Hang Seng TECH Index. (Part -1)

Are Chinese tech stocks trading cheap?

What is this Index?

The Hang Seng TECH Index ("HSTECH") represents the 30 most prominent technology companies listed in Hong Kong with high business exposure to technology themes and pass the index's screening criteria.

The Index is a free-float market capitalization-weighted with an 8% cap on individual constituent weighting.

As you can see by buying this Index / ETF, you can get exposure to large dominant tech businesses like

Meituan : ( $130 Billion Mcap & $27 B rev)

It's a Coupon Duniya, BookMyShow, Zomato/ Swiggy, Goibibo, and the list goes on for China-

And the expansion continues In 2021, they raised $10 Billion to expand into Drones and Self driving cars -

A very informative video on Meituan -

Ali Baba (Mcap = $214.74 B , Revenue = $126 B).

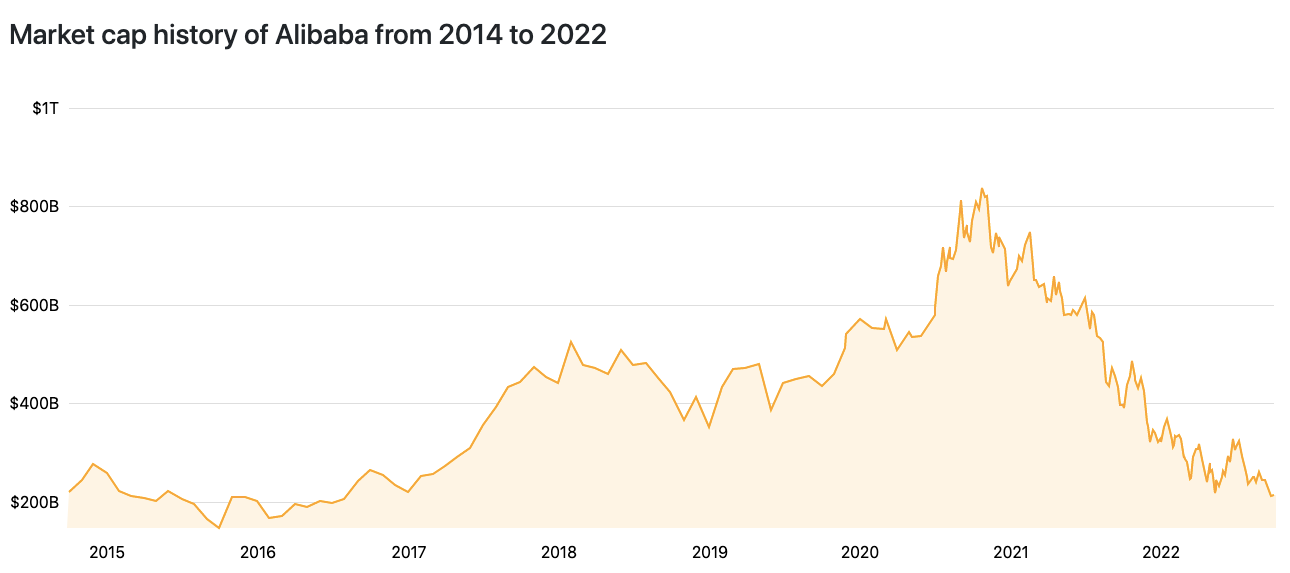

Despite this crazy yoy growth since 2014, Ali- baba Mcap is down by -74% from its peak.

Alibaba if you think about it is the most corrected -74% dominant juggernaut tech business of China and without a doubt, they are the OG of new age tech businesses of China, you will be surprised how treacherous the initial journey was for both Jack Ma and Alibaba – which was nicely summed up in this documentary (must watch) by one of Alibaba’s early lieutenants.

The trouble for Chinese Tech started right after Jack’s notorious speech on 24 Oct 2020, criticizing the traditional banks for operating with a ‘pawn shop’ mentality, and regulators for having a backward ideology, likening the current banking regulations as a treatment for Alzheimer’s. Right after the speech, Alibaba’s FinTech arm (Ant Financial) IPO was pulled at the eleventh hour, and everything else was history.

