What is INVIT ?

An Infrastructure Investment Trust (InvIT) is a collective investment scheme similar to a mutual fund, designed to pool money from investors to invest in infrastructure projects. InvITs provide a structured way for developers and operators of infrastructure projects to raise capital by monetizing existing assets, thereby unlocking value and providing returns to investors through regular distributions.

Key Features of InvITs

Structure:

Sponsor: The entity that sets up the InvIT and transfers its infrastructure assets to the trust.

Trustee: An entity responsible for overseeing the operations of the InvIT and ensuring compliance with regulations.

Investment Manager: Manages the assets of the InvIT and makes investment decisions.

Project Manager: Responsible for the operations and maintenance of the infrastructure projects held by the InvIT.

Regulatory Framework:

In India, InvITs are regulated by the Securities and Exchange Board of India (SEBI) under the SEBI (Infrastructure Investment Trusts) Regulations, 2014.

Types of InvITs:

Public InvITs: Listed on stock exchanges and available for public investment.

Private InvITs: Not listed on stock exchanges and typically available for investment by institutional investors.

Investment Objectives:

Income Generation: Provide regular income to investors through distributions from the cash flows generated by the underlying infrastructure assets.

Capital Appreciation: Potential for capital appreciation through the appreciation of the value of the underlying assets and new acquisitions.

Underlying Assets:

Infrastructure projects such as roads, bridges, power transmission lines, renewable energy projects, and other similar assets.

Distributions:

InvITs are required to distribute at least 90% of their net distributable cash flows to unitholders, typically on a quarterly or semi-annual basis.

Benefits of InvITs

Stable Income: Provides a regular income stream to investors through distributions from the cash flows generated by the infrastructure assets.

Diversification: Offers exposure to a diversified portfolio of infrastructure assets, reducing risk.

Liquidity: Public InvITs provide liquidity to investors as units can be traded on stock exchanges.

Tax Efficiency: InvITs enjoy certain tax benefits, such as pass-through status for interest and dividend income, and exemption from dividend distribution tax.

Professional Management: Managed by professional investment managers and project managers, ensuring efficient operation and maintenance of the assets.

Risks of InvITs

Regulatory Risk: Changes in government policies and regulations can impact the performance of InvITs.

Operational Risk: Risks related to the operation and maintenance of infrastructure assets.

Market Risk: Market fluctuations can impact the value of the units and the returns generated.

Interest Rate Risk: Changes in interest rates can affect the cost of borrowing and the returns on investment.

What PGInvIT Does ?

Owns and Operates Power Transmission Lines:

PGInvIT owns a network of high-voltage power transmission lines. These lines transport electricity from power plants to substations, which then distribute it to homes and businesses.

Long-Term Contracts:

They have long-term contracts, called Transmission Service Agreements (TSAs), with power distribution companies. These contracts typically last for 35 years, providing a stable and predictable source of income.

Revenue Based on Availability:

Unlike some businesses where revenue depends on how much product is sold, PGInvIT earns money based on the availability of its transmission lines. As long as their lines are operational and available, they get paid a fixed amount.

Incentives for High Availability:

If PGInvIT maintains high availability (ensuring their lines are operational most of the time), they receive additional incentive payments. This encourages them to keep their infrastructure in top condition.

Protection from Market Fluctuations:

Their revenue is insulated from the ups and downs of the electricity market. They get paid regardless of how much electricity flows through their lines or the current market price of electricity.

In summary, PGInvIT is in the business of maintaining and operating power transmission lines with a focus on reliability and long-term stability. Their unique revenue model ensures they get paid consistently, making them a stable investment.

Hey I would love to know how stable / predictable are the revenue?

The revenue for Powergrid Infrastructure Investment Trust (PGInvIT) is insulated from demand, supply, and price fluctuations of the power tariff due to the following reasons:

1. Long-Term Transmission Service Agreements (TSAs):

- PGInvIT's revenue is derived from long-term TSAs with a fixed duration of 35 years from the scheduled commercial operation date (COD) of each project. These agreements specify fixed transmission charges that are not subject to renegotiation or market fluctuations, providing stable and predictable revenue streams over the contract period.

