Management guided for $100 million profit by F27 - which is close to Rs 800 Cr.

lets say if that happen we can see company trading at at least 15-20x earnings (maybe) then we are looking at 1.5 to 2x kind of returns in 3 years (which is 14 to 25% cagr).

In 2020, venture capital firm Gateway Partners 3 acquired a 15% stake in the company for $100 million, valuing the firm at approximately ₹7,000 crore. Since then, the company's revenue has doubled, yet its market capitalization is currently only ₹8,000 crore.

will that happen ? lets try to understand the business.

Company History

TVS Supply Chain Solutions Ltd. serves a diverse range of customers across various industries, including:

Automotive Sector

Major Customers: Isuzu, Daimler Trucks, Dennis Eagle, Mahindra & Mahindra, Hyundai Motor India, TVS Motor Company, and Hero MotoCorp.

Defence Sector

Key Client: The Ministry of Defence in the UK.

Utilities Sector

Notable Clients: Network Rail, Electricity North West, and United Utilities.

Consumer Goods and Industrial Sector

Clients Include: Sony India, Johnson Controls-Hitachi, Ashok Leyland, and Panasonic Life Solutions.

Technology and Infrastructure

Customers: Companies like Diebold Nixdorf and VARTA Microbattery.

Global Reach

TVS SCS has a significant international presence, serving over 10,000 customers globally, including 72 companies listed in the Fortune Global 500. In India, it has provided services to 1,044 customers, including 25 Fortune Global 500 companies.

This extensive clientele reflects TVS SCS's capability to cater to both large multinational corporations and smaller enterprises, leveraging its integrated supply chain solutions to improve efficiency and reduce costs.

TVS Supply Chain Solutions Ltd. is part of the TVS Group, a large Indian conglomerate. They have grown through strategic acquisitions and mergers, such as the recent proposed amalgamation of several wholly-owned subsidiaries to simplify the corporate structure and create synergies .

The Indian logistics market used to be dominated by monoline service providers who partnered with industry players and their captive logistics arms for transportation or warehousing requirements until the early 2000s when some captive logistics players like TVSSCS started using their capabilities to service other players as a third-party vendor. TVSSCS pioneered the development of the Supply Chain Solutions market in India.

In supply chain solutions the differentiator is technology and TVSSCS has had a long history of acquisitions to develop and complement its technology suite. They have made more than 20 acquisitions in the last 16 years across Europe, the United Kingdom, the United States and Asia Pacific (including India)

Investors should note:

Debt Repayment: The company has utilized IPO proceeds and other sources to repay all long-term borrowings, significantly reducing financial leverage .

Growth Vision: The company aims to be among the top 50 logistics companies worldwide, with a target of $2.5 billion in revenue and $100 million in profit by FY27 .

Focus on Margins: Continuous focus on improving margins through operational efficiencies and cost management initiatives .

A supply chain solution provider with end to end capabilities -

TVS Supply Chain Solutions Ltd. is like a specialized delivery and warehouse management service that helps companies manage everything related to their supply chains. Let’s break it down with some simple examples:

1. Integrated Supply Chain Solutions (ISCS)

Example: Car Manufacturing

Sourcing/Procurement: Imagine you are a car manufacturer. TVS helps you find and buy the necessary parts like engines, tires, and electronics from various suppliers. They make sure you have a steady supply without running out or having too much stock.

Integrated Transportation: They arrange transportation for these parts from suppliers to your factory and ensure it’s done cost-effectively.

In-Plant Logistics: Inside your factory, TVS manages the parts, ensuring they are at the right place on the assembly line exactly when needed. They handle storage and movement within the plant.

Finished Goods and Aftermarket Fulfilment: Once the cars are built, TVS stores and manages them until they are shipped to dealerships. They also handle spare parts for repairs, ensuring these parts are available when customers need them.

Global Freight Forwarding (GFS): If you export cars, TVS takes care of shipping them overseas, dealing with customs, and ensuring they arrive on time.

Time Critical Final Mile Solutions (TCFMS): They ensure that urgent deliveries, like a spare part needed immediately for a car repair, reach the destination quickly, sometimes within the same day.

2. Network Solutions (NS)

Example: Electronics Company

Global Freight Forwarding (GFS): Suppose you manufacture electronics and need to ship them worldwide. TVS arranges for shipping, whether by air, sea, or land, ensuring cost-effective and timely delivery.

Time Critical Final Mile Solutions (TCFMS): If a customer’s laptop needs a critical part replaced, TVS manages the logistics to get that part delivered to the repair center quickly, ensuring minimal downtime for the customer.

Real-Life Example

Amazon (Hypothetical Example)

Amazon Warehouses: TVS might help Amazon manage their warehouses. They ensure products are stored efficiently and ready to be shipped when an order is placed.

