Why this Company ?

The company was founded by three former Citi bank employees, Jaithirth Rao, PS Jayakumar, and Manoj Viswanathan almost 10-12 years ago (have seen atleast two cycles IL&FS and Covid).

Manoj Viswanathan is the current CEO and Managing Director of the company. The company's board is comprised of experienced individuals, including Deepak (former MD of HDFC and CEO of HDFC Life), Sakthi Prasad Ghosh (former ED of NHB), and Sujatha Venkatraman (Global Head of Credit Bureau Management at HSBC).

The company focuses on the affordable housing market with an average loan size of 10 Lakhs and primarily serves urban, salaried customers. The company is highly focused on digitalization and has a good rating for its app in the app store and a lot of customers using their app to track and pay EMIs. They have a fastest turnaround time for loan disbursement in the industry because of extensive use of technology.

What I found most interesting about this company is their focus on usage of technology and operational model.

How housing loan is disbursed in the industry today by most of the players?

For big banks like HDFC , SBI of the world customer approaches them with documents etc and everything gets processed in a bank branch. Mostly these banks have pre approved housing projects and builders kind of layout choices in front of customer, then SBI / HDFC risk management team verifies the documents tick mark their criteria based on it either approve or reject the loan application.

In affordable housing generally things are more complex, first the ticket size is generally below < 20 lac, There may or may not be pre- approved projects. Typical customer profile is such that they don’t have all the documents a bank would typically need in-order to tick mark the eligibility criteria, For example Raju who is a lathe machine operator working in a unorganized sector earning Rs 25,000 /- per month (in cash). He has a skill which industry needs perfectly capable of paying down debt but doesn’t have a income proof and CIBIL score.

These are the type of customers typically affordable housing finance companies cater to and banks on the other hand are happy in catering the higher ticket size demand in bigger cities, both are large enough markets. The large and mid size housing market growing @ 20% and affordable is growing @ 30%.

Housing finance pyramid

Lets try to imagine journey of Raju to understand how affordable housing finance companies work.

// 1st scenario -

Raju wants to buy home nearby the factory he is working for, goes to nearby SBI branch. They ask for truck load of documents, income proof etc which obviously Raju doesn’t have he then disappointed goes to the pan shop discuss this with friend, friend then tells him about the housing finance NBFC which he took loan from (word of mouth sourcing or referral)

// 2nd scenario - (builder network / connectors)

Raju interested in buying a house the builder connects him to the affordable housing finance company.

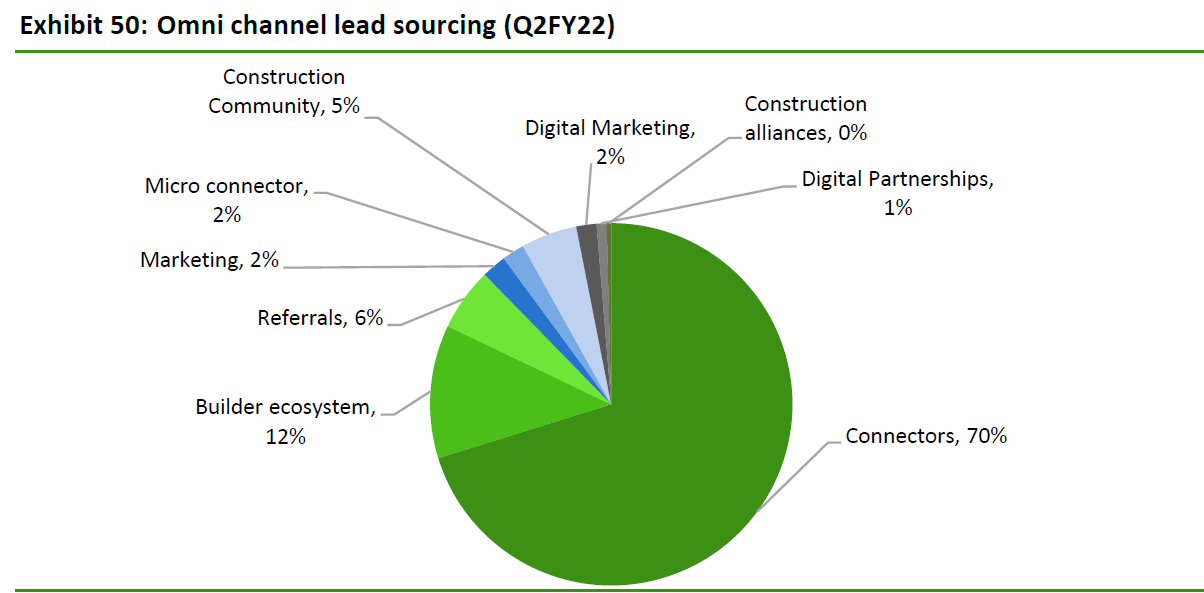

For home first finance 80-85% of lead generation happens through the network of connectors, construction community, micro connectors etc and 6% happens through referral. Rest happens through digital market places like Paytm, digital marketing etc.