Ali Baba is a B2B not only limited to China but to the world e-commerce giant.

Personally, I had an amazing experience buying from AliBaba.com 5-6 years ago when I was trying to build an IoT product for which I couldn’t find the required sensors, ICs, motors, etc in India which were not only cheap but delivered very fast (a couple of weeks) to me in India from China. I used to shop in AliBaba.com as we do in Amazon India today. It used to be really fascinating to me that I could order Rs 600 product from China and it would get delivered to me in India in a couple of weeks.

They have built great global supply chains for many retailers around the world as China has been the Factory of the world. Nevertheless they are the biggest B2B Ecomm company in China as well.

Xiaomi: ( Mcap = $28.44 B , Revenue = $47 B, Net profit = $2 B)

In Fy 19, Xiaomi was listed at a valuation of $50 Billion then Mcap peaked at $114 Billion, and today it’s trading at $26 billion.

We all know how dominant Xiaomi is in India, They own a brand called MI which is dominating as well in the Mobile, smart TV, Fridge, and also the future Car maker, etc. In smartphones Xiaomi lead the market in Q2 2022 with a 19% shipment share, closely followed by Samsung.

Although the smartphone market is very competitive, As you can see Xiaomi lost market share from 23% in Q1 2022 to 19% in Q2 2022 but not only in India Xiaomi is globally competitive and Ranked #3 in terms of market share (13.8%) globally -

Only company enjoyed growth in marketshare QoQ globally -

Apart from US, they dominate everywhere -

Currently, they are spending $2.39 Billion on R&D and it’s expected to increase to $14 Billion by 2027 as they want to improve in Smart homes, Smart manufacturing, EVs, and Robotics. (FYI: TCS spent 1.2% of its total revenue, or ₹1,917 crores ($0.239 B), in R&D and innovation during FY21.)

Check out their website If you are interested there are many futuristic products they are doing, CyberOne for example in the video below -

If at all any company globally Competing with the U.S. are Chinese and in many segments Chinese are doing better than the US globally like TikTok (Bytedance).

Anyways Xiaomi is the market leader in Smart TV in China -

And they are coming with Smart AC, Fridge, Washing Machines and Laptops as well.

Interesting to see how it will all pan out.

Tencent: (Mcap = $325.85 B, Revenue = $85 B, Earnings = $32 B)

Tencent Mcap peaked in Feb 2021 shy away from $1 T ( $ 920 B) and today it’s trading at $325 B map.

Despite crazy revenue growth-

What is the great thing about Tencent is they are like the Facebook (meta) + Berkshire of China.

In many ways, they were able to better monetize their social networking platform (Wechat 1.3 B daily active users = payment + messaging + shopping) than Facebook and they have an incredible investing track record in Chinese tech companies (like owning a considerable stake in companies like Meituan $20-30B dollar) and they have a wonderful high margin Gaming business.

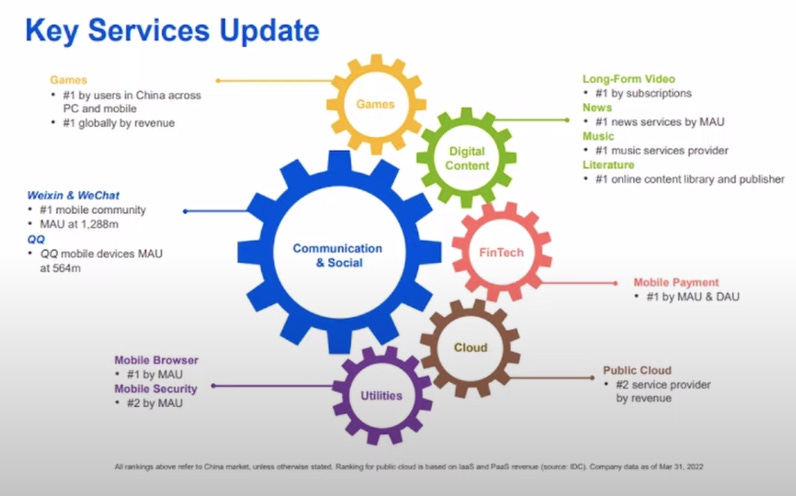

Tencent = We chat (digital advertising) + online gaming + cloud computing + fintech.