2. Availability-Based Revenue Model:

- Revenue is based on the availability of the transmission lines rather than the actual volume of power transmitted. This means PGInvIT receives payment as long as the transmission lines are available, regardless of how much power flows through them. This model ensures that revenue is insulated from variations in power demand and supply.

3. Fixed and Escalable Components of Transmission Charges:

- The transmission charges under the TSAs consist of fixed 'non-escalable' charges and, in some cases like PVTL, a variable 'escalable' component. The fixed charges provide a steady revenue stream, while the escalable component adjusts periodically based on predefined criteria, further stabilizing income.

The escalable component is designed to protect PGInvIT's revenue against inflation by allowing for periodic adjustments based on a regulatory index. This mechanism helps maintain the financial stability of the project by ensuring that revenue remains aligned with rising operational costs.

The CERC publishes an escalation index semi-annually, which is used to adjust the escalable component of the tariff. This index takes into account various factors, including inflation rates, to ensure that the escalable charges reflect current economic conditions.

For PGInvIT, the escalable component of the tariff applies specifically to the PVTL (Powergrid Vizag Transmission Limited) project. Other projects under PGInvIT, such as PKATL, PPTL, PWTL, and PJTL, do not have an escalable component in their tariffs.

The base escalable tariff for PVTL was initially set at ₹37 million. This amount is subject to annual escalation based on the rates published by the Central Electricity Regulatory Commission (CERC). For example, an annual escalation rate of 4.32% has been considered for the projections, which is based on the average inflation rates published by CERC from April 1, 2015, to December 31, 2020

The escalable component of the tariff ensures that revenue projections incorporate adjustments for inflation, providing a more accurate and realistic forecast of future revenues. For instance, the projected escalable component of tariff for PVTL is expected to increase incrementally from ₹45.66 million in the year ending March 31, 2022, to ₹49.73 million in the year ending March 31, 2024.

For other projects like PKATL, PPTL, PWTL, and PJTL, the TSAs do not include an escalable component. These projects rely entirely on fixed non-escalable tariffs for their revenue, which means their income does not adjust for inflation or other cost increases. This difference in tariff structure could be due to various factors, including the specific requirements of each project, the financial modeling at the time of bidding, and the regulatory framework applicable at the time.

4. Incentive Payments for High Availability:

- PGInvIT earns additional revenue through incentive payments for maintaining high transmission availability. Incentives are awarded for availability levels above a specified threshold, typically 98%. This structure encourages efficient operations and provides extra revenue beyond the fixed charges.

The target availability for projects is set at 98%. If the transmission system's availability exceeds this threshold, the company is eligible for incentives. Conversely, if availability drops below 98%, the transmission charges are proportionally reduced.

If the availability falls below 95%, the company incurs penalties. The detailed calculation for incentives and penalties is as follows:

Incentive: 0.02×Annual tariff×(Actual annual availability−Target availability)0.02×Annual tariff×(Actual annual availability−Target availability)

Penalty: 0.02×Annual tariff×(Target availability−Actual annual availability)0.02×Annual tariff×(Target availability−Actual annual availability)

5. Regulatory Framework and Payment Mechanism:

- The Central Transmission Utility (CTU) collects transmission charges from Designated Inter State Transmission System Customers (DICs) and disburses them to transmission licensees like PGInvIT. This centralized collection mechanism reduces the risk of payment delays and defaults, ensuring a reliable cash flow. Additionally, late payments by DICs incur a surcharge, providing further assurance of timely receipts.

By securing long-term, fixed-price contracts and linking revenue to availability rather than power flow, PGInvIT effectively mitigates the risks associated with demand fluctuations and price volatility in the power market.

This is interesting, the escalable component can provide some upside in cashflow ? what % of revenue comes from escalable component for PVTL ?

Haha Not much , The escalable component of revenue for PVTL (Powergrid Vizag Transmission Limited) is a portion of the transmission charges that adjusts annually based on inflation and other indices as per the Central Electricity Regulatory Commission (CERC) guidelines. Here is the detailed breakdown of its contribution to PVTL’s total revenue:

Base Escalable Tariff:

The base escalable tariff for PVTL was set at ₹37 million and is subject to annual escalation based on rates published by CERC.

Projected Escalable Tariff:

For the year ending March 31, 2022, the escalable component was projected to be ₹45.66 million.

