I remember back in September 2022, I was looking at the stock price, which was hovering around ₹600, giving it a market cap close to ₹7-8K crore. I did a quick calculation, projecting the sales 20 years into the future. Assuming a conservative net profit margin of 10%—though many independent pharmacy owners claim it’s more like 15%—I wondered if the current market cap was justified ? I felt the market cap seemed unjustified. At the time, it looked quite expensive to me. However, the stock quickly shot up to ₹900, leaving me scratching my head. Two years later, the unpredictable Mr. Market offered me the stock again around ₹650 - 700 levels.

Although the company has grown its revenue by 40% and increased the number of stores by 15% over these two years, the stock price hasn't budged much. Now, those back-of-the-envelope calculations make more sense to me.

Let's start with these promising back-of-the-envelope calculations. Then, we'll take a deep dive into understanding the business to assess how likely our forecast may come true.

Although the company has been growing at over 20% CAGR over the last 1, 3, and 5 years, we'll use a more conservative estimate of 15% growth for the next 10 years, followed by 12% growth for the subsequent 10 years, and a 5% terminal growth rate.

A simpler back-of-the-envelope calculation:

After 10 years, the company will be generating ₹22,500 crore in revenue. Assuming a conservative 10% net margin, it will yield ₹2,250 crore in net profit. Applying a 15 PE multiple gives a market cap of ₹33,750 crore, which is 4.2 times today’s market cap, implying an expected return of around 15% CAGR.

What if they make 5% net margins ?

Then you will just make 2.2x return over 10 years. (which is not great). Currently there Mature stores make 10% EBITDA margins then we should be working with 5-6% net margins. In that case it may not be trading cheap.

Currently their Mature stores make 10% EBITDA margins , maybe with private label and economy of scale and cutting on discounting as markets mature after 10-15 years (like happening in telecom) they maybe able to do 13-15% EBITDA , 7-10% net margin.

Currently markets are either pricing in 18% cagr growth for next 10 year and 7% net margins or 15% cagr growth and 10% net margins and then 13% growth for next 10 years.

If you think realistically company can only do 5% net margin (what their mature stores might be doing today) then company has to grow 20-22% cagr to give you 12-13% CAGR return in next 10 years.

MedPlus Margins Analysis

MedPlus Health Services Limited exhibits a complex margin structure driven by several factors, including the mix of products sold, store maturity, and operational efficiencies. Here’s a detailed breakdown of their margins based on the latest data from their earnings report and conference call:

Gross Margins

MedPlus gross margins are influenced significantly by the type of products they sell. The introduction and expansion of private label products play a critical role here. Private label products typically offer higher margins compared to branded generics. The company has been able to introduce these products at a significant discount (50-80%) compared to branded equivalents, leveraging their control over the supply chain and reducing marketing costs. This strategic move not only enhances customer loyalty but also increases gross margins over time.

Operating EBITDA Margins

For Q2 FY'24, MedPlus reported a consolidated operating EBITDA margin of 2.9%. The pharmacy operations, which constitute 99% of the revenue, had a store-level EBITDA margin of 9% for stores older than 12 months. This margin improves with the maturity of stores, as evidenced by a 9.8% margin for stores older than 24 months. Newer stores (less than 24 months old) tend to be a drag on overall EBITDA margins due to the initial ramp-up period where fixed costs are high relative to revenues.

Impact of Store Maturity

The maturity of stores is a crucial factor in margin performance. Stores typically break even within three to six months, with EBITDA margins reaching around 3-4% at the one-year mark. By the end of the second year, EBITDA margins for these stores can reach 7-8%, and mature stores (24-30 months) often achieve margins around 10%. This progression highlights the importance of store age in financial performance and the benefits of scale and operational efficiencies over time.

Private Label Products

The contribution of private label products to revenue and margins is noteworthy. Private label sales accounted for approximately 14% of total revenue in the current quarter. These products not only offer higher gross margins but also improve overall profitability as they replace lower-margin branded products. MedPlus' strategy includes expanding the range of private label products, which is expected to further enhance margins.

Inventory Management and Cost Efficiency

MedPlus employs advanced inventory management systems, which optimize stock levels and reduce costs. The real-time tracking of inventory across their extensive network ensures efficient distribution and minimizes wastage. This system helps in identifying and redistributing products nearing their expiry date, thereby reducing losses and improving margins.

Regional and Segment Performance

Geographical expansion and the performance of different segments also impact margins. The company's strategic focus on expanding in Tier-II cities and beyond has shown positive results, with these markets accounting for 34% of pharmacy revenues in the current quarter, up from 31% in the same period last year. The diagnostics segment, although still operating at a loss, has shown significant revenue growth and improved EBITDA margins, indicating potential for future profitability as the segment scales.

Future Margin Outlook

MedPlus anticipates continued improvement in margins driven by several factors:

Increased Penetration of Private Label Products: As private label products gain more traction, the overall gross margin is expected to improve.