China has such bad state-owned banking companies (worst than Indian PSBs) that Fintech provides most of the services and makes most of the money from the financial sector, Chinese are even comfortable keeping money in app wallets rather than in a bank.

and they are number 1 in most of these business verticals -

Why Berkshire of China?

Unlike Alibaba, Which often tries to acquire controlling stakes, Tencent prefers to remain a minority shareholder and avoids directly meddling in the management of the companies in which invests.

Companies partly owned by Tencent that have gone public include Pinduoduo an interactive comm platform, JD.com, Meituan, and Singapore-headquartered Sea, which operates online gaming, ecomm, and digital financial services.

Tencent has a track record of investing a considerable amount of money in early-stage startups in China which have gone on to become either #1 or #2 in their respective industry.

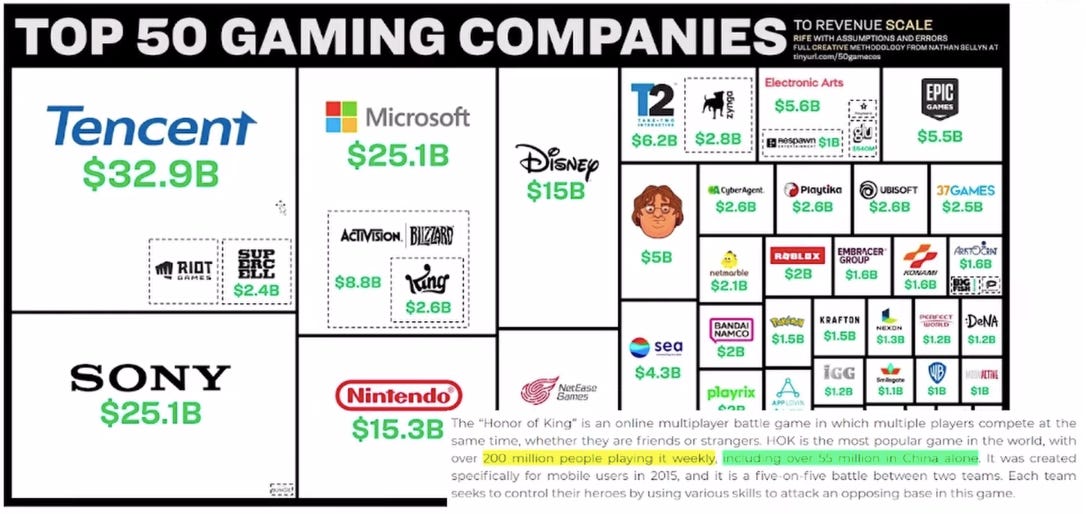

Tencent gaming business -

Surprise surprise even after Chinese regulators crack down on gaming ( limiting how much kids can play online there), It’s still bigger than anybody else in the gaming industry globally.

Kuaishou Technology ( Mcap = $28.43 B, Rev = $11.64 B)

Kuaishou is a users short video-sharing mobile app, and a social network and they burnt a lot of money (from the last two years posting on an average $13B per annum loss - Reliance invested this much to build JIO) in order to compete with TikTok / Douyin (Bytedance) but failed.

Market cap crashed from $214 B to $28 B lost -86% from the listing price. (It was clearly in a bubble)

Although they have lost it to TikTok in the Chinese market, Kuaishou is doing pretty good in their live streaming video businesses and most of their revenue comes from tipping ( commission from when people transfer money during the live video) or celebrities selling stuff via live streaming.

The amazing thing about Kuaishou is it was originally GIF generating app then it turned into a short video app and this was before even TikTok/ Douyin was born, seeing the popularity of Kuaishou, Tencent the ultimate cloner of all released a similar short video app but failed to compete with Kuaishou and then Tencent did what it always does invest in Kuaishou by this time TikTok/ Douyin was launched growing fast in tier-1 / 2 cities in China and whereas Kuaishou was more popular in a rural part of China and it is still the market leader in rural china.

The next leg of companies will be covered in part -2.

How you can invest in these Chinese tech companies from India?