In my investment approach, I have embraced a strategy that minimizes losses at the portfolio level. I believe that investing in market leaders who continuously expand their market share is the most effective way to achieve this. Even if it's challenging to identify the precise factors that give these companies a competitive edge, the underlying principle remains steadfast: there is always some form of competitive advantage driving their long-term market share growth.

This approach is rooted in the fundamental workings of capitalism, which ensures that superior products and services ultimately prevail while inferior ones fade away over time. By investing in companies that excel in their respective industries, we align ourselves with the forces that govern market dynamics.

An exemplar of this strategy is Godrej Agrovet, a company that dominates market share across multiple verticals in which it operates. After its initial public offering (IPO), the company's valuation has settled at a fair value, providing an opportunity for investors to enter the market at an appropriate price.

Currently, it’s trading at its historic low market cap / Sales ratio -

From a PE ratio standpoint, the company may appear expensive. However, this is mainly due to the fact that it ended FY23 with historically low margins. I believe these low margins are temporary and not reflective of the company's long-term performance. In fact, the company has been consistently growing its revenue, and certain verticals within the business hold significant growth potential over the next decade. Considering these factors, I expect the margins to revert to their mean levels, making the current valuation more reasonable in the context of the company's future prospects.

What do they do?

I have to say that analyzing this business is like analyzing 5 different businesses.

They are mainly into 5 business verticals -

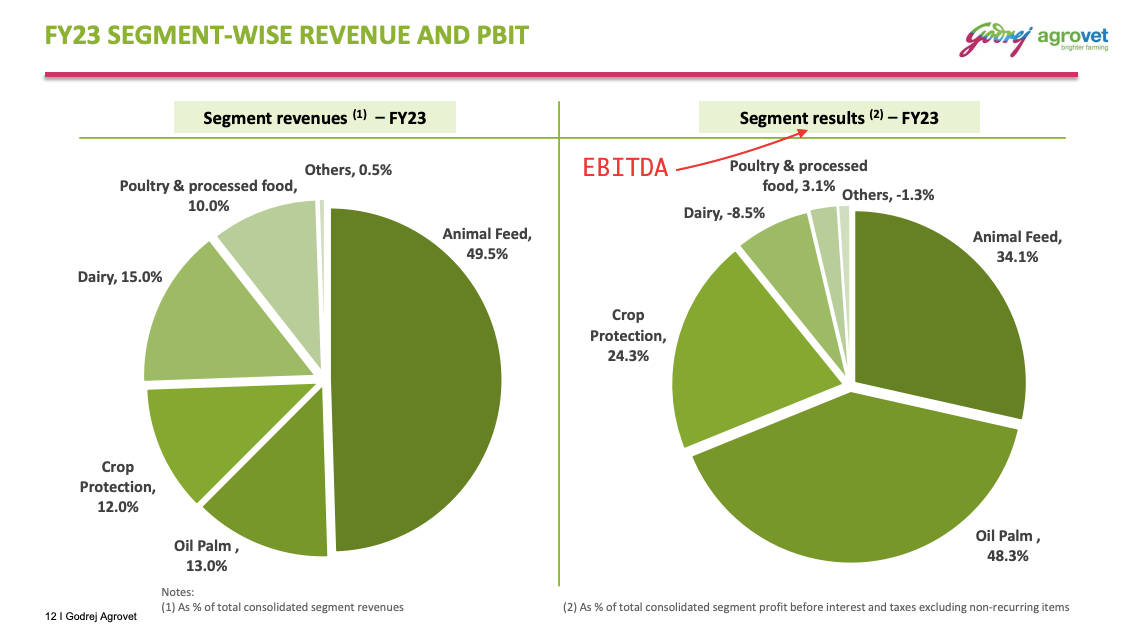

Most of the revenue (49%) comes from animal feed but most of the EBITDA (49%) comes from Oil Palm business.

Let’s analyze each of these verticals in detail -

Animal Feed -

The Indian animal husbandry market size reached INR 1,08,500 Cr in 2022. Looking forward, IMARC Group expects the market to reach INR 1,68,300 Cr by 2028, exhibiting a growth rate (CAGR) of 7.4% during 2023-2028.