Operational Leverage: Automation and scale in warehousing and corporate operations are expected to drive down costs relative to revenue, enhancing operating margins.

Mature Store Contribution: As more stores mature and reach optimal efficiency, the overall EBITDA margin is likely to improve.

Story on MedPlus -

MedPlus has really crafted an intriguing business model. Picture this: It all started in Hyderabad, way back in 2006. The founder, Gangadi Madhukar Reddy, envisioned a robust health services company. Today, MedPlus Health Services Limited has blossomed into one of India’s leading pharmacy chains, and their business model is a blend of both traditional retail and modern technology.

First off, MedPlus operates a vast network of brick-and-mortar stores spread across numerous cities and towns in India. These physical stores are the backbone of their business, where customers can walk in and purchase a wide range of medicines, health products, and wellness items. The stores are strategically located in high-traffic areas to ensure easy access for customers.

But here’s where it gets interesting—they didn’t just stop at physical stores. MedPlus integrated an e-commerce platform that allows customers to order their medicines online through their website or mobile app. Think of it as bringing the pharmacy to your doorstep. This service caters especially to those who prefer the convenience of home delivery or who might not be able to visit a store in person.

Then there’s their diagnostic services. MedPlus offers a range of diagnostic tests through partnerships with accredited labs. Imagine needing a blood test; you can simply book it through MedPlus, and they will send someone to your home to collect the sample. The results are delivered online, making the whole process seamless and hassle-free.

On top of that, they offer teleconsultation services. Let’s say you’re feeling unwell but don’t want to step out to see a doctor. MedPlus connects you with healthcare professionals through their platform for an online consultation. It’s all about making healthcare accessible and convenient.

Their revenue streams are quite diversified. The primary chunk comes from pharmacy sales, both offline and online. Then, there’s income from their diagnostic services. They also have subscription-based health packages, which offer regular customers discounts on medicines and tests.

One thing that stands out about MedPlus is their focus on growth. They’ve been expanding rapidly, opening new stores and increasing their product offerings. Over the last few years, they’ve been growing their revenue at a compounded annual growth rate (CAGR) of over 20%. They even have ambitious plans to continue this momentum, though they conservatively project a 15% growth rate for the next decade.

Their operational efficiency is quite impressive too. MedPlus employs a centralized warehousing system, which helps in maintaining a streamlined inventory and ensuring timely delivery of products. They’ve partnered with third-party logistics providers for last-mile delivery, ensuring that customers, even in remote locations, can access their services.

MedPlus also places a strong emphasis on customer engagement. They offer robust customer support through various channels, including call centers and online chat. Plus, they engage their customers with health-related content, tips, and articles, which not only educate but also build a loyal customer base.

Regulatory compliance and safety are paramount in their operations. MedPlus ensures that all their products and services meet stringent quality standards. They work closely with certified suppliers and accredited labs to maintain these standards.

In terms of financial health, MedPlus has been prudent. Despite the rapid growth, they’ve managed to keep their debt levels in check, which is a good sign for long-term sustainability.

So, if you think about it, MedPlus isn’t just a pharmacy chain. It’s a comprehensive healthcare provider that’s leveraging both traditional and modern channels to meet the diverse needs of its customers. They’re expanding rapidly, innovating constantly, and focusing on customer satisfaction, which seems to position them well for future growth.

MedPlus employs a data analytics-driven cluster-based approach to their store network expansion. They first achieve high store density in densely populated residential areas within a target city before expanding their store network into the surrounding areas of that city. This is followed by further expansion into other adjacent cities. Their cluster-based approach is driven by a deep understanding of catchment demographics, market dynamics, and their ability to support store expansion with back-end infrastructure, such as warehouses and distribution centers.

They believe that this approach and understanding allow them to (i) create brand visibility within the cities where they operate through focused marketing and advertising initiatives, (ii) increase their market share in these cities, (iii) replicate their growth model in adjacent underserved cities and towns as they develop their presence in those clusters, and (iv) generate cost efficiencies due to operating leverage achieved in their supply chain and inventory management. MedPlus has a streamlined and methodical store opening process that supports their expansion strategy and dedicated operations and business development teams at the area, city, and state levels that vet and approve the opening of new stores.

MedPlus cluster-based expansion approach and replicable store roll-out strategy have allowed them to achieve and maintain attractive and healthy store-level economics. According to the Technopak Report, for the financial year 2021, their average revenue per store was approximately ₹15.9 million, compared to the average revenue per store in the domestic pharmacy retail industry of approximately ₹2.3 million. Between April 1, 2018, and September 30, 2021, they opened an aggregate of 1,158 new stores. As of March 31, 2021, over 60% and 75% of their new stores achieved positive Store Level Operating EBITDA within the first three months and first six months of operations, respectively. Furthermore, as of September 30, 2021, their Mature Stores had a median payback period of less than three years and demonstrated a compounded average same-store sales growth of 8.30% on maximum retail price (MRP) from the financial year 2019 to the financial year 2021. For the financial year 2021 and the six months ended September 30, 2021, their Store Level Operating EBITDA Margin for Mature Stores was 11.0% and 11.58%, respectively, and their Store Level Operating ROCE for Mature Stores for the financial year 2021 was over 60%.

