VISION:

TeamLease set in motion the larger company mission of ‘Putting India to Work’ by focusing on its vision of 3 E’s – Employment, Employability and Education.

What they do?

Teamlease is a leading HR services company in India that provides a wide range of services to both employers and job seekers. Here are some of the key services offered by Teamlease:

Staffing Services: Teamlease offers temporary and permanent staffing solutions to businesses across various sectors. They assist in sourcing, recruiting, and placing suitable candidates for different job roles and positions. (90% of the revenue)

Recruitment Services: Teamlease provides end-to-end recruitment services, including candidate sourcing, screening, interviewing, and selection. They help businesses find the right talent for their specific requirements.

Training and Skill Development: Teamlease offers skill development programs and training services to enhance the employability of job seekers. They provide customized training modules and courses designed to bridge the skill gap and improve the capabilities of individuals.

Compliance Services: Teamlease assists companies in ensuring compliance with various labor laws and regulations. They help with documentation, statutory compliance, payroll management, and other HR-related legal requirements.

Payroll and Benefits Administration: Teamlease provides payroll management services, including salary processing, tax calculations, and benefits administration. They help businesses streamline their payroll processes and ensure accurate and timely salary payments.

HR Advisory Services: Teamlease offers expert HR advisory services to businesses, providing guidance on HR policies, employee engagement, performance management, and other strategic HR initiatives.

Government Programs: Teamlease actively participates in government initiatives and programs aimed at promoting employment, skill development, and entrepreneurship. They collaborate with government bodies and provide support in implementing these programs effectively.

It's important to note that the specific services offered by Teamlease may vary based on the unique needs of their clients and the prevailing market conditions.

FOCUS AREA:

Why bet on this company?

Within the HR services & staffing industry, you'll encounter a plethora of options, ranging from small, independent ventures to large-scale enterprises. Just as a neighborhood grocery store offers personalized attention and familiarity, mom-and-pop HR services businesses provide a niche and localized experience, often specializing in specific tech domains. However, in the league of industry giants, we find remarkable success stories like Teamlease and Quesscorp, who have managed to scale up and establish themselves as industry leaders.

Scaling up is tough in any business the fact they have been able to do it in this industry is remarkable and it is worth knowing how?

Nonetheless, staffing in India is a huge industry. There are approximately 23,500 recruitment firms in India. And more than twelve staffing companies produce a turnover of more than ₹1000 crores—a couple of these companies are even closer to the ₹5000 crore turnover mark. These staffing juggernauts are increasingly spreading awareness about the advantages of staffing and recruiting to large organisations. All these features are propelling India towards the $20 billion staffing mark to overtake Netherlands—currently the sixth-largest market—by 2025.

The staffing industry in India is highly competitive, and there are several well-established companies operating in this space. While it's challenging to definitively identify the top five companies, here are five prominent staffing firms in India known for their extensive reach and services:

TeamLease Services: TeamLease Services is one of India's leading staffing companies, offering a wide range of services, including temporary staffing, permanent recruitment, payroll processing, and compliance management. They cater to various industries such as IT, retail, BFSI (banking, financial services, and insurance), healthcare, and more.

Mcap 3840 Cr ($480 million)

FY19 (pre covid) Net Margin 2.2% , Rev 4448 Cr.

Fy23 Net Margin 1.4%, Rev = Rs 7870 cr

Quess Corp Limited: Quess Corp is a diversified business services company that provides comprehensive staffing solutions. Their services include temporary staffing, permanent recruitment, executive search, payroll management, and compliance services. Quess Corp serves clients in sectors like IT, telecom, healthcare, manufacturing, retail, and facilities management.

Mcap Rs 5843 Cr

Fy 19 Net Margin = 3%, Revenue = Rs 8,527 Cr

Fy 23 NM = 1.3%, Revenue = Rs 17,158 Cr

Randstad India: Randstad is a global HR services company with a strong presence in India. They offer a range of staffing solutions, including temporary staffing, permanent recruitment, executive search, and outsourcing services. Randstad caters to industries such as IT, engineering, finance, healthcare, and manufacturing.

It’s an 8.63B EUR Billion Mcap company.

Operates with a 3.75% Net Margin.

Trading at a 6% dividend yield.

Adecco India: Adecco is a well-known global staffing company with a significant presence in India. They provide staffing services across various sectors, including IT, telecommunications, engineering, finance, hospitality, and healthcare. Adecco offers temporary staffing, permanent recruitment, and workforce management solutions.