Currently, the animal feed industry in India remains largely unorganized, and Godrej Agrovet holds the leading position with a market share of approximately 6-7%. The process of formalizing the industry is expected to take additional time, mainly due to the non-application of GST (Goods and Services Tax) in the agricultural sector at present.

In India, there exists a multitude of small-scale, local animal feed producers, often referred to as "mom and pop" players. This prevalence can be attributed to the ease with which individuals can establish such ventures, sometimes even operating from a single room.

For example, as shown in the video link below -

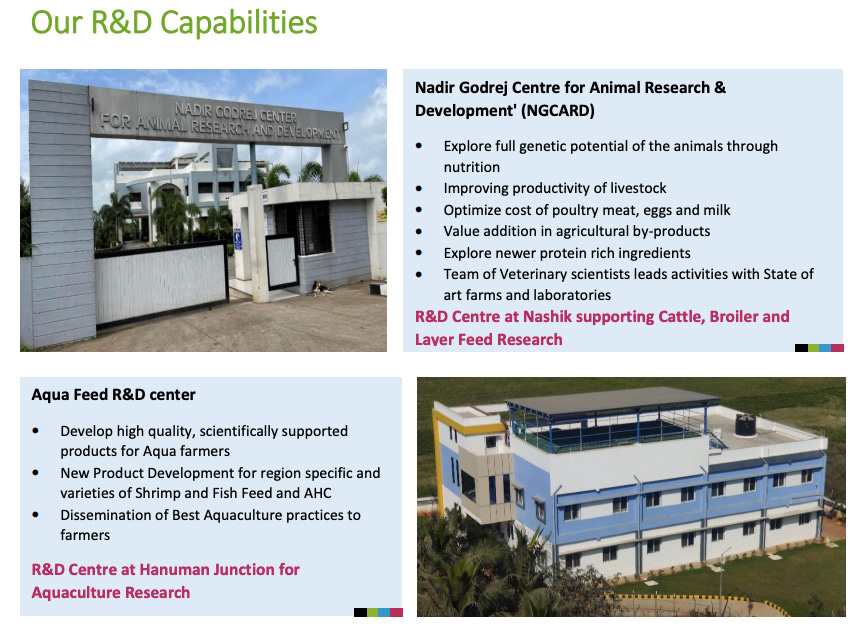

Animal Feed Processing Machines Making Pelletizer Granulation Chicken Cattle Feed Pellet Machine

The Animal Feed business was started in 1971 as oil extraction business, as a division of Godrej Industries, and was transferred to Godrej Agrovet in 1992. The company also acquired Goldmohur Foods and Feeds from Hindustan UniLever (HUL) in 2001, which made it the market leader in the animal feed industry in India. Godrej Agrovet is one of the largest in the organized space in the compound feed market in India, clocking a sales volume of over 1.3mn MT in FY20. Its diverse portfolio includes products in Cattle, Poultry, Aqua and Specialty Feed. It has over 32 state-of-the-art manufacturing plants, equipped with quality assurance labs, which help farmers improve their farm productivity and profitability. The company differentiates itself from competitors by building strong brands, whereas competitors are still largely a commodity play. The company has an R&D centre in Bangalore and, in 2015, had set up the Nadir Godrej Centre for Animal Research and Development in Nashik, Maharashtra - a one of its kind animal husbandry research centre in India. Thus, the company relies heavily on R&D. We believe Godrej Agrovet is well-placed in animal feed by virtue of having a high-quality R&D setup. Cattle feed is the fastest-growing segment within the animal feed industry. The company holds about 6% market share within the organised sector. It has developed ‘Prepwell’ for pregnant cows; ‘Calf Starter’ and ‘Calf Grower’ for calves; ‘Milk More’, ‘Bypro’ and Bovino’ for lactating cows. Poultry feed is an important segment within animal feed segment.

On one hand, small-scale mom-and-pop players benefit from cost savings in research and development (R&D) and leverage tax arbitrage to offer competitively priced products in the market.

On the other hand, Godrej Agrovet's focus on investing in R&D and maintaining stringent quality control measures positions it well for future global competitiveness.

The two biggest animal feed players globally are

CP Group, is a Thai-based agribusiness conglomerate.