For the year ending March 31, 2023, it was projected to be ₹47.65 million.

For the year ending March 31, 2024, it was projected to be ₹49.73 million.

Total Revenue and Escalable Component:

In fiscal year 2020, PVTL's total revenue from operations was ₹3,129.34 million, which included ₹106.17 million from incentive payments and the escalable component.

In fiscal year 2019, PVTL's total revenue from operations was ₹2,954.42 million, which included ₹100.90 million from incentive payments and the escalable component.

In fiscal year 2018, PVTL's total revenue from operations was ₹2,422.95 million, which included ₹79.52 million from incentive payments and the escalable component.

To calculate the percentage of revenue from the escalable component for PVTL:

For fiscal year 2020:

Escalable component: Approximate portion of the total ₹106.17 million in incentives and escalable charges (exact split between escalable component and other incentives is not detailed).

Total revenue: ₹3,129.34 million.

Percentage: 106.173129.34×100≈3.39%3129.34106.17×100≈3.39%

For fiscal year 2019:

Escalable component: Approximate portion of the total ₹100.90 million in incentives and escalable charges.

Total revenue: ₹2,954.42 million.

Percentage: 100.902954.42×100≈3.41%2954.42100.90×100≈3.41%

For fiscal year 2018:

Escalable component: Approximate portion of the total ₹79.52 million in incentives and escalable charges.

Total revenue: ₹2,422.95 million.

Percentage: 79.522422.95×100≈3.28%2422.9579.52×100≈3.28%

Thus, the percentage of revenue from the escalable component for PVTL ranges around 3.28% to 3.41% of the total revenue. This illustrates the role of the escalable component in contributing to PVTL's overall revenue.

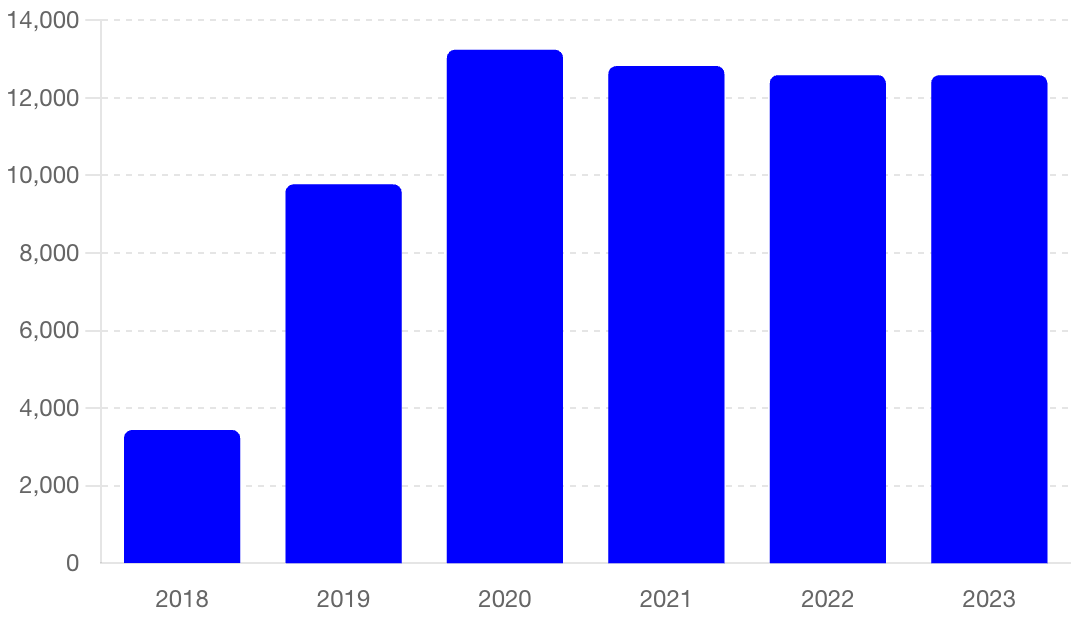

How their revenue has been trending over the year ?

Why so much growth from 2018 to 2020 ?

Acquisition of New Assets - During this period, PGInvIT acquired new power transmission assets, which contributed significantly to the increase in revenue. Acquisitions expanded the asset base and added new sources of income.

What will drive future growth ?

