Why it’s a great Business?

The psychology of credit card spending-

When money is not flowing out of your bank account you tend to focus more on product rather than price of the product and most people end up spending more than they would have otherwise while using the credit card and more people are spending more are the chances credit card companies will endup making more money but responsible credit card use provides benefits that cash can't match.

It’s easy to convince yourself, without even knowing it, that you’re not spending “real” money when you charge on your credit card. And technically, that's correct.

"In fact, you're not really spending money — you're borrowing money," writes author and certified public accountant Michele Cagan in her book, "Debt 101." "You know that you’ll have to pay the bill eventually, but the promise of small minimum payments can make purchases seem like bargains." Unless you pay back the purchase immediately, you won't feel the pain of the bill for basically a month.

Multiple behavioral economics studies back this up, including a now-classic study by Drazen Prelec and Duncan Simester, professors at Massachusetts Institute of Technology, in which randomly selected participants were offered the opportunity to buy highly desirable, sold-out tickets to a professional basketball game.

Half the participants were told that they would have to pay cash for the tickets. The other half were told that they would be required to pay by credit card. Those who were told they would have to pay by credit card were willing to pay more than twice as much on average as those who were told that they would have to pay by cash. In other words, study participants were willing to pay a 100% premium for the opportunity to buy now and pay later.

Another often-cited study is one conducted by Dun & Bradstreet, in which the company found that people spend 12%-18% more when using credit cards instead of cash. The Federal Reserve Bank of Boston recently found an even sharper disparity between cash and non-cash transactions. According to a 2016 report from the bank, the average value of a cash transaction was $22, compared with $112 for non-cash transactions — a 409% jump.

Older studies and real-world data points have also tended to support this general idea through the years:

One study from the Journal of Applied Psychology found that diners tipped an average of about 4.3% more just by seeing a credit card logo on the tray that holds their restaurant bill.

McDonald’s once reported that its average ticket was $7 when people used credit cards versus $4.50 for cash.

A published paper from MIT economist Amy Finkelstein found that U.S. states with highway tolls would tend to increase that toll once they'd installed an automatic collection system, such as EZ-Pass. The study suggests that states realized they could charge more because consumers don't "feel" the electronic transaction in the same way they would by parting with "real money."

Enter the phenomenon known as “payment coupling," which studies refer to as the time difference between when you choose to purchase something and when you actually end up paying for it. With credit cards, because you don’t pay for something the moment you buy it, it’s less psychologically painful to spend your future money than your present money.

How they make money?

credit card companies make most of their money when you fail to pay back your dues within the window you’re expected to pay them. Beyond this, they’ll charge you an interest rate that could vary anywhere between 25% to 40% annually.

As shown below in case of SBI cards -

the transactors are the intelligent folks who use card and pay on time. Whereas rest of the 60% of the folks are either Revolver (Who pay just minimum amount of bill) or EMI’rs (those who buy stuff on EMI using card) generate income for the credit card companies.

Credit card companies do make some money from transactors as well through annual fee if any and through a merchant discount rate, or MDR (when u buy some stuff some fee is charged to merchant). As explained nicely in the pic below by (Finshots)

Now a days some folks are paying rent using credit - card and happy to pay fee as well in doing so https://www.cnbctv18.com/personal-finance/sbi-card-charge-processing-fee-rent-payments-hike-emi-transaction-credit-card-nov-15-15158101.htm

So of the Rs 10,000 Cr revenue in FY22. 48% came from the Interest income and 52% came from the Fees & Commisions.

End of the day credit card is an credit product and it seems much more attractive than the many other credit products out there.

Credit card industry in India-

The credit card industry has grown 20% carg in the last five years. The number of credit cards crossed 78 million in July 2022.

How did SBI Card do Vs Industry ?

In 2017 SBI cards had 15.7% (4.57/29) marketshare with 4.57 million cards outstanding.

Today, Q2Fy23 they have total 14.8 million (19% marketshare) cards outstanding. Which is about 26% cagr growth which is much higher than industry 20% cagr growth.

How about in volume & transactions terms?

The graph above clearly shows industry just came back to pre-pandemic levels, the growth trajectory dipped during FY 2020–21 due to COVID-19. Also, the slowdown was due to the barring of the largest issuer HDFC from issuing cards by the RBI.

Volume in yellow = Num of transactions & Value in red.

