as integration into GRO-Xstream will allow for them to work with us and other integrated BFSI partners on numerous transaction types.

operationalized, the NIM calculation for NBFCs or technology enabled players like us will has a very different context because of our earning would become fee based.

And in Q3 Fy 20, They were able to rope in ICICI bank -

They had their direct digital lending product live too -

When Covid -19 hit ( Q4 FY20)

They came up with a very transparent slide, showing their risk assessment. Which is indeed commendable from a governance perspective. (Size of bubble shows disbursement)

and launched Sanjeevani “Their Digital lending product” to fund SMEs benefited by Covid

Co-lending although a great idea on paper but it's not that easy -

Q2 FY21 - Not business yet…

In Q3FY21 - they launched another new product (first to provide on tap credit on GeM Sahay) and their underwriting passed the Covid stressed test - (which is commendable)

Our portfolio is holding up well from the stress that is to be expected from a black swan event like COVID-19. Our collection efficiency remains high at 96% for secured loans and 92% for the unsecured loan which is the monthly collection efficiency as of December 2020 and we are in close contact with our partners or customers whose business may be seeing stress at this time.

This quarter we have made great progress on two technology initiatives we had announced in Q2, we have completed integration on our side with GeM Sahay making one of the first lenders to do so and we are fully prepared for the expected launch in February 2021 by the Government. Also, our highly wanted upcoming digital supply chain financing platform growth chain has completed its first two phases of development and we will go live in February 2021.

we have made great strides in creating integration to a large platform like GeM Sahay so that we can be one of the four front leaders in cash flow based financing. Third, we have this distribution channel which we call GRO-Xstream which is a core lending platform wherein during the quarter we have operationalize six partnership with smaller NBFCs and Fintech partner and we are seeing an average disbursement of around 15 Crores a month and fourth is digital which we are starting next financial year.

To Summerize this is how movie unfoled by Q3 Fy21:

We did three years of research with Crisil and came out with our all eight-focus sector which contributes roughly around 40% to 50% of the SME market. Then we built what we call our center of the pillar which is our data analytics and underwriting platform which is a hybrid model looking at the conventional underwriting parameters and using both analytics and what kind of data can be utilized and how can you improve the origination ease of collection, ease of doing business and we invested a very significant amount of both human capital as well as financial capital.

Third, we believe that they are roughly 100+ market intermediatory which are small NBFCs and Fintech and payment platform who have access to the smallest micro-credit platform, but they need access to the liquidity and that is why we have built this platform called Gro Xstream which partners with them and co lend and eventually fourth is our digital direct which will start next year which allows the ability to customers to come to us directly, on the asset side that is the broad picture.

co-lending - So, as we know that we have four co-lending partnership which is SBI, Bank of Baroda, ICICI, and Kotak and we are hopeful that in next quarter at least one of them after the revised guideline would get become operational and provide massive liquidity and that would elevate the need of leveraging the balance sheet too much.

What is score-card ?

Healthcare sub-sector Nursing scorecard -

Interesting the way they have partnered with Fintech’s too -

They launched their micro-enterprises lending vertical in Q3 FY21 -

We will be catering to these micro enterprises primarily through our new Saathi Program and the launch of Gro micro branches, these Gro micro branches will cater primarily to the bottom of the pyramid small businesses providing livelihood and employment to millions across the country and thus present a real pathway for improvise to beat the poverty. We have commenced our direct distribution channel across five states, Karnataka, Tamil Nadu, Gujarat, Telangana, and Rajasthan with five branches opening each of this state through mid-January 2021. This has been a highly successful rollout of our direct distribution channel with all 25 branches in our pilot program inaugurated and operationalized as per schedule. This has been a very large undertaking for us. As these 25 branches have come with a large growth in overall headcount but we feel that this is the perfect time for us to target calibrated but aggressive growth and demonstrate our long-term commitment to micro-enterprises and financial infusion in general. These branches are spread across tier 2 and 3 locations and will allow us to greatly expand both the breadth and the depth of our distribution without cannibalizing any existing business lines. Aside from commencing the new business lines, we have also been targeting growth across our existing business lines.