Acquisition of Remaining Stakes in SPVs:

Acquiring the remaining 26% stake in the four SPVs (PWTL, PPTL, PJTL, and PKATL).

Timeline: Expected to be completed by the end of FY2024.

New Transmission Projects:

Implementation of a 400 kV Bus Reactor at Kala Amb Substation.

Acquisition of Remaining assets from Power Grid Corporation of India:

How much revenue will be up after acquiring 26 % stake in remaining 4 SPVs ?

Dividend Component:

Currently, PGInvIT receives dividends from the 74% stake in these SPVs. The additional 26% stake will result in acquiring the dividends previously going to Power Grid Corporation of India Limited for this portion.

For instance, in the recent quarter, INR 0.39 out of the INR 3 distribution per unit was on account of the taxable dividend from these four SPVs. Acquiring the additional 26% stake means PGInvIT will receive these dividends directly

Debt Financing for Acquisition:

The acquisition will be financed through debt, which will introduce interest outflow and capital repayment obligations.

The average cost of debt for PGInvIT is around 8.18%. This will slightly increase financial costs, but it is designed to be manageable within the existing financial structure.

Revenue and Cash Flow Stability:

The acquisition aims to enhance operational efficiency and consolidate ownership, ensuring better control over the assets.

While the financial uptick might be minimal in the short term, the consolidation offers long-term strategic benefits and potential for better optimization of resources

The additional revenue from acquiring the remaining 26% stake in the four SPVs will not significantly increase the revenue due to the already consolidated nature of the financials and the offsetting cost of debt. The strategic benefits of full ownership include better control, operational efficiencies, and streamlined management, which could offer long-term financial stability and incremental benefits. but there will be some increase as these are 15% ROE assets and you are acquiring them with 8% cost of debt.

What about other growth drivers ? how about Current Capital Expenditure (Capex)

PGInvIT's ongoing capital expenditure (capex) is primarily focused on several strategic initiatives to enhance their infrastructure, maintain operational efficiency, and support future growth. Here are the key reasons for the current capex:

Modernization and Upgrades:

Upgrading existing infrastructure to improve efficiency and reliability.

Incorporating new technologies and automation to enhance operational performance.

Expansion of Transmission Capacity:

Adding new transmission lines and substations to increase capacity and meet growing demand.

Specific projects like the implementation of a 400 kV Bus Reactor at the Kala Amb Substation and a 400 kV line bay at the Parli Substation for renewable energy interconnection.

Regulated Tariff Mechanism Projects:

Projects like the 1x125 MVAr, 420 kV Bus Reactor at Kala Amb Substation, which is expected to be commissioned shortly and will be under the regulated tariff mechanism with a return on equity of 15.5%.

The Parli Substation project, expected to be completed by December 2025, with an estimated cost of ₹18 crore and a return on equity of 15.0%.

Operational Efficiency and Safety:

Routine and preventive maintenance, in-house maintenance, and OEM support to ensure high availability and safety of the transmission assets.

Use of aerial patrolling through drones and other modern techniques to maintain and monitor transmission lines.

Strategic Acquisitions:

Preparing for future acquisitions by maintaining financial flexibility and ensuring that existing assets are operating at optimal efficiency.

Consolidating ownership in SPVs by acquiring the remaining stakes, which requires strategic investments and financing.

National Monetization Pipeline (NMP):

Aligning with the Government of India's National Monetization Pipeline, which involves monetizing power transmission assets and reinvesting in new projects to support the sector's growth.

On one hand Indigrid has been able to increase distribution to unit holders since 2018

because of constant seeking of growth opportunities by the management.

IndiGrid's revenue growth from 2018 to 2023 can be attributed to several key factors, including strategic acquisitions, operational efficiencies, and favorable regulatory changes. Here are the nuanced details with numbers:

1. Strategic Acquisitions:

- FY 2018-19: IndiGrid acquired several assets, including Maheshwaram Transmission Limited (MTL), RTCL, PKTCL, and Patran, contributing significantly to the revenue increase from INR 4,480 million in FY 2017-18 to INR 6,656 million in FY 2018-19 .

- FY 2019-20: The acquisition of NTL, OGPTL, and ENICL led to a revenue jump to INR 12,427 million. Specifically, NTL alone contributed INR 4,832 million to the revenue .