Archer-Daniels-Midland Company (ADM) is an American multinational food processing and commodities trading corporation that is headquartered in Chicago. (40 billion dollar market cap)

Archer-Daniels-Midland Company (ADM) is an American multinational food processing and commodities trading corporation that is headquartered in Chicago, Illinois. ADM is the second-largest cattle feed producer in the world, with an annual production of 18,000 metric tons. ADM is also a major player in the poultry, swine, and aquaculture feed markets.

ADM has been able to achieve its position as a leading cattle feed producer through a number of factors, including:

A strong global presence: ADM has operations in over 20 countries, giving it a global reach that allows it to source raw materials and distribute its products efficiently.

A focus on innovation: ADM is constantly investing in research and development, which has allowed it to develop innovative feed products that meet the needs of its customers.

A commitment to quality: ADM has a strict quality control system in place, which ensures that its products meet the highest standards.

"Godrej, although small today, has been investing in all the tenets mentioned above." Not only this enables them to compete with global brands domestically but does enable them to enter markets outside India too in the future.

Although during Covid-19, the animal feed industry went through a down cycle but Consolidation is unlikely in the Animal Feed segment as barriers to entry are low.

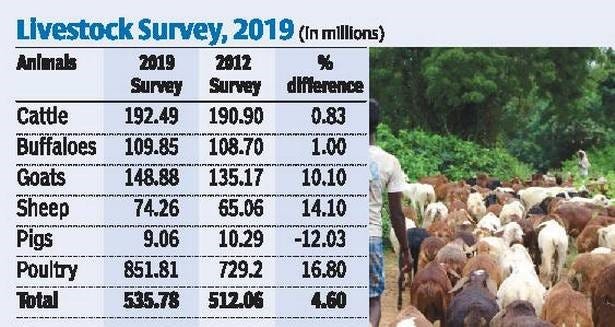

The only way formalization of the Animal feed industry could happen over time is when Aminal husbandry industry in India gets formalized, Big players who do animal husbandry in large scale look for more reliable, quality feed for the animals but today’s problem is there are many small animal farmers in India (Most are not by choice but because there aren’t any better job opportunity for them). India’s livestock sector is one of the largest in the world. About 20.5 million people depend upon livestock for their livelihood. Livestock contributed 16% to the income of small farm households as against an average of 14% for all rural households. Livestock provides livelihood to two-third of rural community. It also provides employment to about 8.8 % of the population in India. India has vast livestock resources. The livestock sector contributes 4.11% GDP and 25.6% of total Agriculture GDP.

Employment:

A large number of people in India being less literate and unskilled depend upon agriculture for their livelihoods.

But agriculture being seasonal in nature could provide employment for a maximum of 180 days in a year.

The land less and less land people depend upon livestock for utilizing their labour during lean agricultural season.

Feeding 50Cr live stock has to be a big enough market.

The majority of the animal feed revenue comes from cattle and chicken feed, however, the company has invested US$ 11-12mn on a fish feed plant in Uttar Pradesh in FY22.

Aqua feed in itself a big industry, Not long ago Avanti feed was valued 10,000 Cr by the market which is equivalent to entire mcap of Godrej Agrovet Ltd today.

Over the past 8 years, Godrej Agrovet has focused on lowering its revenue contribution from the animal feed business (80% in FY12 to ~49% in FY23) through diversification in other segments like palm oil, crop protection and others. Over this time, while palm oil and crop protection businesses have grown at a CAGR of ~11% and ~9% respectively, the animal feed business witnessed CAGR of ~7%. Out of all business segments, Crop Protection generates a superior margin, followed by the palm oil business. Godrej Agrovet has a pan-India presence and its operations span across five business verticals. It has set up processing facilities and supporting infrastructure as well as R&D to develop a modern operating platform across key agriculture verticals. The nationwide footprint also allows it to leverage its competitive advantages of each location to enhance competitiveness and reduce geographic and political risks in businesses.

Let’s look at other segments which are already contributing more to the net profit of the company and will continue to drive more cashflows for the company.

Palm Oil -

The company specializes in the production of a diverse range of products, including crude palm oil, crude palm kernel oil, and palm kernel cake.

As part of our operations, the company procures fresh fruit bunches ("FFBs") from palm oil farmers and maintains a close working relationship with them. We support the farmers by providing planting materials, agricultural inputs, and technical guidance.