Fast forward to Q4 Fy22-

This is how majority of underwriting is done -

So today when a customer applies to us, all we ask is his GST number, GST statement, and his bank statement along with the KYC documents and post that the system takes over and it goes into very deep and extracts various kinds of parameters for example the borrowing mix, the frequency and magnitude of defaults, history of high cost debt, obligation as a percentage of turnover, etc. which have all been customized to our kind of target segment and this has been back-tested and is administered in real time. So, in terms of giving a credit decisioning to the customer we are right on the cutting edge. So just to you know uh show you all the glimpse of what we have already evidenced through the initial administration of our score typically our scorecard categorizes the customer into five bands: “A”, “B”, “C”, “D”, “E”. “A” being the least risky and “E” being the most risky. And already in our analysis for the customers whom we have given loan and on customers who we haven't given loan we have applied our scorecard and we have found that this risk ranks beautifully. So scoreband “A” customer has negligible default rate and a scoreband “E” customer has relatively higher default rate. So, depending on the kind of customers we have, we now have a template, which of course we are using but eventually the thought process is that it can democratize SME lending in the country. Just to you know reiterate when we started, we said that we want to focus on eight sectors within the SME industry we added a ninth sector called micro enterprises for very small loans. We continue to build more momentum and gain more insights in these sectors. So, whatever statistical work we have done sits on top of our sector selection. This the idea is eventually to have operational, and facility related insights also from customers depending on which sector or sub sector they belong to and make a policy and underwriting very easy for them.

Another insight into underwriting -

Supply Chain Financing Product -

My take on the company :

There is a lot of information to digest about the company, I never felt lost analyzing any company, they bombarded investors with a lot of redundant and repetitive information. I tried my best not to bore you by cutting out what’s not important (something they talked about but its insignificant or never worked) although I do empathise with them as they are an startup & they have to iterate, so most of the things that don’t work do become redundant over time.

What I understood is they are betting on becoming a facilitator rather than the traditional core lender, which they call a Co-lending product.

So, what’s their USP here is - SME focued digital lending products and for capital instead of leveraging up their own balance sheet, they are facilitating banks to directly lend through them with 80-20 partnerships & make additional fees for facilitating the underwriting for the bank. This does create a win-win business model for them and it will only work if banks gain confidence in them overtime, the good thing is their co-lending book has been growing & is no surprise PSBs are happy doing business with them as themselves we all know PSBs employees have no incentive to do it on their own.

I see many parallels between lending (underwriting loans) and investing, in lending you are betting on the survival of the company, and in investing you are betting on something more than just survival of company (although survival do work sometimes in investing if price is cheap enough)

Like any other quant investing strategy, I see U-grow as a quant lending strategy, They picked 8 sectors based on historical analysis with the help of CRISL, they have a scorecard for each sector and they are doing a lot of real-time tracking analysis through GST & bank statements and if done through discipline either quant investing or lending its always supposed to work because it takes away emotions which is the biggest culprit which it comes to investing or lending (Not too bullish when sector is hot & not too bearish when sector is cold).

The good thing with U-gro is they survived the pandemic which instills more confidence in them by the markets. Given how their bonds are trading and even in today’s market, they are easily able to raise money through NCDs.

How I see them is they are catching up with the trends like - UPI, BBPS, OCEN, Account Aggregator, ONDC, etc, and how they are positioned in the market today (co-lending) they can easily transform themselves into an AA as well (In fact they already have AA platform - Gro extreme).

They are well diversified in terms of geography and sectors -

This one slide gives full insight into what they are as a company -

And they want to grow the AUM by 10x to Rs 20,000 Cr by FY25- This is what they think the company will look like in Fy25 -

Of course, I think this is a pipe dream but if that happens it will still be a 4000 to 5000 Cr Mcap company (that’s how roughly Mcap as a % of AUM nbfcs trades) which is a good 4-5x upside from today’s Mcap.

I think it’s an interesting future-looking startup trying to solve the big unsolved problem of SME lending with a new approach with most of the pillars of success in place.

All the YouTube videos related to the company -

https://www.youtube.com/playlist?list=PLzKxPAGJfd5SW39I6ukL_JYiwKzyDFjwF

Let me know your views in the comment below-

BLOGS ARE NOT A RECOMMENDATION SERVICE – These are my personal views about the Business Quality, Management Quality, Business Execution & Performance.

Thanks,

Dhruva Pandey

Email : dhruva.pandey@outlook.com

Twitter : https://twitter.com/Dhruvapandey

How are they different from MAS financial services ? The collection efficiency nos, negligible provisioning don't bother you ?

How are you looking at this business now.They have no where price wise for last 3 years.The aum stand at 11000 cr now.There has been a general neglect for the entire sector for some time.Their ROCE and Roe expansion cycle may coincide with the sector coming in fancy.Doesn't seem much downside at this price