- FY 2020-21: Further acquisitions, including GPTL, JKPTL, PrKTCL, and NER-II, pushed the revenue to INR 16,769 million .

- FY 2021-22: The addition of solar assets such as IndiGrid Solar-I (AP) and IndiGrid Solar-II (AP), along with Kallam Transmission Limited, increased the revenue to INR 22,222 million .

2. Operational Efficiencies:

- IndiGrid maintained high EBITDA margins, typically around 90-93%, which indicates efficient management of operational costs .

- Continuous investments in maintenance and technology enhancements, such as the IBM-Maximo collaboration, helped improve asset reliability and operational efficiency .

3. Regulatory Support and Tariff Adjustments:

- CERC orders led to increased tariffs for assets like NTL and OGPTL due to changes in laws, resulting in additional revenue from arrears and revised tariffs .

- Reduction in trading lot sizes and increased leverage limits by SEBI facilitated easier capital raising, which funded further acquisitions and growth .

4. Capital Raising:

- Multiple rounds of capital raising, including a rights issue of INR 12.84 billion and public NCD issues worth INR 10 billion, provided the necessary funds for acquisitions and operational improvements .

By combining these strategies, IndiGrid achieved substantial revenue growth from 2018 to 2023, transforming from INR 4,480 million in FY 2017-18 to INR 22,222 million in FY 2021-22.

On the other hand, PGInvIT is not very active in seeking new areas of opportunity for growth. It operates as a typical bureaucratic organization, and growth may only occur when the sponsor, Power Grid, decides to sell some assets to the trust.

IndiGrid, on the other hand, has ventured into solar assets for growth. I hardly see PGInvIT doing anything similar but Power Grid Corporation of India Limited (POWERGRID), does own several projects that are 100% owned, and there are plans to monetize these assets as part of the broader strategy under the National Monetization Pipeline but nobody knows how much and when that will happen or if that will happen at all in the future.

What do you think about the valuation ?

PGInvIT owns a total of 3,699 circuit kilometers (ckm) of transmission lines across its various projects, where as their sponsor POWERGRID operates more than 172,000 circuit kilometers (ckm) of transmission lines across India. which is 40x more than what currently PGInvT owns, There is lot of scope for growth but it will all depends on Gov and Capex requirement of Power Grid. Does it makes sense for Gov / Power Grid to raise equity and debt through PGInvT and acquire assets of power grid to provide them cash to do more expansion or does it makes more sense for power grid to just raise more debt / equity for the capex ?

Deciding between raising equity and debt through PGInvIT or directly raising debt/equity for capex involves evaluating several strategic, financial, and regulatory factors. Both approaches have their pros and cons, which can impact the financial health and growth potential of both PGInvIT and Power Grid Corporation of India Limited (POWERGRID). Let's analyze the scenarios:

Raising Equity and Debt through PGInvIT

Advantages:

1. Asset Monetization: By transferring assets to PGInvIT, POWERGRID can monetize existing assets, unlocking capital without increasing debt on its balance sheet.

2. Leverage InvIT Structure: PGInvIT, as an infrastructure investment trust, can attract long-term investors interested in stable returns, such as pension funds and insurance companies.

3. Efficient Capital Recycling: The funds raised can be reinvested in new infrastructure projects, supporting growth without additional debt burdens.

4. Regulatory Benefits: InvITs often have tax benefits and regulatory advantages that can make them an efficient vehicle for raising capital.

5. Enhanced Valuation: Assets transferred to PGInvIT can potentially achieve higher valuations due to the trust structure, benefiting both PGInvIT and POWERGRID.

Disadvantages:

1. Dilution of Control: Transferring assets to PGInvIT means POWERGRID will no longer have full control over these assets.

2. Market Dependence: Raising equity through PGInvIT is subject to market conditions and investor sentiment, which can be volatile.

3. Distribution Requirements: InvITs are required to distribute a significant portion of their cash flows to investors, which can limit reinvestment in new projects.

Raising Debt/Equity Directly for Capex

Advantages:

1. Full Control : POWERGRID retains full control over its assets and can manage them according to its strategic priorities. ( Gov may want to control them given the strategic importance of some of these transmission lines )

2. Potentially Lower Costs: Depending on market conditions, raising debt directly might be cheaper than equity due to lower interest rates.

