Hang Seng TECH Index (part - 2)

In this, I’ll briefly cover the remaining companies in the Hang Seng Tech Index.

We covered Kuaishou (TikTok competitor in china) in Part -1 (link mentioned below), and next is NTES.

NetEase Inc. (Mcap = $52 B, Rev = $14B , Net profit = $3B)

The market cap has almost grown up by 1000x (1000 baggers in 20 years) and revenue by 4000x since 2002.

And look at the revenue growth rate over the year -

So, what do they do?

Netease is expanding the gaming ecosystem, the Company develops and operates some of China’s most popular and longest-running mobile and PC games.

Beyond games, NetEase service offerings include its majority-controlled subsidiaries Youdao (NYSE: DAO), China’s leading technology-focused intelligent learning company, and Cloud Music (HKEX: 9899), China’s leading online music content community, as well as Yanxuan, NetEase’s private label consumer lifestyle brand.

The simple yet most effective thing they did is originally they copied all the famous PC / Console games and made them available on Mobile. This strategy worked really well for them, they are really shameless cloners.

Over time they became so good that they started making originals as well and today they are a very respected online mobile gaming company. Even the Indian Gaming influencers cover them over youtube -

This video covers the interesting journey of the CEO & Founder of the company Ding Lei -

If you are a gamer - you might be able to relate it in a better way but it’s pretty impressive to see the footnotes.

If you are interested in digging more, you can access the presentation here -

SUNNY OPTICAL: (Mcap = $11.2 B, Rev= $5.8 b , Net income = $0.9 B)

Basically, they sell lenses and camera modules for mobile phones and automobiles, All major android smartphone manufacturers are their customers from Samsung to Vivo / oppo.

Over the medium term, it is expected the EV will drive the new growth engine for this company and over the long term Metaverse.

Product Segments :

This company has Monopoly power in the Optical Industry, Originally Japanese companies used to dominate this industry, and then Taiwanese companies but today sunny optical is dominating the market due to its price-value proposition.

It’s been said that the technological gap between sunny optical and leading Taiwanese lens maker largen reduced to 1 -2 years and in mobile phone camera lens they are now on par with Largen.

In terms of high-pixel lenses, the company has developed products such as large image surfaces and ultra-small lenses which are catching up with the Taiwanese largen.

Recently Sunny Opticals have been able to beat Largen to win supplies for Apple, Now it’s a matter of time before they become from Chinese #1 to the global #1 mobile camera lense manufacturer.

“You can hide you can run but you can’t escape Chinese products”

let’s move on to the next company.

SMIC: (Mcap = $22.57 B, Rev= $6.74 B, Net profit= $2.33 B)

Okay, the Chinese have copy pasted many American Tech companies, and today not only have they succeeded locally but globally some are even stronger than their American counterparts. SMIC has started to end the monopoly of TSMC (Taiwan Semiconductor Manufacturing Corporation) which is always good for the world irrespective of what Ideology the Chinese government follows. anyways I think the best thing to happen to this world is Chinese upped their game to disrupt the companies in the west and this really helped bring the price of goods lower and western companies had to work really hard, and innovate more to stay in the competition. If America still wants to dominate the world they have to now work a little harder which is a good thing.

Here is an amazing story about SMIC 20 year story-

In July 20, 2022 - SMIC started shipping 7nm ASICs which is a huge achievement. which places them on par with TSMC and Samsung.

however, TSMC claims SMIC has not achieved a good yield on the 7nm process yet, which means it’s much more expensive to fabricate in SMIC Vs TSMC.

SMIC has been the leading Chinese market player so far but their ambition is to tap into American players, As they said in their earning call below -

Here is a great documentary on the genius (X-tsmc) running SMIC today

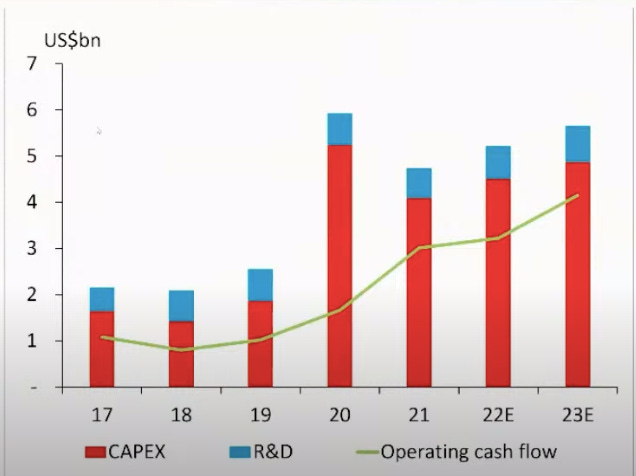

SMIC has been putting $5-6 Billion into CAPEX and R&D, that’s what it takes to win in semi-conductor. We are still framing some PLIs in India (not going to help)

It’s still an Underdog, the US politically doing whatever it can for this company to not succeed the US has blocked the export of ASML lithography machines to China, Chinese Gov is helping this company in whatever way it could to become self-sufficient in Chip manufacturing. It will be interesting to see how things will pan out in the future.

BAIDU (Mcap = $43.31 B, Rev = $11.90 B)

The used to be the “google of China” and is now known as a competitor to Tesla in autonomous driving.

Interesting interview by Robin Li -

It’s a leading AI company today globally, Baidu started investing in self-driving back in 2013. According to Robin Li Autonomous the feature is the most important feature of EVs, in 2021 they spent $2.1 Billion on R&D.

One place where Baidu is ahead of google is they have developed their own AI chips

Unlike Tesla, Baidu's goal is to provide self-drive car solutions to any Auto company. Which is what google has been trying to achieve as well.

Another interesting interview that I found of Baidu COO, Qi Lu discussing AI in 2018. His rationale on what advantages Baidu has over US companies in winning the AI market, the Difference between Chinese and US work culture, and also talked about what he is trying to change in Baidu culture, also he talked about why he believes Chinese product people are better than the US.

Another interesting thing he talked about about Tencent culture is that whenever they have a new idea they will make 3 teams independently working on the same thing so, that the best idea wins.

A snippet from the interview - “Why China will win over the US in certain products”

and to their credit, they have built a fully autonomous beautiful-looking car and if they truly succeed in their vision of creating these robo taxi’s they will be able to tap into the huge Uber/ Ola kind of ride-hailing market at least in China. (they are running the pilot already shown in the video below)

Hi Dhruva...Excellent analysis and contra idea. These businesses are no doubt cutting edge and have a great competitive edge. The question that is more pressing is ,what would we can get our hands on as a shareholder. The valuations at these points are no brainer, plus the businesses are growing well. Any favorable regulation towards these by CCP will lead to fast upward movement in the prices. The downside surely is limited.

My question : What would make you change your mind and sell the index?

hi dhruva, saw that ur planning to close out positions from HangSeng?

what the rational? (too much optimish around it now ? )