To further strengthen its position, Company established memoranda of understanding with nine state governments. This collaboration grants them access to approximately 61,700 hectares of land dedicated to oil palm plantations. This acreage represents roughly one-fifth of India's suitable area for oil palm cultivation, as of March 31, 2017.

Our commitment and dedication to the industry have been acknowledged and awarded. In 2015, we received recognition as the 'Highest Crude Palm Oil Producer in the Country' at the prestigious GLOBOIL conference.

Crop Protection Business -

It is competing with UPL LTD (Mcap 51,293), many consider it second to UPL Ltd and has a good potential to be 10x bigger in the future.

The company's Crop Protection business encompasses a wide range of agrochemicals, including herbicides, insecticides, fungicides, plant growth regulators, and organic manure. With a robust pan-India distribution channel of over 7,000 distributors, the company operates in this segment. Currently, the legacy crop protection business contributes approximately 52-55% of the total revenues, while the remaining 45% is derived from Astec LifeSciences (Astec), an Indian manufacturer of agrochemical active ingredients, formulations, and intermediate products.

Over the past five years, the company has diversified its product portfolio, which was previously centered around plant growth regulators (PGR) and other niche categories. It has introduced new products across multiple categories. Godrej Agrovet holds a strong market share in plant growth regulators, soil conditioners, and cotton herbicides. Notably, it is one of the major players in homobrassinolides, marketed under the brand names Double and Combine. The company has also launched Oryzostar, a rice herbicide that competes directly with PI Industries' renowned brand Nominee Gold. Additionally, it introduced 'Hitweed Maxx,' an in-house herbicide designed to effectively control major weeds in cotton crops. Through a licensing agreement with Nissan Chemical Corporation, Japan, the company offers 'Hanabi,' a product used for managing mites in tea plantations. Furthermore, the company has launched other products such as Bloxit, Veteran, Prudens, and Rohelus. These additions not only enrich the product portfolio but also enable entry into new crops and markets.

Looking ahead, the company has plans to launch 11 new products within the next 2-3 years. Out of these, six will be proprietary products, including four herbicides, one fungicide, and one bio-fertilizer, while the remaining five will be in-licensed products.

n August 2015, Godrej Agrovet acquired a 45.3% stake in Astec LifeSciences (Astec), initially investing approximately Rs 160 crore. Subsequently, the company increased its ownership by acquiring an additional 6.9% equity stake through an open offer. Additionally, Godrej Agrovet purchased shares from the open market, resulting in a current equity stake of 62.4% in Astec.

Astec LifeSciences, established in 1994 by Ashok Hiremath, is an Indian manufacturer specializing in agrochemical active ingredients, formulations, and intermediate products. It focuses on niche segments such as triazole fungicides and proprietary off-patent products in the CRAMS (Contract Research and Manufacturing Services) domain. The company operates in both technical and bulk sales within India and exports its products to over 25 countries across North and South America, Asia, Europe, Australia, and Africa. Astec also undertakes contract manufacturing for multinational clients and maintains long-standing relationships with major Indian and global agrochemical companies. Its manufacturing processes incorporate proprietary techniques and backward integration, which provide cost advantages compared to Indian and Chinese counterparts. The company is actively pursuing backward integration strategies to mitigate risks associated with raw material sourcing, particularly reducing reliance on Chinese suppliers.

Godrej Tyson Foods Ltd -

In 1994, our Company ventured into the poultry business by launching the ‘ Real Good Chicken’ brand.

and in 2008, with an objective to grow our poultry and processed foods business, we entered into a joint venture with Tyson India Holding Limited, a subsidiary of Tyson Foods Inc., U.S.A.

Tyson Foods Inc., U.S.A. has approximately 75 years of experience producing, distributing and marketing poultry and other animal protein related products.

We have set up two processing plants with integrated breeding and hatchery operations

and we have a diverse customer base comprising of retail customers as well as institutional clients such as quick service restaurants, fine dining restaurants, food service companies and hotels.

