Bonds that i am finding interesting > 10 % Yield.

and why i exited HDFC bank.

As I navigate my investing journey today, I'm reminded of a similar feeling from back in 2018. At that time, my knowledge was quite limited, and I struggled to spot any real value in the market. With a bit of uncertainty, I decided to park my surplus cash in bonds. Little did I know that this decision would work out quite well for me in the long run.

When 2020 rolled around, the market took a nosedive, and the RBI slashed interest rates. Suddenly, my bonds were outperforming equities. It was a golden opportunity, and I sold my bonds to scoop up equities at what felt like bargain prices. However, getting to that point wasn't easy. Watching large-cap stocks soar by 30% over two years was challenging, and it took a lot of patience to hold onto those bonds. Meanwhile, small and mid-cap stocks had peaked in 2018 and endured a three-year bear market.

This experience taught me a valuable lesson about patience and the unexpected turns the market can take. It’s a story I like to revisit because it reminds me of the importance of staying informed and being adaptable, even when the market doesn’t seem to make sense.

In my quest to uncover a long-term, low-risk, high-reward value bet—or what some might call a mispriced asset—I find myself in a familiar position. Just like in 2018, I've decided to park some extra cash in bonds. Today, I want to share why I've made this choice and delve into my recent decision to exit a two-year-long underperforming position in HDFC Bank (Although i ended up making 15% return in it).

The search for that mispriced asset in the market is ongoing, but in the meantime, bonds have become my safe haven once again. However, parting ways with HDFC Bank wasn't an easy decision.

Despite my hopes and expectations, HDFC Bank has struggled to grow their CASA (Current Account Savings Account) as quickly as they had promised. The strategy for success seemed straightforward: increase CASA to lower the cost of funds by replacing HDFC Ltd liabilities with CASA, thereby boosting Net Interest Margins (NIMs).

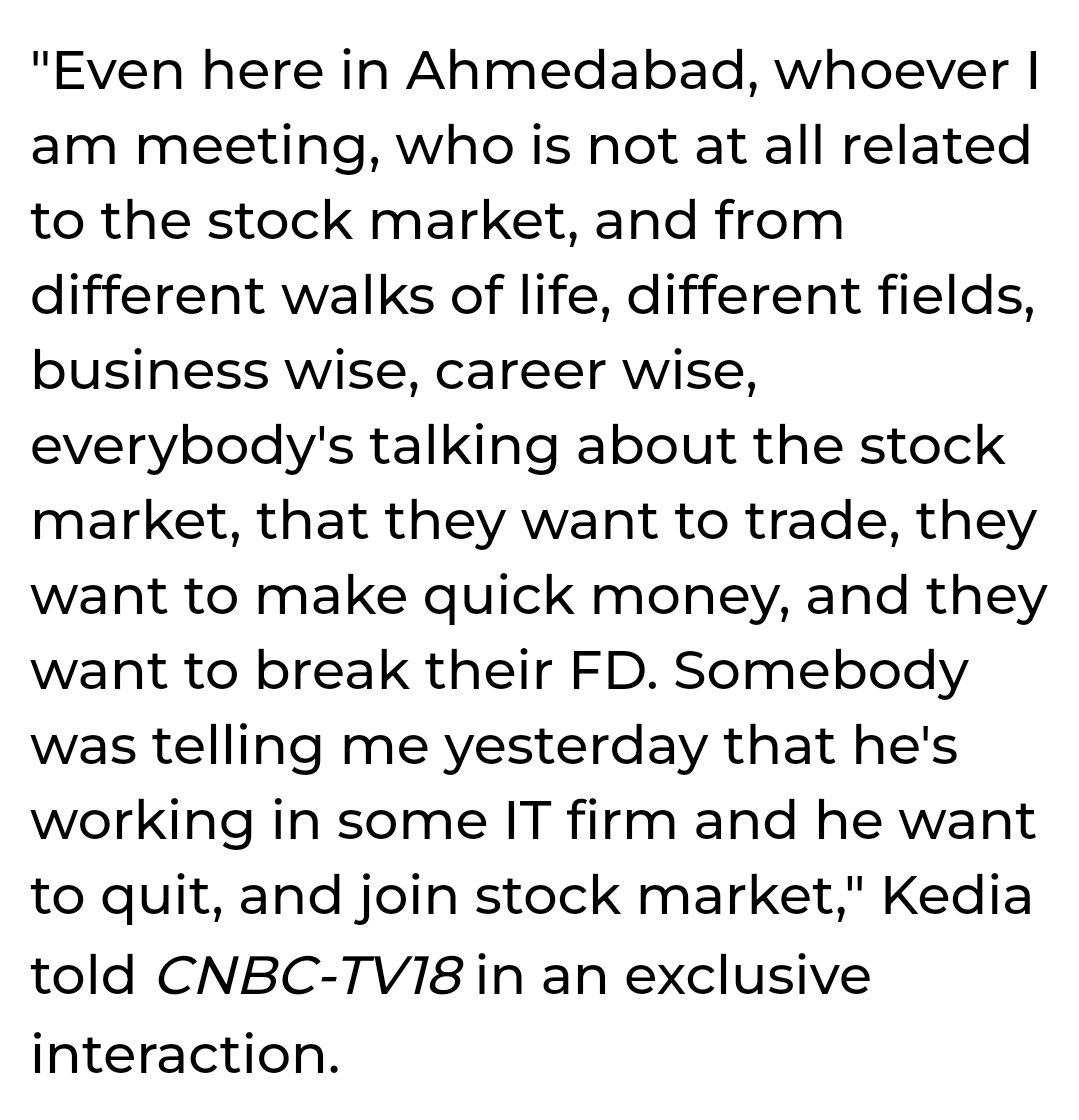

However, the trend of people shifting their money from savings to trading has posed a significant challenge for a primarily retail-dependent bank like HDFC. This shift has made it difficult for HDFC Bank to grow its CASA as anticipated.

From Vijay Kedia -

I think It's likely that only after a market crash will we see people shift from speculating in F&O and SMEs back to term deposits. Until then, HDFC Bank will face a tough time growing its deposits to improve its Net Interest Margins (NIM), which have decreased due to the merger and that day, I believe, will present a fantastic opportunity to buy HDFC Bank.

We don't know when the markets going to crash (if at all), but we can be prepared if it happens. Such an event could lead to a shift of money moving from F&O speculation back to fixed deposits, which would benefit companies like HDFC Bank.

One of the biggest challenges with exiting a position is figuring out where to deploy that cash next. This is precisely why I've written a blog on why your favorite holding period should be forever. HDFC is that kind of business but i guess we have to wait for more opportune time to build position on that.

Coming back to bonds -

I think the risk of rates going significantly up from here are low given the historic trend and inflation trajectory recently.

and unlike equity markets i don’t see any Euphoria in bond markets like we used to see in 2018 when even India bulls was able to raise at 8.5% from markets. In fact the company like UGRO Capital raising at > 10% and long duration at 12 % in today’s market despite equity investors valuing it like AAA company.

Here are the list of bonds i have found interesting -