If you ignore Covid disruption, pre-covid Fy18 to Fy20 volume grew by 16% cagr (instead of 8% in the last 5 yrs) and value grew by 17% cagr (Instead of 13% cagr).

How did SBI Card do Vs Industry ?

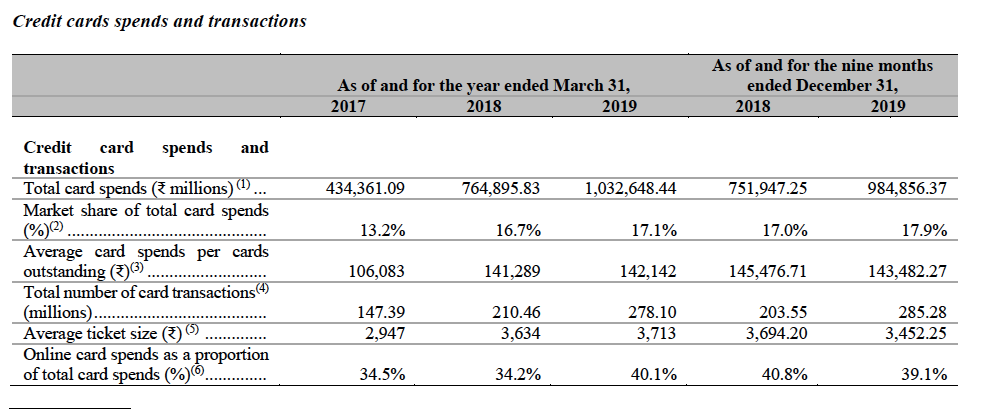

As you can from table below SBI cards showed impressive growth in all of the matrices from 2017 till 2019 greater than the industry.

On Fy22, Total card spend was Rs 186,353 cr. which has grown impressive 34% cagr from Fy17 much higher than industry as can be seen from 13% marketshare in 2017 to 18% markeshare today in total card spend.

How have they been able to gain marketshare?

SBI Cards spends a bulk of its revenue on promotional and sales activities — Free movie tickets, reward points, gift cards, discounts, cashback etc. Also, All Gov PSU corporate credit cards are generally issued by SBI and SBI serves to most of the Gov employees. (being SBI) Their Cost of funds is among the lowest in the industry and about 40,000 sales personnel operating out of 140 cities spread across most of India’s territory. In Fy22 they burnt about 30% of Revenue in marketing, reward points, commissions and Advertising to maintain its marketshare in ultra competitive market.

SBI Cards DRHP doesn’t have past data but on reading some management interviews I get the sense the explosive growth post-Fy17 happened because that’s when SBI Card started working with SBI Bank for customer acquisition. You are bound to grow like crazy if you get the SBI Bank data to run your algorithm over.

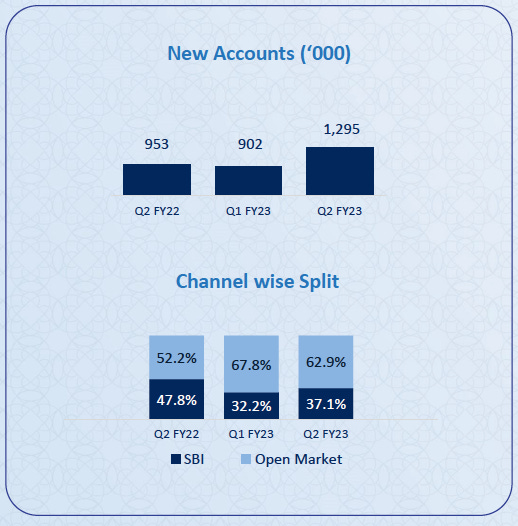

but even today SBI cards acquire most of its customers through open channels as shown below (63% in Q2 Fy23), As they have the 30-40 thousand ground force all over the country in the railway station, malls, airports etc day and night working for them.

SBI cards has both the distribution network, Low cost of funds and Cash to burn in order to compete in this very lucrative market.

I think we can roughly work with these numbers for estimating future growth in financials, we will come back to this later while valuing the company.

Just to give you some flavor of it the markets are currently pricing in 15 % cagr eps growth for 20 years with a terminal growth rate of 6% with a return expectation of 14% cagr (Given the expectations from nifty50 is 12-13% cagr).

Does it look probable?

