Stagflation occurs when the short-run aggregate supply curve shifts to the left. This reduces real output and real income while boosting the price level. Boomflation occurs when aggregate demand shifts to the right, boosting real output and real income (in the short run) while increasing inflation. The late 1960s were an example of boomflation while 1974 was an example of stagflation, Today we have both due to demand push by $15-$20 trillion monetary stimulus by the central banks around the world and Oil & Gas supply disruption due to Covid & Russia - Ukraine war.

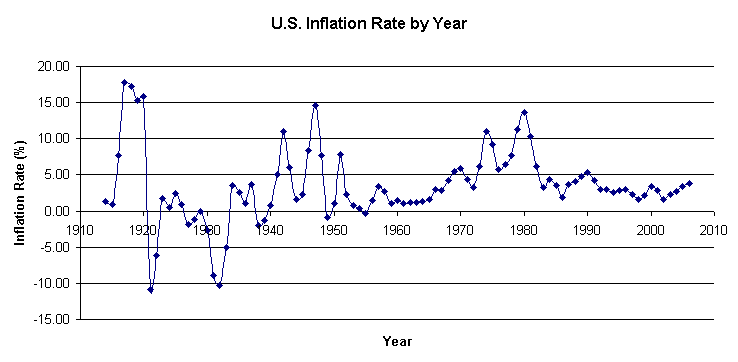

In 1964, inflation measured a little more than 1 percent per year. It had been in this vicinity over the preceding six years. Inflation began ratcheting upward in the mid-1960s and reached more than 14 percent in 1980-82. It eventually declined to average only 3.5 percent in the latter half of the 1980s.

While economists debate the relative importance of the factors that motivated and perpetuated inflation for more than a decade, there is little debate about its source. The origins of the Great Inflation were policies that allowed for excessive growth in the supply of money.

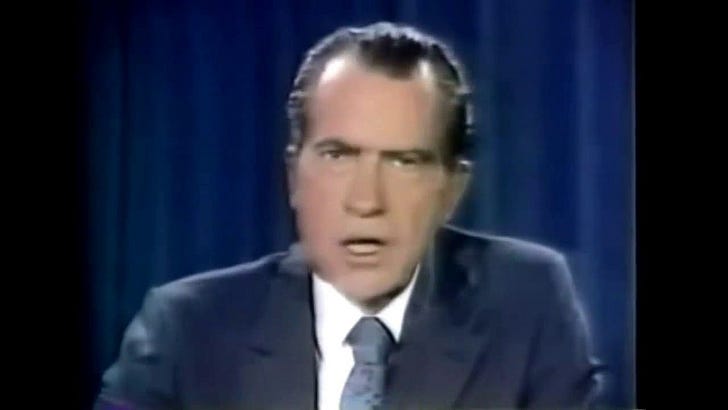

As inflation drifted higher during the latter half of the 1960s, US dollars were increasingly converted to gold, and in the summer of 1971, President Nixon halted the exchange of dollars for gold by foreign central banks.

So, what the fuck really happened in 1971?

This - “The End of gold-backed US dollar“

History never repeated itself but it often rhymes and although this decade going to be very different than anything we have seen in the past as -

we never did QE in past.

we never did Helicopter money in the past.

Central banks never cut & stimulated the economy in anticipation of recession (when covid happened) in past.

The world supply chains were never this interdependent in past. (Peak Globalization )

etc.

Keeping all this in context we can always learn from the past to have a fair idea in assessing the probability of where we are possibly heading or at least what worked and what doesn’t work in a stagflationary world from an investment perspective.

The 1970s is a critical decade in the worlds economic history, I would try to go through key macro points -influenced stagflationary environment and its repercussions not all however this website below does cover in detail a lot of it -

https://wtfhappenedin1971.com/

The 1970s is also sometimes referred to as “the great inflation” -

One important lesson we can take away from the below graph is like anything in the financial world, Inflation doesn’t go up in a straight line. There were steep raise in Inflation and an unbelievable correction in inflation (CPI) and then again steep raise in CPI so on … till all the way to 15% CPI in 1982.

So, It’s important to not get very fearful when everybody is talking about peak inflation & greedy when everybody starts saying inflation worry is over in a stagflationary environment.

One underline current which was driving stagflation during the 1970s was Oil & War ( some parallel with today)

Something similar can be said about 2020 what has been said about 1970s -

However, The period was not uniformly negative for all economies. Petroleum-rich countries in the Middle East benefited from increased prices and the slowing production in other areas of the world. Some other countries, such as Norway, Mexico, and Venezuela, benefited as well. In the United States, Texas and Alaska, as well as some other oil-producing areas, experienced major economic booms due to soaring oil prices even as most of the rest of the nation struggled with the stagnant economy. Many of these economic gains, however, came to a halt as prices stabilized and dropped in the 1980s and remained flat for 20 years.

How did stock markets in the US do during this decade?

The DJIA, which was just above 800 at the start of the 1970s, had only advanced to about 839 by the end of the decade, an overall gain of 5% over this 10-year period.

Although markets remained flat during this 10-year period there were many cyclical bear market rallies and declines along the way.

Although you might think coming out +5% wasn’t that bad after a decade like 1970’s, but because it was an inflationary period “in inflation-adjusted terms” markets really did pathetically - In inflation-adjusted terms markets were actually down -70%.

By definition, stagflation means low growth and high inflation, As we can see in the chart below GDP growth have remained relatively low vs inflation during the 1970s (which cyclically went up from 5 to 18%).