MedPlus' business operations across the entire value chain are backward integrated and wholly managed and operated by them. Their operations are supported by a technology-driven supply chain and distribution infrastructure, organized in a hub-and-spoke model, which provides a strong foundation and significant leverage to continue scaling the business. The entire business value chain, from sourcing products to warehousing, distribution to stores, store operations, customer interfacing, and last-mile delivery, is supported by an integrated technology infrastructure developed in-house.

As of September 30, 2021, MedPlus had primary warehouses in Bangalore, Chennai, Hyderabad, Vijayawada, Kolkata, Pune, Bhubaneshwar, Mumbai, and Nagpur. These warehouses are supported by smaller warehouses in cities with higher store density. These technologically enabled warehouses form hubs for their stores, with store inventories replenished through a centralized inventory management system capable of tracking sales and inventory levels at stores and warehouses in real-time. MedPlus manages a fleet of vehicles and delivery personnel to facilitate the transportation of inventory between warehouses and stores, generally providing daily inventory replenishment for stores in densely populated metropolitan areas and thrice per week for stores in other cities.

Their supply chain is supported by an algorithm-driven automated replenishment and stock picking system, driven by a real-time inventory analytics platform developed in-house and refined over the last ten years. They generally procure inventory directly from pharmaceutical companies and their carry-forward agents, reducing commissions and leakages in the value chain and offering products at more affordable price points to customers. The product offering is enhanced by a curated selection of private label products, from which MedPlus derives higher margins while maintaining quality. These attributes of their technology-driven supply chain and distribution infrastructure distinguish them from other pharmacy retailers.

MedPlus' business operations are led by a qualified and experienced management team, comprising individuals from diverse backgrounds in medicine, finance, business, and technology. The founder, Managing Director, and Chief Executive Officer, Gangadi Madhukar Reddy, who is both a doctor and an entrepreneur, plays an instrumental role in the strategic direction and growth of the business.

MedPlus business and operations are led by a well-qualified, experienced, and capable management team with diverse backgrounds in medicine, finance, business, and technology. Three members of their senior management team are doctors who intimately understand the business, industry, and competitive landscape. The founder, Managing Director, and Chief Executive Officer, Gangadi Madhukar Reddy, holds a bachelor’s degree in medicine and surgery from Sri Venkateswara University and a master’s degree in business administration from the Wharton School of Business, University of Pennsylvania.

Strengthen Market Position by Increasing Store Penetration in Existing Clusters and Developing New Clusters

MedPlus aims to capitalize on the shift from unorganized to organized retail of pharmaceutical products in India. By leveraging the low base of organized pharmacy retail penetration and the increasing usage of mobile and internet in India, they plan to strengthen their market position through (i) increasing store penetration and customer reach in existing clusters and (ii) developing new clusters in other states and cities.

According to the Technopak Report, for the financial year 2021, MedPlus had an aggregate share of approximately 8% of the pharmacy retail market in key cities such as Hyderabad, Bangalore, Chennai, and Kolkata. Moreover, the penetration of organized retail in the pharmacy market in Tier 1 cities and Tier 2 cities and beyond is approximately 7% and 6%, respectively. This indicates significant growth potential for their existing clusters.

MedPlus intends to leverage their replicable store roll-out process and well-developed supply chain and distribution infrastructure to increase market share in states where they have established clusters, starting with Tier 1 cities like Chennai, Bangalore, Hyderabad, and Kolkata, and then moving to Tier 2 cities and beyond. They also plan to replicate the success they have had in key cities in other cities like Mumbai and Nashik, and across Tier 2 cities in the seven states where they are currently present.

Furthermore, MedPlus plans to enter one to two new states every year. To establish their presence in new geographies, they will use their cluster-based approach and replicable store roll-out process, while concurrently developing the required supply chain and distribution infrastructure, including primary warehouses to serve as distribution hubs, building fleets of delivery vehicles, and hiring delivery personnel. When starting new clusters in regions of a state where they already operate, they expect to leverage their brand equity to grow these new clusters. They aim to achieve this at lower incremental costs by leveraging economies of scale and their established technology framework, which can be replicated cost-efficiently across new cities they expand into.