Transportation: They arrange for products to be moved from the warehouse to various distribution centers or directly to customers.

Technology Integration: TVS uses advanced software to track inventory, manage transportation routes, and ensure timely deliveries.

Characteristics of Their Business Model

Asset-Light Model: TVS doesn’t own all the warehouses and trucks. Instead, they lease them, which allows flexibility and scalability. For instance, if there’s a surge in orders during the holiday season, they can quickly add more leased warehouses and trucks.

Diverse Customer Base: They serve different industries like automotive, consumer goods, technology, and healthcare. This means they might be handling car parts for a manufacturer, managing food products for a supermarket chain, and ensuring medical supplies are delivered to hospitals.

Growth Strategy

Customer: They aim to get more business from existing customers (e.g., handling more types of products for Amazon) and acquire new customers (e.g., starting to work with a new electronics company).

Capability: Developing new skills and services (e.g., adding a new software system to track deliveries in real-time).

Country: Expanding into new regions (e.g., starting operations in a new country).

In essence, TVS Supply Chain Solutions is like a behind-the-scenes powerhouse that ensures companies can efficiently manage their products from suppliers to customers, using smart logistics and technology.

The customers of TVS Supply Chain Solutions Ltd. span various industries and geographies, emphasizing their role as a global supply chain solutions provider.

Customer Engagements

Long-Term Contracts: Many of their customer engagements are based on long-term outsourcing contracts, some extending up to 13 years.

Technology Integration: They use advanced technology solutions to enhance operational efficiency and service delivery for their clients.

Examples of Customer Wins

Centrica: One of the leading utilities in the UK, which went live in Q1 FY24.

New Business Development: The company secured almost INR 255 crores of new business development in Q1 FY24, indicating robust customer engagement and new client acquisitions.

TVS Supply Chain Solutions Ltd. serves a diverse set of industries including automotive, industrial, consumer goods, technology, rail and utilities, and healthcare. They provide end-to-end supply chain solutions, leveraging long-term contracts and advanced technology to meet the complex logistics needs of their clients. Their customer base is global, reflecting their extensive capabilities and market reach.

Business Model

TVS Supply Chain Solutions Ltd. operates an asset-light business model with a focus on end-to-end supply chain management. They operate in two primary segments:

Integrated Supply Chain Solutions (ISCS):

Customer Engagement: Long-term outsourcing contracts (mostly above 5 years) with defined scope, service levels, and pricing.

Revenue and Margin Drivers: Mix of cost-plus management fee, template/deployment linked, volume linked/variable, and gain-share pricing models. Higher utilization of network drives margin enhancement.

Cost Drivers: Solutioning, process and technology deployment, outsourced vendors (transportation partners), manpower deployment, and asset deployment (warehouse and equipment).

Network Solutions (NS):

Customer Engagement: Mix of long-term and short-term commercial contracts, with a combination of cost-plus management fee and template/deployment linked models.

Revenue and Margin Drivers: Revenue is driven by cost-plus management fees and template/deployment linked contracts. Margins vary based on input costs due to a higher share of contracts with cost-plus management fee pricing models.

Cost Drivers: Solutioning, process and technology deployment, operational manpower deployment, network cost (stock locations, outsourced couriers, and support engineers).

Customers

The customer base is very broad and stickiness is high given that the tenure of the relationship is around 10 years on average. Further, the company serves 72 of the top 500 Fortune companies. The top 5, top 10 and top 20 customers account for 18%, 28% and 39% of the revenue respectively in 2023.

TVS Supply Chain Solutions Ltd. serves a diverse set of industries, including:

Automotive:

Example: Managing the logistics for large automotive companies, ensuring timely delivery of car parts to assembly plants.

Industrial:

Example: Handling logistics for a manufacturer of industrial machinery, ensuring timely delivery and efficient management of raw materials.

Consumer Goods:

Example: Managing the supply chain for major retailers, ensuring smooth movement of products from suppliers to warehouses and retail stores.

Technology and Tech Infrastructure:

Example: Handling logistics for tech giants, ensuring timely delivery of components and final products.

Rail and Utilities:

Example: Managing logistics for utility companies, ensuring timely transportation of equipment and materials to project sites.

Healthcare:

Example: Managing the supply chain for pharmaceutical companies, ensuring timely delivery of medicines and medical equipment.

Real-Life Example

A real-life example of TVS Supply Chain Solutions' impact is their work with a leading Indian multinational home appliances company. They provided a complete overhaul and redesign of the supply chain network, including supply chain consultancy, warehouse design, inventory automation, and transport management. This resulted in improved space management, compliance with standard operating procedures, inventory management, and reduced operating costs

In the case of TVS Supply Chain Solutions Ltd., the significant decline in global freight rates has the following implications:

Impact on Network Solutions Segment:

The Network Solutions (NS) segment is directly affected by changes in freight rates. When freight rates drop by 55%, the base cost decreases substantially.