Godrej-Tyson Foods (Ready to Eat) Godrej Agrovet’s processed poultry and vegetarian products business, Godrej Tyson Foods (GTFL), is best known for two brands − Real Good Chicken and Yummiez. The latter offers a range of vegetarian and non-vegetarian ready-to-cook products. Started in 2008, Godrej Tyson is a 51% subsidiary of the company, with the balance stake held by Tyson Foods, one of the world’s largest poultry processing companies. GTFL is the second largest player in the processed poultry segment in India. Revenue has remained largely flat around Rs 500cr for 5 years pre covid but this segment has doubled from FY21 to revenue Rs 1000 Cr business.

ACI Godrej joint venture operates in Bangladesh growing its animal feed business > 25% cagr in the last 10 years.

Dairy Business

Over a decade ago, Godrej Agrovet entered the dairy business by acquiring a minority stake in Creamline Dairy Products (CDPL). In December 2015, the company further increased its ownership by acquiring an additional 25% stake. Currently, Godrej Agrovet holds a majority stake of 51.9% in Creamline.

Creamline operates across Telangana, Andhra Pradesh, Tamil Nadu, Karnataka, and Nagpur (Maharashtra), where it markets milk and dairy products under the brand name Jersey. The company also operates dedicated Jersey milk parlours throughout South India. With a processing capacity of 0.8 million litres per day and over 100 collection centres, Creamline has established a robust dairy distribution network. This network includes approximately 4,000 milk distributors, around 3,000 milk product distributors, 50 retail parlours, and direct sales to institutional customers.

Godrej Agrovet aims to introduce 3-4 new products each year, with a focus on value-added products that have shorter shelf-life and lower working capital requirements. The company has been actively expanding its value-added portfolio in the dairy segment, which currently constitutes around 30% of its offerings. In the first nine months of FY21, Creamline launched dairy sweets called "Mysore Pak" and rebranded its entire product portfolio under the new "Godrej Jersey" logo.

EBIT Margin profile of each business-

Animal feed = 3.5% to 6%

Crop Protection = 20 - 25%

Astec Life = 14 - 20%

Palm Oil = 8 to 16%

Dairy = -0.3% to 2.5%

Our Competitive Strengths-

Pan-India Presence with Extensive Supply and Distribution Network -

several of our facilities are located near major consumption centers, we are able to ensure product freshness by reducing delivery time to customers as well as reduce our transportation costs.

Our nationwide footprint also allows us to leverage the competitive advantages of each location to enhance our competitiveness and reduce geographic and political risks in our businesses.

We believe that our business model with a strong procurement base, diversified product portfolio and large-scale operations enables us to achieve economies of scale in sourcing of raw materials and the distribution of our products.

Animal feed business, our distribution network comprises approximately 4,000 distributors 2017.

Our distribution network in India for crop protection products comprises approximately 6,000 distributors.

In our oil palm business, we had access to approximately 61,700 hectares under oil palm plantations across nine states, or approximately one-fifth of India’ s oil palm plantations.

For our dairy business, our supply chain network includes procurement from six states through a network of 120 chilling centers as of June 30, 2017. As of June 30, 2017, our dairy distribution network included approximately 4,000 milk distributors, approximately 3,000 milk product distributors and 50 retail parlors, as well as direct sales to institutional customers.

Diversified Businesses with Synergies in Operations-

We believe that our presence across five business verticals has enabled us to grow our revenues over the last five years.

We also believe that our diversified businesses along with our geographic diversification provides a hedge against the risks associated with any particular industry segment or geography while benefiting from the synergies of operating in diverse but related businesses.

Our synergies across diverse businesses provide us with the ability to drive growth, optimize capital efficiency and maintain our competitive advantage.

Strong R&D Capabilities

For instance, we have developed ‘ Prepwell’ for pregnant cows, ‘ Calf Starter’ and ‘ Calf Grower’ for calves and ‘ Milk More’ , ‘ Bypro’ and Bovino’ for lactating cows. ‘ Milk More’ , our innovative cattle feed contains proteins, energy, minerals and vitamins in adequate quantity and proportion to meet the nutritional requirements of dairy cattle.

We spent ₹ 3.22 million, ₹ 18.25 million, ₹ 16.88 million and ₹ 29.35 million

towards our research activities (which does not include salaries and benefits of our R&D employees and capital expenditure) during the three months ended June 30, 2017 and the financial years 2017, 2016 and 2015, respectively.

Strong Parentage and Established Brands

Reasons for Recent Margin Decline -

Over the period from 2015 to 2021, the cost of materials consumed consistently represented a significant portion, ranging from 73% to 75%, of the company's total revenue. However, in the last quarter of FY23, it escalated to 80%.