Well, it looks more plausible compared to what markets are pricing in for the likes of Nykaa. The good thing about the credit -card (in general credit) business it’s a natural hedge against inflation, If you look at the average ticket size has undergone a steady growth of 7.3% (after recovering from the dip in FY 2019–20.) which is inline with inflation and your net income (cash) is your raw material so, you get these fly wheel going as long as you are lending prudently (Bajaj Finance or HDFC).

More the inflation —> more the cost of goods/services —> more will be the spending volume on credit cards.

so, if you see inflation growing at 7% and GDP growing at 7%, it’s fair to assume credit-card transaction volume can easily grow at 14% cagr after considering the growth in credit card penetration it could potentially grow at a higher rate as it has been growing historically.

As shown above, the number of credit card transactions has grown almost 20x since 2005 which is around 22% cagr growth (pre-pandemic growth). so, what markets are pricing in a long-term 15% cagr growth may be possible and could potentially happen as well. Even if you look at the pre-pandemic growth rates of 5 biggest players dominate >80% of the industry below across matrices -

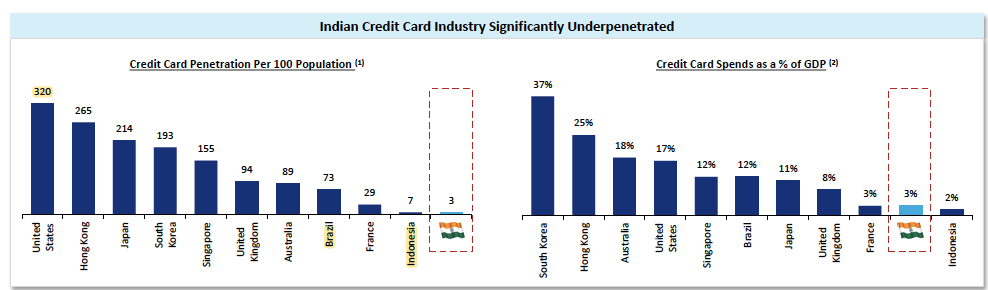

(Not surprisingly SBI cards did far better than many private players in terms of growth rates pre-pandemic) and on the top of everything India is still largely an underpenetrated market, and only 3% of the population has a formal credit card.

To put this 3% of population into some prospective, 4.3% of the population of around 1.4 billion has a demat account, the income tax filers make up just about 6.5% of India's adult population (all of whom are voters) and that’s why neither the Indian Gov nor the Majority of the voter give any fuck about how they are spending the Tax payers money.

What will drive the high penetration?

As per the RBI, 65% of the credit card penetration is present in tier I cities. Comparatively, the penetration in tier II and III cities has been significantly less. However, with the introduction of new business centres in tier II and III cities – such as Surat, Nashik and Kanpur – the increase in economic activities, entry of major brands across categories and emergence of manufacturing and service-based economy, there has been a considerable increase in the salaried customer base in these cities. I think with SBI distribution reach into these cities they have the better chance of growing into this untapped market.

The self-employed professionals such as freelancers, medics, chartered accountants and architects, remain one of the least-penetrated segments in the credit card industry. Today, a few FinTech players offer products catering to business-related credit-cumpayment needs of a self-employed professional. Entry of new players with differentiated offerings, coupled with value-added services, will help deepen the penetration of this segment.

Early jobbers, who typically fall within the age bracket of 18–25 years and are new to the employment market, generate a substantial demand for credit cards. However, the non-availability of credit history and low starting income have restricted the supply of credit cards. To curb this, some credit card issuers have started the issuance of cards with lower limits.

Where do we stand globally?

In US everybody is holding about 3 cards 😮 and south Koreans spends 37% of GDP using credit card 😮. I don’t know how its going to pan out for India but there is lot of scope for growth clearly.

Competitive Scenario-

Pre-Covid -

As we can see from the chart above SBI cards (dark red line) had a upward trending line pre-covid, Its been gaining marketshare.

Post-Covid -

I don’t have the trend data but SBI Cards grew enough to maintain its marketshare in number of cards outstanding but lost a bit of marketshare in spends, despite HDFC being barred from the markets. It’s the ICIC that took the most benefit of it.

HDFC Bank has the highest market share in credit card spends at 28.34 %, followed by ICICI Bank (20.1%), and SBI Card (16.7 %). Axis Bank has a spends market share of 8.7% as of July.