Now, after the lead generation typically how traditional players used to work is they will have a risk manager asking for all physical copy of documents like Id proof, address proof etc then physically visiting the factory to verify the income proof side of things and then if full-fills the criteria either accept or reject the application. This is not a very scalable model - imagine if millions of application are received now the risk managers have to run pillar to post to process all the applications.

Home first does all of this in very cost effective and productive way by leveraging technology. First of all they have build all their flow from lead generation to loan management system on the top of sales force. When the lead is generated through connectors they don’t send their risk management team to all the due diligence, they ask the connectors or ground staff to upload scanned copy of all documents in the tool then this ground staff goes makes video of the guy operating lath machine in factory this gets uploaded in the cloud linked to the tool and then the centralized risk management team stilling in the office looking into profiles of these customers either accept or reject the application. This works so well that one can pull up the profile of customer anywhere and have access to everything they have sourced in one place.

This I think is very scalable business model, which really caught my eyes because this is very scalable and they can build very large AUM on top of it without changing much in the operational model whereas competitors will have to change their operational model as they become big.

If you interested in learning more about the company please refer link below-

Its a long read two things i found insightful about the HFFC mentioned below from the article -

Focused on niche cash salaried and underserved segments

HFFC’s focus is on the Economically Weaker Section (EWS) and low-Income Group (LIG) segments. These categories of customers contribute around 77% to its AUM. Although 74% of its AUM consists of salaried class, 26% of the AUM consists of customers belonging to the cash salaried segment, which entails assessing their cash flows, both from formal and informal sources. These customers would typically be employed with SMEs or would be working in junior positions in large corporates.

They would have monthly income of less than Rs50,000 and would not have formal documentation, hence are not tapped by banks and large HFCs. Almost 30% of its customers are new to credit, and hence, their income assessment requires deeper understanding of the customers and more importantly the consistency of their cash flows.

Differentiated sourcing model and reliance on technology

HFFC has a hub and spoke model where underwriting is done at the HO and lead conversion is done by RMs at the branches. It has omni channel lead generation where sourcing is done mainly through connectors, which account for 70% of the overall sourcing. Connectors are usually insurance agents, tax practitioners and local shopkeepers. The role of connectors is restricted to just generating leads, for which they charge a commission of 40-50bps on conversion of the leads. Once the lead is generated in the app, the RM at the respective branch would then do the field visit and build detailed understanding of the customer and upload all the necessary information in the Salesforce platform. This is then followed by the Branch Manager and then the Regional Manager processing those documents further. Credit assessment is done at a centralized location while property assessment is done by a separate team which assesses the builder’s background and the value of the property. All the processes from sourcing to collections are digitized.

HFFC has focused on technology since inception with all its processes being completely digitalized. There is a separate app for connectors, RMs and customers, which are integrated with each other and also with third party sources like Hunter, Perfios, etc. Further, it collects 100+ data points of its customers which get integrated with the data from third party, resulting in strong underwriting. All the documents are stored digitally and saved on cloud. Owing to complete digitization, it has a TAT of 48 hours – from inputting the information in the app till sanctions, which is one of the lowest in the industry. It has also tied up with fintech players like Paisabazaar.com, Indiapost Payments Bank, Paytm, etc., for lead generation. Currently, about 3% of its disbursements are done to leads generated through these sources, which is likely to expand going forward. As of September 2021, 72% of its customers are registered on the app and it has seen consistent rise in app logins.

On valuation -

In the article they tried to compare it with gruh finance and their to justify the valuation.

There is always debate between valuing these company as PE or PB multiple, what i have seen is if company is really good with underwriting tends to get valued with PE multiple. Theoretically, if NPAs are <1% yoy and always contained then you can see it as any other business generating cash & value it as FMCG business (practically this happened with Bajaj finance & Gruh finance).

It has to been seen how things pan out for home first finance but its never a bad idea to pay PE < 30 for company growing at the rate > 30%.

Thanks for subscribing and all your support. Please share the article to others who you think might find it interesting.

Small twitter thread on - comparison of three affordable housing finance players -