Given that it constitutes a major expense, it is evident that managing raw materials is a key focus for the management. Understanding the dynamics of raw materials is crucial in comprehending the economics of this business.

Animal Feed Business depends on -

maize, extractions, animal proteins, molasses, amino acids, vitamins and minerals and other additives, all of which are purchased from the open market.

Our crop protection business depends -

on organic chemicals, petroleum solvents, intermediates, fluro chemicals, catalysts, inhibitors, anti–oxidants, solid fuel, fine chemicals phytosterols, vegetable oil extracts and emulsifiers.

Dairy business depends on -

the availability of raw milk, cultures, sugar, flavour, spices, packaging material, stabilizers, preservatives and other additives.

Oil palm business depends on -

oil palm seedlings.

Poultry and processed foods business -

We require broiler feed, day old chicks and the Vencobb breed of birds, which we source from one of our competitors (Kind of sounds crazy).

Seems like this is the painful part of running this business -

The price and availability of such raw materials depend on several factors

beyond our control, including overall economic conditions, production levels, market demand and competition for such materials, production and transportation cost, duties and taxes and trade restrictions.

The mentioned below as a risk -

“We usually do not enter into long-term supply contracts with any of our raw material suppliers and typically source raw materials from third-party

suppliers or the open market. The absence of long-term contracts at fixed prices exposes us to volatility in the prices of raw materials that we require and we may be unable to pass these costs onto our customers, which may reduce our profit margins.”

The challenging aspect of this business is the multitude of variables that make it difficult to estimate future margins accurately. However, analyzing the historical trend provides some insight. The operating profit margins (OPM) have exhibited a cyclical pattern, fluctuating between 5% and 9% with an average of 8%. Similarly, the net margins have ranged from 3.6% to 6%, averaging at 4.7%. Taking into account these historical figures, we can gain a perspective on the current state of affairs.

When examining the historical data, it is evident that certain verticals of the business encountered margin pressures in specific years, while others performed better than expected, resulting in an overall operating margin range of 7% to 9%. However, FY23 stood out as an exceptional year where all verticals experienced margin pressure simultaneously. Fy23 ended with 6% OPM and 3% Net Margins.

Fy23 - Below are the reasons why various business verticals faced margin pressure -

Even with the worst margin cycle company is doing ROE > 17%

ROE seems to be artificially low due to the company investing a lot of money since IPO into CAPEX, the depreciation makes the net profits look low and hence the ROE.

Valuation -

If I take Fy23 as a normal year and let us assume they did their average OPM of 8.7% and Net margins of 4.6%, then they would have done a net profit of Rs 468 Cr (EPS = 22). which I think they will do either in the next financial year or the year after that as margins will revert to mean and let’s assume revenue will continue to grow 13% cagr over the next 10 years and 7% thereafter. On applying DCF with 15% hurdle rate we get Rs 446 stock value per share.

Today the company is trading around a similar price as of today -

Risks -

This is from the DRHP: In 2017, 10 of the 35 processing facilities that produce our animal feed products are owned by us, 7 are operated by us, while the rest are operated by contract manufacturers whom we do not control.

Dairy Business -

Palm Oil Business -

Poultry & Processed food business -

Seasonal Variations -

we sell lower volumes of cattle feed during the monsoons due to the availability of green fodder.

In our poultry and processed foods business, the demand for poultry products is higher in the second half of financial year since the consumption of poultry meat and eggs are higher during winter months. while the sale of such products is lower during certain religious festivals.

Crop Protection Business -

In our crop protection business, our domestic sales tend to be higher during the Kharif season in view of significant application of our product on Kharif crops.

Dairy Business:

Thank you,

Please share if you find it interesting and let me know your view in the comments below.

BLOGS ARE NOT A RECOMMENDATION SERVICE – These are my personal views about the Business Quality, Management Quality, Business Execution & Performance.

Thanks,

Dhruva Pandey

Email : dhruva.pandey@outlook.com

Twitter : https://twitter.com/Dhruvapandey

Excellent presentation, v detailed analysis, data driven approach is commendable. Within 2 weeks market understood the report and stock zoomed. Well done.