It’s been argued that during the 1974 recession FED made a policy error by cutting interest rates, the negative real interest rate in 1974 contributed to an even larger spike in inflation leading to the 1981 recession. Similarly, the Fed interest rate cuts below the CPI in 1981, possibly contributed to an even larger inflation spike and recession in 1982. Thus, both of these cases are possible Fed errors, which led to even higher inflation, and a recession.

Will the FED repeat the same policy Error by keeping the real interest rates negative in the stagflationary environment for long? Will they start easing “cutting rates” if a recessionary scenario builds up like 1974?

“My guess is possibly not”, Currently markets have turned bullish thinking recession will make the FED dovish.

Whereas during the 1970s then-Fed Chair Paul Volcker is credited with crushing it and the economy by raising interest rates as high as 20 percent.

If FED has learned its lesson of the 1970s to not remain too loose during inflation despite a recessionary scenario then possibly we can see a lot higher interest rates than markets are pricing in. My base case scenario is we have hit one cyclical top in inflation but if FED turns dovish then we will see the repeat of the 1974 FED policy error and will see another cyclical higher high in inflation.

But Unlike the FED of 1970s, the FED today has to deal with the DEBT to GDP problem.

Paul Volcker was able to kill inflation by raising rates to 20% because he wasn’t constrained by the DEBT/GDP problem, Today can FED really afford to raise interest rates above let’s say even 5%? or 10%? with DEBT/GDP touching the historic World War II level of 120%.

Although there are parallels of today’s world with 1970s but when we take Debt/GDP into consideration it looks like very similar to the 1940s. To finance WW-I, come out of the great depression and WW-II, FED did the same thing that it has done to come out of the great financial crisis and Pandemic - “printed boatloads of money”

During the 1940s as well central banks had to deal with inflation running above 10% couple of years and like always it went cyclically up.

World War II began on Friday, September 1, 1939. By mid-1940, Germany had defeated Poland, France, and Belgium, and a British expeditionary force had been forced to withdraw from the continent. In a speech on October 30, President Roosevelt promised Britain “every assistance short of war” and Britain soon began placing orders for large quantities of planes, artillery, tanks, and other heavy weapons, even though it lacked the financial resources to pay. Congress signaled that it would finance whatever Britain required when it passed the Lend-Lease Act in March 1941.

Emanuel Goldenweiser, director of the Division of Research and Statistics at the Federal Reserve Board, recommended to the FOMC in June 1941 that “a definite rate be established for long-term Treasury offerings, with the understanding that it is the policy of the Government not to advance this rate during the emergency.” He suggested 2½ percent and argued that “when the public is assured that the rate will not rise, prospective investors will realize that there is nothing to gain by waiting, and a flow into Government securities of funds that have been and will become available for investment may be confidently expected.” Three months later, Goldenweiser recommended a congruent monetary policy, “a policy under which a pattern of interest rates would be agreed upon from time to time and the System would be pledged to support that pattern for a definite period.”

Active U.S. participation in World War II followed the bombing of Pearl Harbor in December 1941 and ended with the surrender of Germany in April 1945 and Japan four months later. From year-end 1941 to year-end 1945, Treasury indebtedness increased from $58 billion to $276 billion. Marketable debt accounted for 72 percent of the increase; war savings bonds and special issues to government trust funds accounted for the balance. The increase in marketable debt included $15 billion of bills, $38 billion of short-term certificates, $17 billion of notes, and $87 billion of conventional bonds.

By mid-1942 the Treasury yield curve was fixed for the duration of the war, anchored at the front end with a ⅜ percent bill rate and at the long end with a 2½ percent long-bond rate. Intermediate yields included ⅞ percent on 1-year issues, 2 percent on 10-year issues, and 2¼ percent on 16-year issues.

Basically FED kept the Fixed Pattern of Rates (sometimes called yield curve control) without worrying about the inflation.

You may ask why any private investor would own bond if its yielding less than inflation (similar situation today), that why during that time the Fed had to buy whatever private investors did not want to hold at the fixed rates. As a result, the size of the FED Account increased from $2.25 billion at the end of 1941 to $24.26 billion at the end of 1945.

As bonds weren’t looking attractive to private investors during 1940s the stocks did relatively well in this decade compared with 1970s.

Markets went up by 100-120% from 1938 to1950, yielded around 7% cagr return and markets were more or less flat in inflation-adjusted terms with two gut-wrenching declines along the way a lot better than the 1970s -70% decline.

We don’t know what FED going to do in this decade -

We could see them following Paul Volcker-like rate hikes to 15% to kill the inflation or

we could see them doing yield curve control like in the 1940s.

I think we may end up seeing the next decade a lot like the 1940s.

How Gold performed during these times?

Gold prices were fixed to dollars until 1971. After the Famous Nixon, speech gold price went up by more than 10x over the stagflationary decade of the 1970s.

Thank you.

BLOGS ARE NOT A RECOMMENDATION SERVICE – These are my personal views about Business Quality, Management Quality, Business Execution & Performance.

Thanks,

Dhruva Pandey

Email : dhruva.pandey@outlook.com

Twitter : https://twitter.com/Dhruvapandey

Hi Dhruva, it's a nice read.

Which platform do you use to invest in bond market?

Nice read Dhruva but I would be skeptical of bonds as controlling the yield curve would be next to impossible due to the nature of the crisis. ( Opec+ hiking oil prices , Reduced inventories globally for oil along with sub optimal investments in renewable). These could keep inflation high making the bonds not so good as an investment unless the Central Bankers could ensure demand destruction.