Increase Share of Private Labels and Enhance Stock Keeping Unit (SKU) Mix

MedPlus aims to increase their share of private label products, which generally yield higher gross margins. By expanding the range of private label products, they intend to steadily grow sales in this segment. Due to the scale of their purchases, MedPlus is less constrained by minimum order quantity requirements imposed by suppliers, allowing them to stock a wider range of private label products. This strategy enables them to offer customers a broader selection, potentially increasing customer wallet share and enhancing gross margins.

MedPlus plans to (i) increase the penetration of private label pharmaceutical products by introducing them for more therapeutic areas, particularly for sub-chronic and chronic ailments, and (ii) introduce new private label products in the fast-moving consumer goods (FMCG) sector, especially in the nutrition and wellness categories. To boost sales of private label products, they also plan to (i) market and advertise these products as high-quality items offered at competitive prices, and (ii) conduct training for their sales staff, providing financial incentives for identifying customer needs and cross-selling private label products. Additionally, MedPlus will support their sales staff with a technology framework that offers point-of-sale assistance and prompts.

Technology and Data Science

MedPlus' business operations are supported by robust service-oriented, event-driven technology systems and infrastructure. They host data centers in Bangalore and Chennai and maintain in-house testing, training, and staging centers in Hyderabad to develop and manage their systems and processes. Their team of over 90 software professionals helps develop, operate, and manage a technology system customized to their business needs while remaining flexible to future market changes.

MedPlus utilizes proprietary software developed in-house across their offline and online channels. These software solutions are based on open-source frameworks with reusable software modules, avoiding third-party software licensing costs except for their enterprise resource planning software. The team has developed numerous mobile applications to streamline back-end and front-end operations, including:

- Shutter App: Manages the new store opening process.

- Vendor App: Facilitates orders from vendors.

- Delivery App: Manages last-mile deliveries.

The three key pillars of MedPlus' technology systems are:

1. Front-end Customer Facing Systems & Omnichannel Platform

MedPlus uses technology to engage with customers and ensure a seamless consumer experience. They have developed various e-commerce portals such as 'MedPlus Mart,' 'MedPlus Lens,' and 'MedPlus Labs,' enabling customers to view and purchase products online via their website and app. To attract and retain customers, they utilize search-engine optimization technologies, referral programs, promotions, and online customer support through bots. MedPlus aims to maximize customer value by optimizing recommendations through predictive algorithms, integrating various payment gateways, and achieving interoperability between online and offline sales channels via their omnichannel platform.

2. Point of Sale Systems

MedPlus' in-house developed point-of-sale (POS) system is customized to their requirements. It supports billing, pricing, and payment system integrations, helping store staff cater to customer needs effectively. For example, the system provides prompts on alternate medications or private label products relevant to a particular customer.

3. Back-end Technology and Data-Science Infrastructure for Inventory Management

Their technology infrastructure and systems are critical components of every stage of operations, enabling real-time tracking of key performance indicators both centrally and on-site at stores. For back-end warehousing operations, MedPlus uses optimized algorithms to track every product stocked in their warehouses and stores in real-time. This helps balance product availability with inventory optimization. Their systems identify, track, and redistribute products nearing their expiry date and other non-moving stock to stores experiencing high demand for those products. Real-time reporting and visibility of key performance indicators are facilitated through supervisory dashboards and reporting modules developed for various management levels. A range of reports is automatically generated by their systems, and automatic alerts are triggered for performance deviations at any stage of the supply chain, enabling supervisors to intervene and rectify issues promptly.

PER CAPITA HEALTHCARE EXPENDITURE IN INDIA -

per capita healthcare expenditure in United States in calendar year 2018 was $10,624, it was $73 in India for the corresponding period. Similarly, per capita pharmaceutical expenditure in calendar year 2018 was $16 in India, as compared to $1,554 in the United States and the global average of $156.

As of Calendar Year 2018, India ranked 168 out of 193 countries in terms of current health expenditure as a percentage of GDP.

DOMESTIC PHARMACEUTICAL MARKET -

India’s domestic pharmaceutical market was valued at ₹ 1,500 billion in financial year 2020, having grown at a CAGR of approximately 10% in the last five years, and is expected to grow at a similar rate going forward. The key market characteristics of the domestic pharmaceutical market include a low per capita health expenditure, high share of private out of pocket expenses (which includes purchases from pharmacies), and lower penetration across rural areas which has led to a high opportunity of growth given the limited penetration of health services in rural and urban areas.

