Is firstcry trading cheap ?

Brainbees Solutions Ltd

To know if the company is trading cheap or not we have to work through some assumptions to come up with what will be the realistic net profit of the company lets say on maturity 10 years from now ?

1. Current Profitability Status and Trajectory

Consolidated Net Loss (FY25): ₹2,648 million (₹264.8 crore)

Segment Reality: Core “India Multi-Channel” business (the main operational pillar) is already PAT positive with a segment margin of 4.4% and Adjusted EBITDA margin of 9.5% in FY25.

“India multi-channel business turned PAT and Free Cash Flow positive for FY 2024-25. This indicates a positive shift in its most significant operational pillar.”

Other Segments: Losses persist due to ramp-up in International business and Globalbees (House of Brands), but both segments have markedly improved in unit economics and margin trajectory.

2. Industry Benchmarks for Mature Businesses

Global Benchmarks: Net profit margins for mature omni-channel retailers or global “house of brands” platforms typically fall within 2% to 5%.

“A net profit margin of around 2% to 5% is often considered standard in the retail sector.”

3. Key Levers for Margin Expansion and Maturity

As per management commentary following are the structural levers for steady margin expansion into maturity:

Growth of Home Brands: Home brands surpassed 55% of GMV in FY25, materially lifting gross/EBITDA/net margins.

Operational & Tech Efficiencies: Supply chain, AI/automation, improved inventory management, and advanced logistics.

Scale & Cost Discipline: Larger scale, optimized category mix, cost discipline (especially internationally), store productivity, and improved customer experience.

Rationalization of Underperforming Assets: Globalbees is pruning low-margin/underperforming “other brands,” aiming to lift blended margins to 4.5–5%+ over time from the current 1–1.5%.

The pattern in India Multi-Channel (4.4% segment net margin, FY25) is a reliable reference for mature margin potential.

5. Reasoned Estimate for 10-Year Mature Net Profit Margin

Assumptions:

All business segments (India, International, Globalbees) achieve “mature” status: structural positive net profit, stable/optimized operations.

Consolidated revenue grows to ₹25,000–₹30,000 crore (from ~₹7,660 crore in FY25) given current 15–20% CAGR revenue trajectory.

Group achieves net margins of 2–4% at maturity—a realistic range for sector leaders with similar business models.

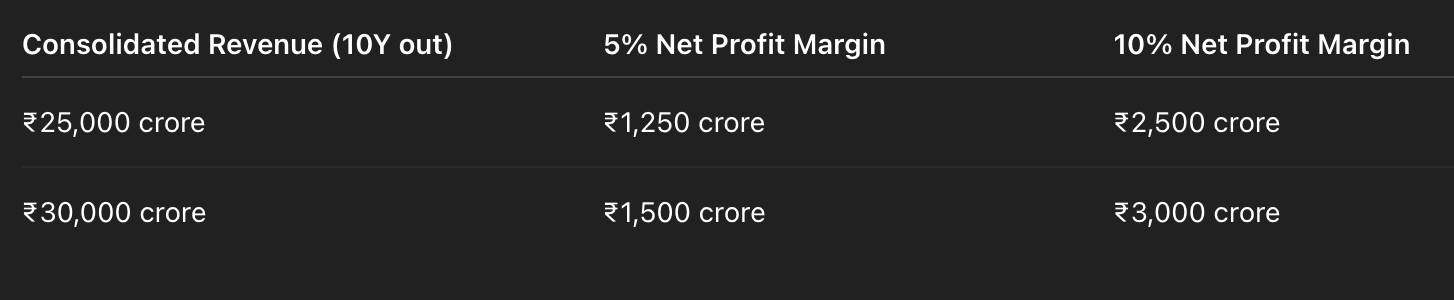

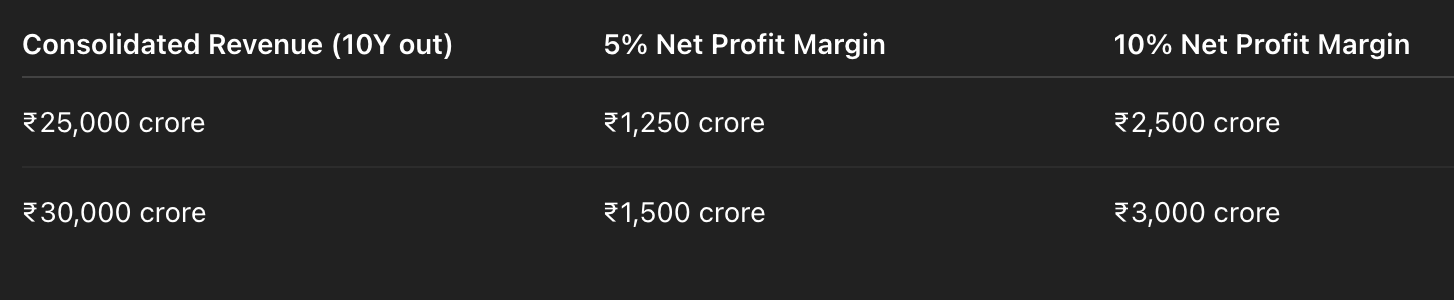

Projected Figures at Maturity:

6. Key Caveats and Competitive Dynamics

Best-case is 4% consolidated net margin, but 2–2.5% is more typical for Indian/Global retail unless home brands or private label deeply dominate (which is improving).

Macro conditions, competition, global expansion risks, inventory overhead, tech disruption, and investment cycles could affect trajectory.

Globalbees and international segments will need to scale considerably and rationalize portfolios for mature profitability.

7. Summary Table: Steady-State Margins by Segment (FY25 vs. 'Maturity' Scenario)

SegmentFY25 Net MarginTarget Net Margin at MaturityIndia Multi-Channel4.4%4–5%+International(18%)2–3% (after full ramp-up)Globalbees(5%)2–4% (post brand rationalization)

Conclusion

Brainbees Solutions (FirstCry) could realistically achieve a consolidated net profit margin of 2%–4% at maturity, translating to net profits of ₹500–1,200 crore per year on projected revenues of ₹25,000–30,000 crore—if its current margin improvement trajectory continues and all segments mature as intended.

Given that its trading at 38-15x FY35 earnings today.

A lot can change over the next decade in terms of growth and margins — the company might exceed expectations or fall short. That said, at current levels, I don’t think the stock is priced too pessimistically.

For perspective, even if we look at a range of 15x (best case) to 38x (worst case) FY35 earnings, it’s not trading cheap.

Ideally we would want 5x Fy35 earnings today, If the stock is trading at 5x FY35 earnings today, and then re-rates to around 20x by FY35, that implies a potential 4x return over 10 years, or about 15% CAGR.

Everything depends on long term margins, company management said they get inspired from page industries whenever street asked about margins but i don’t think realistically they can do 10-15% margins.

lets say if it does between 5-10% margins

for 10% margins its trading at 7.6x to 6.3x earnings. basically this is what markets are pricing in today → 15-20% cagr growth for next 10 years and 10% net profit margins.

What do you think is it realistic ? please let me know on comments below.

Hi, in the last sentence, shouldn't you be taking 15x FY35 today instead of 5x? You had said 15x is the best case earlier. CAGR should drop as it will only be a 33% total return over 10 yrs, 2.9% CAGR.