As freight is a major cost component, the lower pass-through costs result in lower overall revenue, even though the profit margin percentage might remain constant.

Volume and Operational Efficiency:

Lower freight rates can lead to lower operational costs, but the revenue from the freight forwarding business would still decrease because it is directly tied to the cost of freight.

Despite cost efficiencies, the top-line revenue figure reflects the decreased freight rates.

Freight Volume Adjustments:

Customers might ship different volumes based on changing freight rates. If lower rates lead to adjusted shipping schedules or reduced volumes, this impacts the revenue from volume-based services.

Example Calculation

Assume TVS has a cost-plus contract with a 10% markup on freight costs:

Previous Year: Freight cost = $1,000; Markup = 10%; Revenue = $1,000 + $100 = $1,100

Current Year (after 55% drop): Freight cost = $450; Markup = 10%; Revenue = $450 + $45 = $495

Despite maintaining the same margin percentage, the revenue decreases significantly due to the lower base freight cost.

While the cost-plus model helps stabilize margins, the total revenue is still sensitive to significant fluctuations in underlying costs such as freight rates. This explains why a significant decline in global freight rates has impacted the revenue for TVS Supply Chain Solutions Ltd.

Profitability Outlook

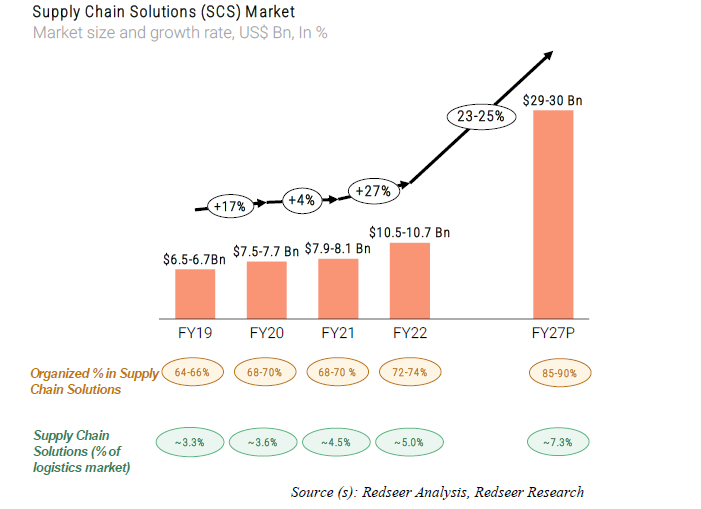

The organized and unorganized market size of the supply chain solutions industry was US$10.1-10.6 billion and TVS Supply Chain Solutions Limited’s market share in the organized sector in the supply chain solutions industry in terms of revenue was approximately 7% in Fiscal 2022 with the most varied client base and one of the most diverse set of services among top organized players in India.

Expected Timeline for Profitability

TVS Supply Chain Solutions Ltd. has undertaken several measures to address the challenges and improve profitability:

Operational Efficiency and Cost Management:

Cost rationalization measures, including optimizing fixed costs and infrastructure, are expected to improve profitability.

Strategic Focus on ISCS Segment:

The ISCS segment, which showed strong growth, is expected to continue driving revenue and profit growth. The company has a healthy pipeline for ISCS services .

Recovery in Freight Rates and IFM Business:

The normalization of freight rates and turnaround in the IFM business are expected to contribute to profitability. The IFM business is projected to achieve target run rate profitability by Q2 FY25 .

New Business Development:

Continued addition of new clients and contracts, along with geographical expansion, is expected to drive growth. New business development contributed significantly to revenue in FY24 .

Medium-Term Goals:

The company aims for a Profit Before Tax (PBT) margin of 8-11% and a Return on Capital Employed (ROCE) of over 20% by FY27 .

Conclusion

As India's first and largest supply chain solutions company, TVS Supply Chain Solutions (TVSSCS) is perfectly positioned to capitalize on the strong growth trends in the country. These include the rapidly expanding network of highways, railways, and air freight capacity, as well as the shift of global supply chains to India as part of the post-Covid China-plus-one strategy. Additionally, if initiatives like the India-Middle East-Europe Economic Corridor come to fruition, TVSSCS stands to benefit immensely, as it is uniquely equipped with extensive international operations that no other Indian company can match.

TVS Supply Chain Solutions Ltd. is working on multiple fronts to address the current financial challenges and move towards profitability. While significant reductions in freight rates and increased costs have impacted revenue and profitability, strategic initiatives focusing on operational efficiency, cost management, and growth in the ISCS segment are expected to drive future profitability. The company is targeting to achieve a run rate profitability by Q2 FY25 and aims for strong financial performance by FY27.