3. Flexibility in Use of Funds: Directly raised funds can be used more flexibly without the need to distribute cash flows to investors.

Disadvantages:

1. Increased Leverage: Raising more debt increases financial leverage, which can strain the balance sheet and affect credit ratings.

2. Higher Interest Burden: Additional debt comes with interest obligations that can impact profitability.

3. Equity Dilution: Issuing new equity can dilute existing shareholders' ownership, which might not be favorable in the current market.

Strategic Considerations

1. Government Policy and Support: The government's policies on asset monetization and infrastructure development will significantly influence the decision. If the government supports asset recycling through InvITs, it can provide regulatory and tax incentives.

2. Market Conditions: Current market conditions and investor appetite for infrastructure investments will impact the success of raising funds through PGInvIT.

3. Long-Term Strategy: POWERGRID’s long-term strategy should align with the method chosen. If the goal is to maintain a strong balance sheet and lower leverage, using PGInvIT might be more suitable.

4. Growth Potential: Given the vast network of POWERGRID, there is substantial scope for growth through both asset monetization and direct investment in new projects.

Conclusion

Given the large scope for growth and the potential benefits of asset monetization, it makes strategic sense for POWERGRID to leverage PGInvIT for raising equity and debt. This approach can provide significant capital for expansion while maintaining a healthier balance sheet. However, a balanced approach might be optimal, where POWERGRID uses a combination of raising funds through PGInvIT and direct debt/equity to diversify funding sources and minimize risks.

Ultimately, the decision will depend on current market conditions, investor sentiment, regulatory environment, and POWERGRID's strategic priorities. Engaging with financial advisors and stakeholders can help in making an informed decision that aligns with long-term growth objectives.

Also they have large headroom for growing by taking leverage -

The ratio of net debt to assets under management (AUM) of 5% as of today, against 70% cap prescribed by SEBI for InvITs that are rated 'AAA' and have made at least six continuous distributions. This provides sufficient headroom for debt-funded acquisitions. Additionally, the long debt tenure (till fiscal 2038) leads to a comfortable debt service coverage ratio (DSCR), Whereas for indigrid its already approaching 70%.

Growing without diluting equity will be easy for PGINVT for near term, There will be some growth due to acquiring remaining 26% of assests from Power Gird and after completing of two projects 400 kV Line Bay at Parli Substation & 1x125 MVAr, 420 kV Bus Reactor at Kala Amb Substation. I think that will make the net distribution Rs 13 per year from Rs 12 currently (that’s my guess there is not enough data to calculate that but based on all the data i have a rough estimate is 5 to 10% growth in distribution by end of who knows when as its a PSU anything is possible and they are never in hurry or capitalist by nature).

With some wild assumptions on future distribution (Coupon payment) shown below, Its is pricing in 13% yield today.

Which is not bad considering the stability of the asset.

What about taxes ?

Investing in Infrastructure Investment Trusts (InvITs) like PGInvIT offers several tax benefits to investors. These benefits are designed to make InvITs an attractive investment vehicle by providing favorable tax treatment on distributions and gains. Here are the key tax benefits:

Tax Benefits for Investors

Exemption from Dividend Distribution Tax (DDT):

InvITs are not subject to Dividend Distribution Tax. This means that the dividends distributed by the InvIT to its unitholders are not taxed at the trust level.

Pass-Through Status:

InvITs enjoy a pass-through status for interest and dividend income. The income is not taxed at the InvIT level but is passed on to the unitholders, who then pay tax according to their individual tax slabs.

Taxation of Interest Income:

Interest income received by the unitholders from the InvIT is taxable in the hands of the unitholders at their applicable tax rates. However, no tax is deducted at source (TDS) if the unitholder is a resident individual.

Taxation of Dividend Income:

Dividend income received by unitholders is taxable in their hands. For resident investors, dividends are taxable at the applicable tax rates. For non-resident investors, the tax rate may be subject to the provisions of the applicable Double Taxation Avoidance Agreement (DTAA).

Capital Gains Tax:

Short-Term Capital Gains (STCG): If the units are held for less than 36 months, the gains are treated as short-term capital gains and taxed at 15% if securities transaction tax (STT) is paid on the sale.