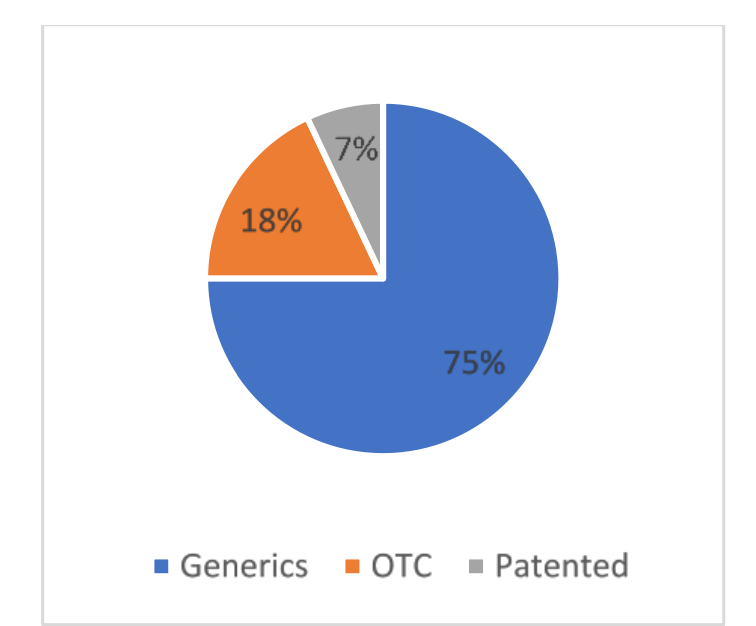

DOMESTIC PHARMACEUTICAL MARKET BY TYPE OF DRUGS -

The domestic pharmaceutical market in India can be segmented based on the type of drugs sold, which includes prescription drugs and OTC drugs. Prescription drugs further comprise of generic drugs (including branded generics and ordinary generics) and branded patented drugs. Branded generics attach proprietary names to generic drug molecules whereas ordinary generic drugs are known by their chemical names. During financial year 2020, generic drugs accounted for 75% of the total domestic market, with over-the-counter (“OTC”) drugs and branded patented drugs accounting 18% and 7%, respectively.

Domestic market by therapy

Pharmaceutical market is also segmented by therapy including acute therapy and chronic therapy. Acute conditions are generally severe and sudden in onset and therefore patients require medications urgently. This could describe ailments ranging from a broken bone to an asthma attack. The major acute therapies are anti-infectives, gastrointestinal, dermatology and vitamin/Nutrient.

A chronic condition, by contrast is a long-developing syndrome, such as osteoporosis or diabetes. Chronic therapies are dominated by cardiac, anti-diabetic and Neuro/CNS therapies. The contribution of chronic therapy is likely to increase as lifestyle diseases show higher prevalence and the age profile of the population moves to higher side.

PHARMACEUTICAL SUPPLY CHAIN IN INDIA

The pharmaceutical supply chain consists of manufacturing plants, intermediary product suppliers, logistics partners and technology partners. The Indian domestic market consists of a large network of more than 500 medium and large companies (that manufacture/contract manufacture), ~60,000 distributors, and ~800,000 pharmacy retail outlets (MedPlus has only 4000), with more than 100,000 pharmaceutical brands available in the market given it’s a branded generics market.

The illustration sets out an indicative supply-distribution chain, with the profit margins varying across the C&F agent, distributor and retailers.

Remember Modern Pharmacy today operate with 20-25% profit margins but while valuing we worked with 10%.

FMCG products play an important role in the overall profitability of a pharmacy retail store, with the sales contribution in a traditional standalone pharmacy store (also referred to as “unorganized retail”) in the range of 15-20%, and in case of a modern organized pharmacy store, it can be as high as 30%.