Mcap 5.4 Billion USD, Net margin 3.1 % (2019) and today (1.4%)

Kelly Services India: Kelly Services is a leading global workforce solutions provider, and they have a strong presence in India as well. They offer staffing services for various industries, including IT, engineering, healthcare, finance, and customer service. Kelly Services provides temporary staffing, permanent recruitment, and managed services.

Mcap 600 Million USD, Loss-making.

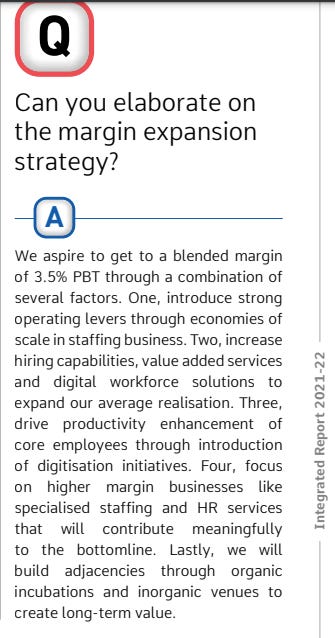

If you see well-run companies globally make 3.5 % margin on average, Even quess corp used to make NM of 3% pre covid, post covid margins dropped for both to 1.3- 1.4% range. The reason for drop in margins is basically inflation, due to hike in salary of the core employees and hikes in associates’ salaries. The company bills its clients on a fixed mark-up and hence the percentage margins got impacted.

I think it’s fair to expect margins to normalize again to 3 to 3.5% over 3 to 5 years for both companies. I particularly like Teamlease over Quesscrop as Teamlease is a pure bet on the formalization of job markets in India, Operating on a few profitable verticals and does more than double the ROE of Quess Corp.

What is more attractive about this market is it’s growing faster than the economy (north of 15 - 20%) and there is a huge TAM to capture as the market is still dominated by unorganized players, from last 5 years team lease has been maintaining a market share of 6% and revenue has grown by 15% cagr.

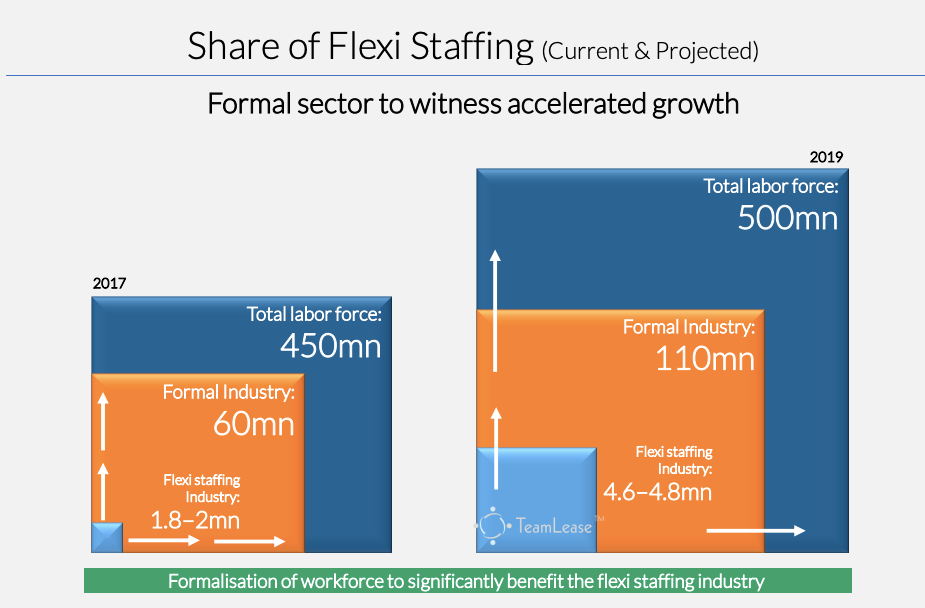

The above slide gives you a great perspective on TAM There are abt 45 Cr labor force in India, and only 6 Cr work in formal industry, and Flexi (contract) workers are just 20 Lacs, The gap 45 - 6 Cr are uncontracted labor’s working in the unorganized industry. If you believe the formalization of the economy will happen over time then this pie will continue to grow faster than the GDP growth of the country.

For example, in the last 10 years team lease grew its earning by 20% cagr, given company started in 2001, it was already a decent size company 10 years ago in the market.

“Conf call 2016 - The opportunity from a perspective of the market given the dynamics of 98.5% is in the informal sector is migrating and that is really where the growth opportunity exist for us continues to be there, the reality that while the GDP has been growing at 5%-6%-7% we have been growing at 25% is a reflection of the formalization that is happening in the market.”