As far as market share in outstanding credit cards is concerned, HDFC Bank has 22.4 % share, followed by SBI Card, ICICI Bank, and Axis Bank at 18.1 %, 17.1 %, and 12.4 % respectively.

According to the RBI, they have grown their business faster than the Indian credit card market over the past 5 years both in terms of the number of credit cards outstanding and the amount of credit card spending.

They are also the largest co-brand credit card issuer in India according to the CRISIL Report, and they have partnerships with several major players in the travel, fuel, fashion, healthcare and mobility industries, including Air India, Apollo Hospitals, BPCL, Etihad Guest, Fbb, IRCTC, OLA Money and Yatra, among others. As you can see SBI card focus has been on the traveling side which could be the reason for lower card spending during covid, Where as ICIC more e-commerce-focused gained marketshare in spending. If that is the case it’s all going to mean revert in due time.

Another reason SBI Cards didn’t capitalize on HDFC cards ban is the Pandemic related delinquencies.

Oct 29, 2020:

What Caused The Sharp Rise In SBI Card's Stressed Credit

Although this looks really bad but there were some green light -

54% of the customers for the first time slipped into the NPA who never missed out on the payments. (so, as economy openeded up they came back paid their dues)

If we look at the trend Sep 20 Proforma GNPA shootup to 7.5% then it started declining -

It declined to GNPA @ 3.91% by Q1Fy22 and by Q2Fy23 it came inline with their historical average: GNPA @ 2.14%, NNPA @ 0.78%.

In Q4Fy21 earning call they talked about thing recovered and they strated again focusing on growth -

Overall looks like they have well passed the pandemic disruption and we could see company aggressively growing again, This fianacial year they are going to do north of Rs 2000Cr net profits and if they keep growing 25% for next 3 years it will be trading at around 18x Fy26 earnings (which is not bad). Certainly of all the growth quality businesses out there it’s been trading at foreseeable growth estimates.

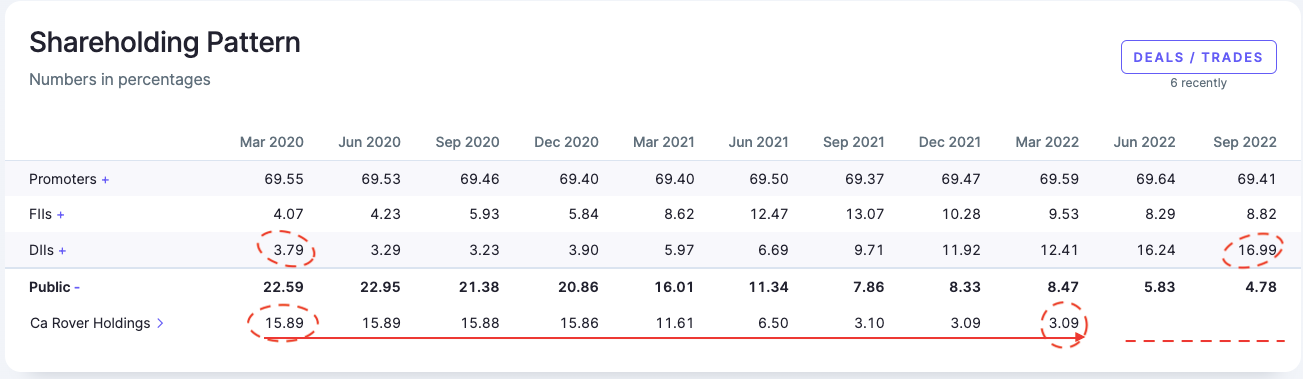

Carlyle which used to own 26% pre-IPO, sold some of it via OFS during IPO have been on a selling spree up until Mar 22.

Now, as they have completely exited the position the technical overhang of a lot of supply is over and most of it went into the strong hands DIIs.

Nice Article Dhruva. Thank You

Nice post Dhruva. I have a question regarding the market (credit card industry) I believe considering the lending history for farmers and the recent ECLG for Msme, which shows that we have a poor credit culture, the industry might grow but with a subsequent lower quality standard in tier 2 and tier 3 cities and a reduction in the MDR can reduce benefits which inturn can reduce credit card viability as an instrument. Also even after so much push for UPI cash levels are near ATH so a subsequent challenge is the mentality shift which would also be hard to overcome.

Side note - Please ,Next post on reverse DCF xD.