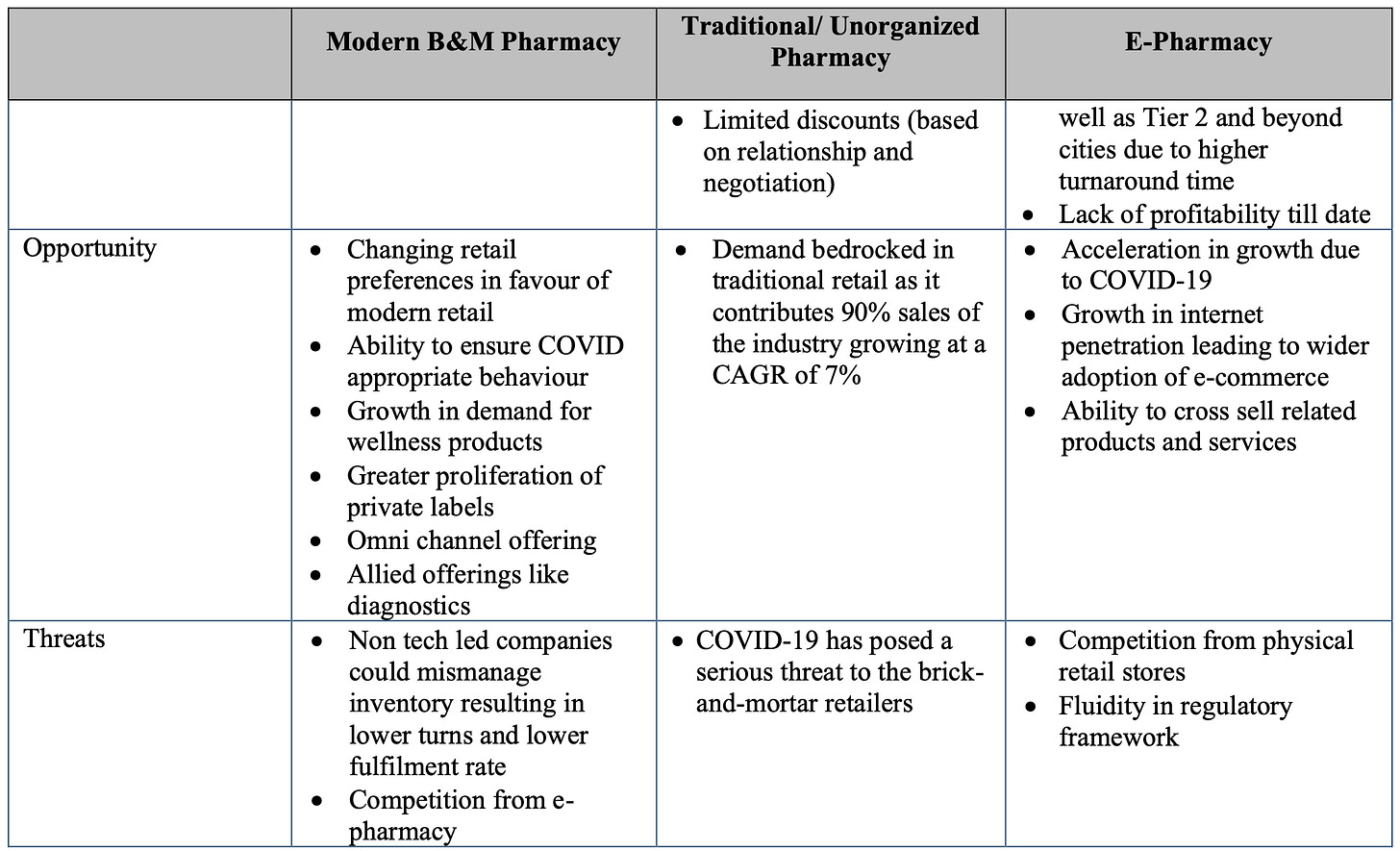

What is driving unorganised to organised?

The traditional Indian pharmacy retail segment predominantly consists of retail stores operating as family-run medical stores with a store size in the range of 150-1000 square feet. As of financial year 2021, there were around 800,000 (Medplus has only 4000 stores today) such pharmacy stores operating across the country, each facing similar challenges including lack of documentation, managing SKU proliferation, poor inventory management and inadequate retail environment, non-availability of medicines and in some cases stocking unreliable medicines.