Long-Term Capital Gains (LTCG): If the units are held for more than 36 months, the gains are treated as long-term capital gains and are taxed at 10% for gains exceeding ₹1 lakh, provided STT is paid on the sale.

Exemption on Distribution of Repayment of Debt:

The distribution received by unitholders that represents repayment of debt is not taxable in the hands of the unitholders as it is treated as a return of capital rather than income.

Benefits for the Trust

Exemption from Certain Taxes:

InvITs are exempt from certain taxes, such as income tax on specified incomes, provided they distribute at least 90% of their net distributable cash flows to unitholders.

No Tax on Transfer of Assets:

Transfer of assets by the sponsor to the InvIT is not subject to capital gains tax, provided certain conditions are met.

Summary

Investing in InvITs like PGInvIT offers various tax benefits, making it an attractive option for investors seeking regular income and potential capital appreciation. The key benefits include exemption from dividend distribution tax, pass-through status for interest and dividend income, favorable taxation on capital gains, and tax-exempt distributions representing debt repayments. These benefits enhance the overall return on investment for unitholders while providing a stable and tax-efficient income stream.

Date 06/27/2024 -

Q4 FY24 Conference call update -

On how long management can distribute Rs 12 per annum ?

No clarity on acquisition of remaining 26% from the sponsor -

Reading this i am less optimistic now about asset / dpu growth than i was earlier -

This comment is very concerning - “triggered me to sell off everything”

I hope they do well and country do well but its very hard for me to invest with Faith. Problem is management are not in control of their destiny. Regulation doesn’t allow them to own assets from power grid, even they are not sure about acquiring remain 26% of the assets from Power Grid in projects they already acquired long ago.

Gov has no incentive to grow this Invit, Management doesn’t have it either.

As per valuation report they submitted if no asset growth the NAV comes down to Rs 85.

Valuation Summary of PGInvIT Transmission Assets Valuation report - (as of September 30, 2024):

NAV Rs 85

Based on -

Vizag Transmission Limited (VTL): Enterprise Value ₹18,374.31M; Equity Value ₹11,051.11M; PGInvIT Holding 100%.

POWERGRID Kala Amb Transmission Limited (PKATL): Enterprise Value ₹3,786.87M; Equity Value ₹2,015.41M; PGInvIT Holding 74%.

POWERGRID Parli Transmission Limited (PPTL): Enterprise Value ₹20,771.63M; Equity Value ₹9,768.45M; PGInvIT Holding 74%.

POWERGRID Warora Transmission Limited (PWTL): Enterprise Value ₹22,821.16M; Equity Value ₹9,135.99M; PGInvIT Holding 74%.

POWERGRID Jabalpur Transmission Limited (PJTL): Enterprise Value ₹16,530.39M; Equity Value ₹5,763.40M; PGInvIT Holding 74%.

Key Methodology:

Valuation conducted using the Discounted Cash Flow (DCF) method under the Income Approach.

Weighted Average Cost of Capital (WACC) of 8.95% applied; terminal growth rate assumed at 0%.

Industry Context:

India's power sector is rapidly growing, with renewable energy integration being a key focus.

Litigation and Tax Disputes:

Litigations: Cases related to land compensation, crop damages, and transmission line disputes are pending in various courts.

Tax Disputes: Income tax claims and service tax disputes amounting to several crores are under appeal.

Physical Inspection of Assets:

Virtual inspections confirmed all assets are operational as of September 2024.

Observations:

Assets are in operational condition, ensuring service continuity.

Legal and tax disputes are ongoing but do not affect operational status.

Major issue with PGInvIT is regulatory change which made selling asset though InvITis unattractive for Power Grid and will not not use InvIT, With Power Grid not selling its assets through InvIT and PGInvIT not finding assets outside to bid. PGInvIT is facing difficulty to bring in new asset to its portfolio,

Please check the valuation reports many of the SPVs projected revenues fall quite a bit close to 30% -40% within next 3-4 years , I don't know how you are assuming higher coupon payments going forward - the current Rs. 12 is not even feasible in coming years. https://www.pginvit.in/uploads/68c3e2f7-6087-4d8a-a966-2e10e73087b1/05_Annexures_(Annual_Report_FY_2022-23).pdf