If we work with the next 10-year growth rate to be 15% cagr and a net margin of 3.5% over 10 years then we can expect the company will be doing Rs 1000 Cr of net profit by Fy 34 and Still, have a good runway ahead of it as today just 20 lac contract workers deployed in the formal job market of 6 cr and informal job market of 45 Cr. 15% growth rate over 10 years means just 20x 4 = 80 lac flexi (contract ) workers by FY34 and I am assuming team lease will grow at industry rate of 15% cagr.

Generally, a 15% cagr growth company gets priced at 20x earnings which means we will get the market cap to be 20,000 Cr by Fy 34. Therefore, the CAGR for the given growth from today’s mcap of 3818 to 20,000 over 10 years is approximately 19%. pessimistically one can expect to make a 13-15 % cagr return if things do work out decently with the company.

The company has been improving its margins since the IPO -

Productivity has been going up - ( should generate operating leverage for them)

On Mar 11 - they had 1 associate per 149 staff employees.

On Mar Fy23 it improved to 340 staff per associate.

Considering today's valuation, I believe this company is the most promising choice within the thriving sector. The staffing market in India is currently valued at $6 billion and experiencing a rapid growth rate of 15%. Surprisingly, TeamLease holds only a 6% market share, indicating significant room for expansion, especially since the industry is predominantly controlled by unorganized players.

Given TeamLease has been able to win back a large chunk of business from Samsung from some of their peers, we can expect more jobs will get created as Apple started manufacturing in India does indicate some shift manufacturing from China to India and Tesla announced coming to India by end of this year. Teamlease is one way of betting on China + 1 if at all this happens.

Also, Company has been building the supply-side ecosystem to support future growth -

FY22 AR- Future growth strategy To support growth and improve efficiency, we are building a strong talent supply ecosystem, leveraging tier 2 location centers and cutting-edge technology tools. Our growth strategy is a combination of increased market share and a balanced portfolio mix of both segments to ensure that we meet both top and bottom-line targets.

Risks - 80JJAA Tax deduction :

The tax percentage on the profit and loss statement (P&L) can be perplexing, as it varies greatly. Often, it appears that taxes are not paid at all, while other times, the tax percentage ranges from 3% to 11%. Occasionally, there are instances where a significantly higher tax rate of 58% or 34% is paid.

Actually, Section 80JJAA of the Indian Income Tax Act provides a tax deduction to eligible businesses for additional employee costs incurred for the purpose of promoting employment. Here are the key details of the 80JJAA tax deduction:

Eligibility:

Applicable to Indian companies, partnership firms, and limited liability partnerships (LLPs).

Only available to businesses engaged in manufacturing, production, or providing specified services.

Deduction Amount:

The deduction is available for 30% of the additional employee cost incurred during the relevant assessment year.

The deduction is over and above the regular employee cost and is calculated on the "additional" cost incurred.

The deduction is available for three consecutive assessment years, starting from the year in which the eligible employment is created.

Conditions for Deduction:

The business must have employed a minimum number of employees in the previous year, as per the following criteria: a. At least 10 new employees (in case of a business employing up to 100 workers) b. At least 2% of the total workforce (in case of a business employing more than 100 workers)

The eligible employment must be maintained for a minimum period of 240 days in a year.

The employees must be eligible for the Employee State Insurance (ESI) Act or the Employees' Provident Fund (EPF) Act.

The purpose of this tax deduction is to incentivize businesses to generate new employment opportunities and promote job creation. It helps companies offset a portion of the additional employee costs incurred, thereby reducing their tax liability. It is important for businesses to carefully review the specific provisions of the Income Tax Act and consult with a qualified tax professional for accurate interpretation and application of the deduction.

As Teamlease has been on a hiring spree as that’s what their businesses is all about they have been using this to save on taxes but the Income tax department thinks otherwise and has sent the notice to the company -

The outcome of the decision will determine whether they receive Rs 155 Cr from the tax department or incur a loss of Rs 95 Cr to the tax department. However, if they end up losing, the significant challenge will be the obligation to pay higher taxes annually, which will heavily impact their net margins.

Thanks for reading, Let me know your views about the sector and the company in the comments below.

Hi Dhruva,

Well written & thorough writeup.

A question - What’s the significance of “core staff per associate”? How are we defining it as productivity? Is a higher ratio better for margins because of either low cost or higher revenue?

Thanks

Thanks. Promotors are selling nearly 8 % in last 2-3 years. Any particular reason ?