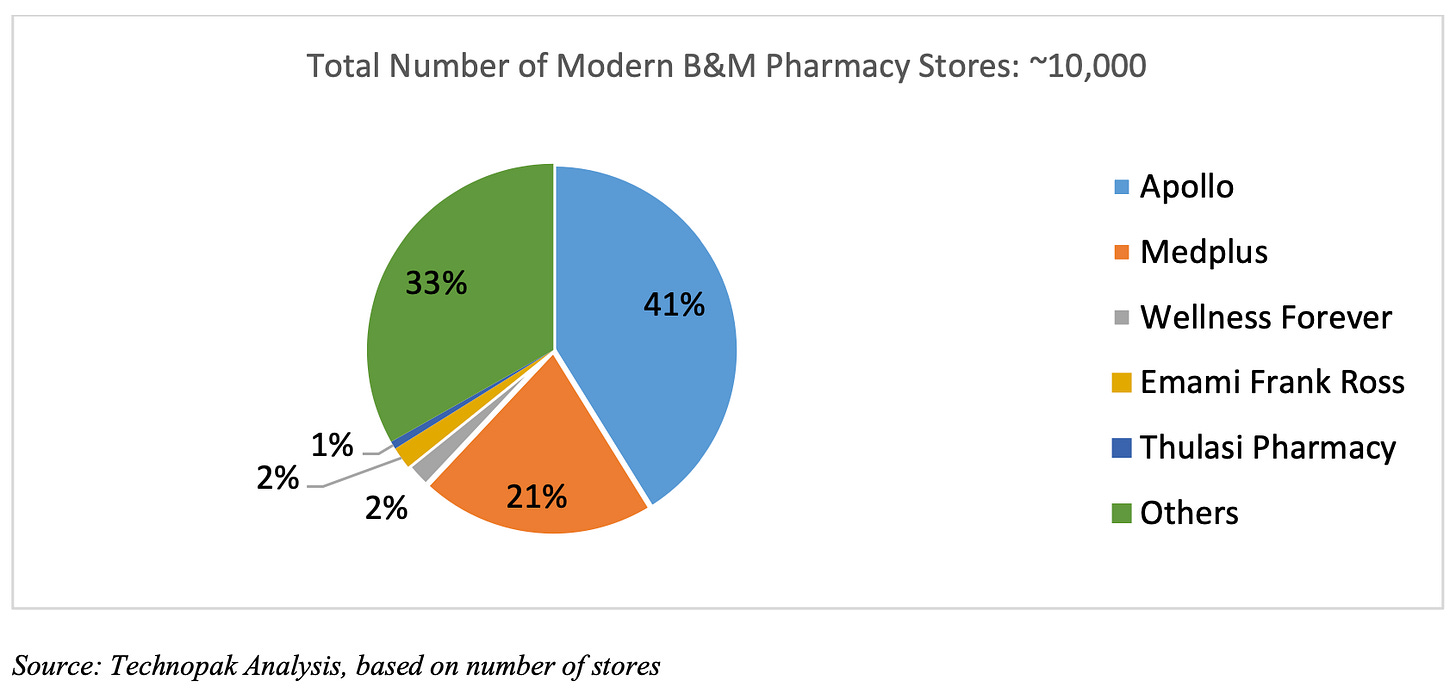

The organized retail sector primarily comprises of B&M stores operated by established players such as Apollo Pharmacy, MedPlus and Wellness Forever, and other smaller players like Emami Frank Ross Pharmacy, Thulasi Pharmacy, and Sagar Drugs & Pharmaceuticals (Planet Health). These players continue to drive growth in the organized segment by establishing a fast-emerging pan-India presence primarily through B&M stores and select players also operate an omnichannel platform. These players typically open multiple outlets in a city and a regional warehouse nearby to cater to these outlets. Some modern B&M retailers have also invested in advanced technology to capture sales data and automate warehouse management for seamless inventory replenishment.

The organized retail sector primarily comprises of B&M stores operated by established players such as Apollo Pharmacy, MedPlus and Wellness Forever, and other smaller players like Emami Frank Ross Pharmacy, Thulasi Pharmacy, and Sagar Drugs & Pharmaceuticals (Planet Health). These players continue to drive growth in the organized segment by establishing a fast-emerging pan-India presence primarily through B&M stores and select players also operate an omnichannel platform. These players typically open multiple outlets in a city and a regional warehouse nearby to cater to these outlets. Some modern B&M retailers have also invested in advanced technology to capture sales data and automate warehouse management for seamless inventory replenishment.

This model facilitates the implementation of logistics and distribution in a cost efficient manner, ensures accurate demand forecast for that region and improved serviceability ensuring consistent availability of products and timely deliveries. Moreover, this model also provides better fulfilment rates and higher profitability, and the benefit of economies of scale, with a high store count ensuring low unit logistics costs and better operational efficiency due to distributed and balanced demand. The pie-chart below sets out the retail market share in terms of number of stores of leading pharmacy retail chain through B&M stores across India as of end of financial year 2021.

Omnichannel presence in organized pharmacy retail ( why its better strategy than only e-comm players)

Omnichannel is a term used in ecommerce and retail to describe a business strategy that aims to provide a seamless shopping experience across all channels, including in store, mobile, and online.

B&M stores adopting the hyperlocal model and operating an omnichannel retail platform are emerging as important players in the pharmacy retail market. This is primarily due to their multichannel approach to sales through a combination of B&M stores and an online channel, which provides a seamless customer experience to consumers, whether the customer is shopping online from an internet enabled device, tele-calling or visiting a physical (B&M) store.

The benefits of operating an omnichannel retail approach are the ability to deliver a consistent brand experience, irrespective of the channel used, to meet the customer demand. Further, the omnichannel retail platform assists in optimizing business through channel diversification and comprehensive integration of data and systems across the channels, allowing for higher customer retention and higher wallet share. Omnichannel retail platforms have a strong focus on integration of the supply chain, logistics, warehousing, technology and inventory across the channels.

The brick-and-mortar players have an edge over the online only players in rolling out such a framework given the fact that they have an existing network of stores that are well-stocked with inventory to service the local cluster and address the demand faster and an optimised cost structure. Key drivers of this include:

Strong presence in neighborhood that ensures high brand visibility and low customer acquisition costs.

Short turnaround time: Many modern B&M retailers with store-led order fulfilment can also deliver the order within a shorter timeframe at a much lower delivery cost vis-à-vis digital natives (e.g. players such as MedPlus can delivery within 2 hours in Hyderabad and Bangalore). Omni-channel players can better address the acute therapy demand because of this faster response mechanism. These advantages particularly play out strongly in Tier II/III cities where the online only players require a longer response time

Optimized cost structure as Modern B&M pharmacies leverage their dense offline store network.

The omnichannel approach also allows players to offer discounts comparable to that offered by online only players while remaining profitable because of their low-cost structure. Walgreens’ and CVS’s omnichannel initiatives have played out well for the developed markets. Walgreens Boots Alliance’s partnership with Microsoft and Adobe to launch a digital experience and customer insights platform testifies their confidence in this approach.

Market Share of different channels

While traditional retail channels historically constituted a large portion of the pharmacy retail market in India, there has been a recent shift towards modern retail channels such as e-commerce and B&M stores, with consumers now increasingly inclined to purchase regular prescription drugs and other wellness products from modern organized pharmacy retail outlets that offer the benefit of an enhanced retail environment, the assurance of authentic drugs, transparent discounts and a wide variety of products. This trend has been accelerated by the outbreak of the COVID-19 pandemic. (As shown below morden retail is growing almost 3x of traditional retail)

In the financial year 2021, the penetration of the organised pharmacy retail market at a pan-India level was estimated to be ~11%. Penetration of modern pharmacy retail is at ~60-70% in United States, ~35-40% in European Union, and ~30-40% in China which further indicates the potential for increase in organized pharmacy market growth.

While modern B&M pharmacy retail outlets in metro and mini-metro cities and Tier 1 cities contribute close to 68% of the total number of outlets in the country, they are yet to increase penetration into the other markets across the country.

COMPETITIVE BENCHMARKING – PHARMACY RETAIL MARKET

INDICATIVE COMPARISON OF UNIT ECONOMICS OF ORGANIZED PHARMACY RETAIL CHAINS AND UNORGANIZED PHARMACY STORES

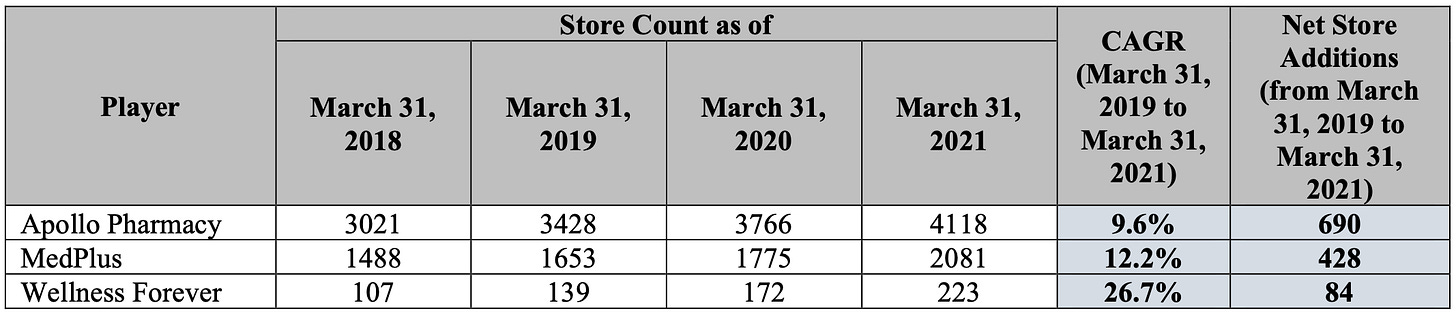

STORE COUNT

As of financial year 2021, MedPlus accounted for the second-highest revenue from operations amongst major pharmacy retailers in India.

Summary

Investing in MedPlus Health Services Limited appears promising due to its robust growth trajectory and innovative business model. With a data-driven, cluster-based expansion strategy, MedPlus has achieved high store density in key cities, enabling significant market penetration and brand visibility. Their diversified revenue streams, including pharmacy sales, diagnostics, and teleconsultations, provide a stable income base. MedPlus' technology-driven supply chain ensures efficient inventory management and operational scalability, supported by in-house developed software and real-time data analytics.

MedPlus’ strong financial performance, with over 20% CAGR in recent years, and strategic focus on expanding private label products, which yield higher margins, further bolster profitability. The experienced and diverse management team, led by founder Gangadi Madhukar Reddy, combines expertise in medicine, business, and technology, driving strategic growth and innovation.

Additionally, MedPlus plans to continually expand its geographic footprint and product offerings, entering new states and increasing market share in existing clusters. Their commitment to leveraging technology for customer engagement and operational efficiency, along with their established brand equity, positions MedPlus well for sustained growth. These factors make MedPlus a compelling investment opportunity with potential for high returns.

BLOGS ARE NOT A RECOMMENDATION SERVICE – These are my personal views about the Business Quality, Management Quality, Business Execution & Performance.

Hi Dhruva, recently came across your post on Ugro. And that led me here. Excellent work!!

Also went through your anti-thesis, of promotor pledging shares, and using that to buy more shares. One doubt/concern that i have, and being from a non-medical background not sure it this is of any significance. As of May 2025, there seems to be continuous notices (which they have filed in exchanges) to some of their drug stores, for closure for 1 or 2 days and some penalty. Reasons for this closure is not given. Is this a common practice, or due to the company not following set practices. Any research done on this?

Thanks in advance!!